CapitaLand Limited – Pick-up in All Businesses

traderhub8

Publish date: Tue, 10 Nov 2020, 09:27 AM

- Sustained recovery in all business segments in 3Q20.

- Remains committed to S$3bn divestment target and digitalisation to build stickiness and future-proof its portfolio, as well as cash conservation.

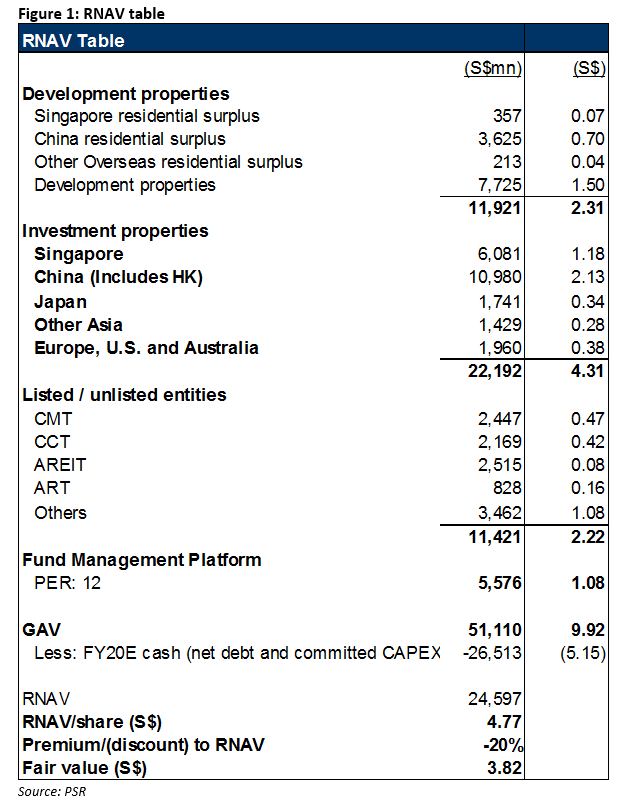

- Reiterate BUY and TP of S$3.82, at a 20% discount to RNAV. CAPL is our top pick in the sector.

The Positives

+ Strong momentum in residential sales. Residential sales in China grew 40% QoQ to c.1,900 units. Singapore’s 3Q20 sales were three times the 35 units sold in 1H20. Handovers were on track in Vietnam, with their YTD value almost tripling from the same period last year.

+ Sustained recovery in Retail and Lodging. Tenant sales continued to improve, to 17% and 31% below pre-COVID levels in Singapore and China. Back in June 2020, they were 19% /42% below. Malls maintained their occupancy in the 87.9-99.8% range. Although reversions in Singapore were -4%, China’s reversions were positive or flat. In the Lodging segment, occupancy increased 40-50% QoQ while RevPAU improved 22% QoQ, but still down 52% from 2019 levels. Despite a longer recovery runway for the hospitality sector, CAPL signed 3,500 keys in 3Q20. This brought its YTD signed to 6,400 keys as franchisees and asset owners validate the value proposition and resilience of the service residence asset class.

+ Digitalisation gaining traction. CAPL’s digital retail ecosystem comprising CapitaStar, eCapitaMall and Capita3Eats have shown results in driving tenant sales. More than 2,000 tenants have been onboarded on the three platforms, up 25% QoQ. eCapitaVoucher sales in Singapore have increased by c.229% YTD. The 13mn CapitaStar members registered appear to underscore the success of its spend-and-be-rewarded strategy. Since the launch of Ascott Star Rewards (ASR) in April 2019, direct bookings and online revenue have grown by 35% and 20% respectively. This lifted margins as direct bookings cut out commissions payable to accommodation-listing platforms and promote brand stickiness. As CapitaStar points are fungible with ASR points, the digital ecosystem encourages cross-selling. This should further entrench CAPL’s position as a diversified real-estate juggernaut.

The Negative

– Earnings and valuations hurt by COVID-19. 1H20 PATMI was down 89% YoY, arising from a subdued operating environment and lower-than-expected capital recycling. Market weakness will likely result in downward revaluations at year-end and impairment assessment for equity investments. CAPL’s FY20 financial performance could be materially affected. However, operations in 1H20 yielded positive cash flows and the impairments to come will have a bearing on profitability rather than cash flows.

Outlook

Momentum is strong in the development segment while leasing headwinds persist in the retail, commercial and industrial sectors. The recovery in hospitality is somewhat stunted, hinging on the vaccine timeline. CAPL is focusing on digitalisation to build stickiness and future-proof its portfolio, while conserving cash.

Maintain BUY and TP of S$3.82

No change in our estimates. Our TP remains based on a 20% discount to RNAV. CAPL is our top pick in the sector. Portfolio diversification and decades of experience in real estate should help it ride out near-term headwinds.

Source: Phillip Capital Research - 10 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024