PropNex Ltd – More Resilient Than Expected

traderhub8

Publish date: Mon, 16 Nov 2020, 02:36 PM

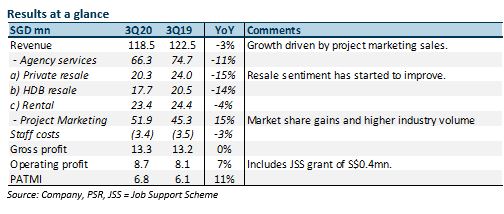

- 3Q20 PATMI rose 10.6% YoY to S$6.8mn, far exceeding our forecast. 9M20 earnings form 111% of our FY20e forecast. Despite lockdown, new project revenue was more resilient than expected.

- Revenue from new projects rose 15% YoY to S$51.9mn. Higher market share, billing of earlier projects and successful virtual selling were some of the reasons.

- Net cash of S$94.7mn, up from 3Q19’s S$74.5mn.

- Maintain BUY with a higher DCF TP of S$0.85, from S$0.70. Circuit breaker might have affected resale and rental revenue but not new project sales. Yields of 6% and cash flows of S$28mn p.a. with modest capex and working-capital requirements are what we like about PropNex.

The Positives

+ Project marketing resilient. 2Q20 new home sales for the industry were down 27% YoY. We had expected the weakness to spill into this quarter as there is usually a lag of 2-3 months before revenue is billable. PropNex was resilient due to market-share gains, delays in prior sales due to options re-issuance and its ability to market projects virtually.

+ Cash kept piling up. 9M20 operating cash flow was S$30mn (9M19: S$21mn). As capex was minimal at S$0.2mn, cash buffer should be sufficient to meet our dividend forecast of S$14.8mn (DPU of 4 cents).

The Negative

– Nil.

Outlook

Resale volumes are recovering as consumer sentiment improves. HDB resales should be supported by enhanced grants for HBD purchasers introduced late last year and delays in BTO completions. Meanwhile, project sales could enter a near-term lull in October and November due to delays in new launches. In September, URA had restricted developers from re-issuing options. Potential buyers will likely need greater clarity and time before disposing of their existing properties and committing to new purchases.

Maintain BUY with higher TP of S$0.85, up from S$0.70

We raise our TP as FY20e/FY21e earnings have been increased by 40%/46% to factor in stronger than expected new-project revenue.

Source: Phillip Capital Research - 16 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024