Frasers Centrepoint Trust – in Sweet Spot Despite Headwinds

traderhub8

Publish date: Mon, 09 Nov 2020, 09:57 AM

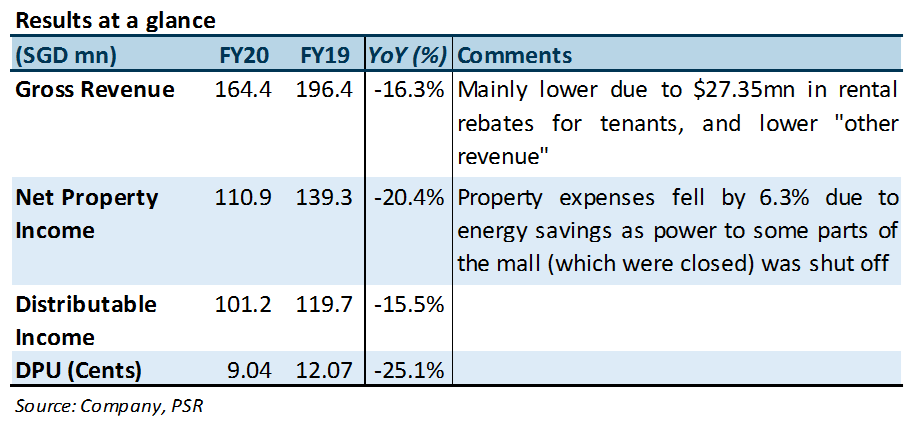

- After accounting for the incremental rental waivers, FY20 DPU of 9.042 cents was broadly in line, at 93.0% of our estimate.

- High occupancy of 94.9% maintained. Rental reversions positive at 4.2%. As its portfolio of suburban malls are located near transportation nodes, they should be high on retailers’ priority list when they review their consolidation plans.

- Upgrade to BUY from ACCUMULATE with stock catalysts expected from growth in catchment surrounding FCT’s and synergies from enlarged scale post ARF acquisition. DDM TP (COE 6.75%) unchanged at S$2.79. We remain confident of the resilience of necessity-driven suburban malls.

+ Positive

+ High occupancy of 94.9% maintained; rental reversions of 4.2%. Portfolio occupancy fell YoY from 96.5% to 94.9% but was up from 3Q20’s 94.6%. Rental reversions in FY20 were positive, mainly thanks to 9M20’s +5.2% reversions. No rental reversions were disclosed on the 24% of leases signed in 4Q20. Calculating backwards, we deduce that the reversions were mildly positive. This was commendable, given a softer leasing environment.

+ Tenant sales recovered to pre-COVID levels. Tenant sales and footfalls stabilised in the last three months, averaging 3.6% and 38.2% below 2019 levels respectively. The discrepancy between footfalls and tenant sales was largely due to an absence of transient footfalls as people worked from home. Shoppers were also more efficient with their trips to the malls, purchasing more items at one go to minimise the inconvenience of going through contract-tracing and crowd-control measures. As Singapore prepares for Phase 3 reopening, tenant sales are expected to be stable. A recovery in discretionary spending is expected to compensate for reduced spending due to working from home.

– Negative

– Impacted by COVID-19, FY20 NPI and DPU fell 20.4% and 25.1% respectively, mainly attributed to S$27.4mn in tenant rebates and decline in other revenue. Other revenue fell 24.9% YoY due to lower carpark and marketing revenue. This was in tandem with lower footfalls and an absence of atrium revenue during Phase 2 due to social distancing. The revenue decline was partially offset by a 13.6% dip in energy expenses as parts of its malls were closed. Details on social-distancing requirements in Phase 3 reopening have not been disclosed and may continue to weigh on atrium revenue.

Outlook

Differentiated strategy under Re-align Framework. Traditional leases are for three years with annual escalations. Rents comprise fixed rents and a variable portion tied to gross turnover (GTO). The fixed-rent component typically makes up the bulk of the rent. While landlords strive to negotiate leases on the traditional model, harder-hit tenants are struggling to return to profitability. FCT has classified its tenants into three categories, with a differentiated leasing strategy for each.

- 3-year leases for tenants less affected, such as those in essential services

- Shorter leases of six months with lower fixed rents and higher GTO-based rents, for tenants affected by COVID-19 but have been recovering since Phase 2. The leases will come with a clause to allow FCT to recover the space upon one month’s notice if the tenants do not do well or if FCT has opportunities to bring in other tenants

- Discussions for exiting its malls with tenants still struggling financially. FCT will remarket the space.

The Re-align Framework was passed by Parliament on 3 November to allow small and micro businesses with a significant fall in revenue to terminate contracts without penalty if they are unable to renegotiate new terms. This allows both tenants and landlords to bite the bullet and go on to engage new tenants for the space. If necessary, repayment plans will be negotiated for the tenants to repay any arrears. Tenants will have to reinstate their premises before returning them to their landlords. FCT shared that 20-30% of its tenants have experienced a 20% drop in sales.

Dominant malls will be prioritised. FCT’s portfolio of heartland malls are located 1-3 minutes from transportation nodes. We believe they will be among retailers’ top priorities when they review their consolidation plans.

Focus on efficiency and unlocking value. With the completion of its acquisition of ARF’s [not listed] assets, FCT will be focusing on consolidating mall management at all its malls. It will also be leveraging its scale to get better contract terms from third parties. On top of that, it will be exploring opportunities to add value to its malls during this period of weaker demand, potentially through asset enhancements and reconfiguration of its tenant mix.

Upgrade to BUY with unchanged TP of S$2.79

Upgrade to BUY from ACCUMULATE with catalysts for a re-rating expected from growth in catchment surrounding FCT’s and synergies from enlarged scale post ARF acquisition. Our DDM TP is unchanged at S$2.79. We remain confident of the resilience of necessity-driven suburban malls.

Source: Phillip Capital Research - 9 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024