StarHub Limited – Border Closure Still Hurts

traderhub8

Publish date: Mon, 09 Nov 2020, 09:58 AM

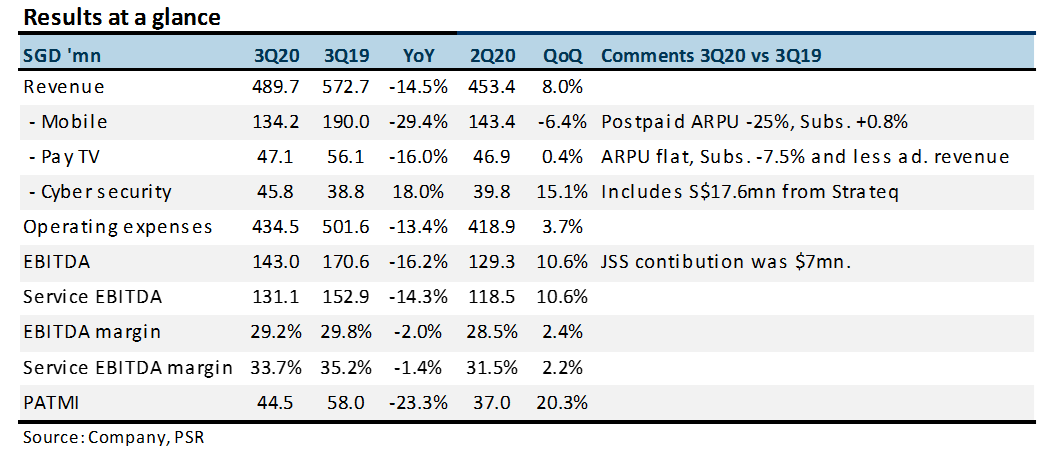

- 3Q20 EBITDA was within expectations, excluding government grants. YTD20 EBITDA was 76% of our FY20e forecast.

- Mobile revenue was down a hefty 29% YoY. This was due to a 25% fall in postpaid ARPU to S$29, a record low. Prepaid subscribers shrank 33% YoY.

- Border closure and loss of roaming revenue to continue to depress earnings. We do see some bright spots. ARPUs for broadband and Pay TV climbed QoQ as promotions ended.

- Maintain NEUTRAL and TP of S$1.24. TP is set at historical 6x EV/EBITDA excluding other income. We raise FY20e EBITDA by 5% to account for another S$15mn in grants in 2H20 and stronger PayTV and broadband businesses. A significant resumption of international travel is key to its earnings recovery. There are little signs yet.

Positive

+ Better QoQ ARPUs for PayTV and broadband. ARPUs for PayTV and broadband rose 2.5% and 7.1% respectively QoQ. Reduced discounts and promotions helped. Revenue for both expanded QoQ due to their better ARPUs.

Negative

– Mobile its Achilles heel. Without roaming revenue, mobile ARPU dived to a record low. Postpaid ARPU was down 25% YoY. Prepaid subscribers shrank by 108k or 33% YoY. There was less demand with fewer tourist arrivals.

Outlook

We lower revenue by 5%. Our forecast for equipment sales was too bullish. We also incorporate revenue from its new acquisition, Strateq. Our EBITDA is raised by 5% to include government grants and an expected uptick in its broadband and PayTV businesses. Enterprise division should enjoy a gradual recovery as projects resume and economic conditions recover. Separately, the launch of non-standalone 5G has garnered a better-than-expected response. Customers are transitioning faster to 5G phones. Faster speeds, lower latency and bundled content subscription have encouraged take-up by niche customers such as gamers and other heavy-content users.

Maintain NEUTRAL and TP of S$1.24

Our valuation is based on 6x FY20e EV/EBITDA. We exclude other income in our EV/EBITDA valuation as it is non-recurring.

Source: Phillip Capital Research - 9 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024