Singapore Banking Monthly – Lukewarm 3Q Expected

traderhub8

Publish date: Tue, 03 Nov 2020, 10:35 AM

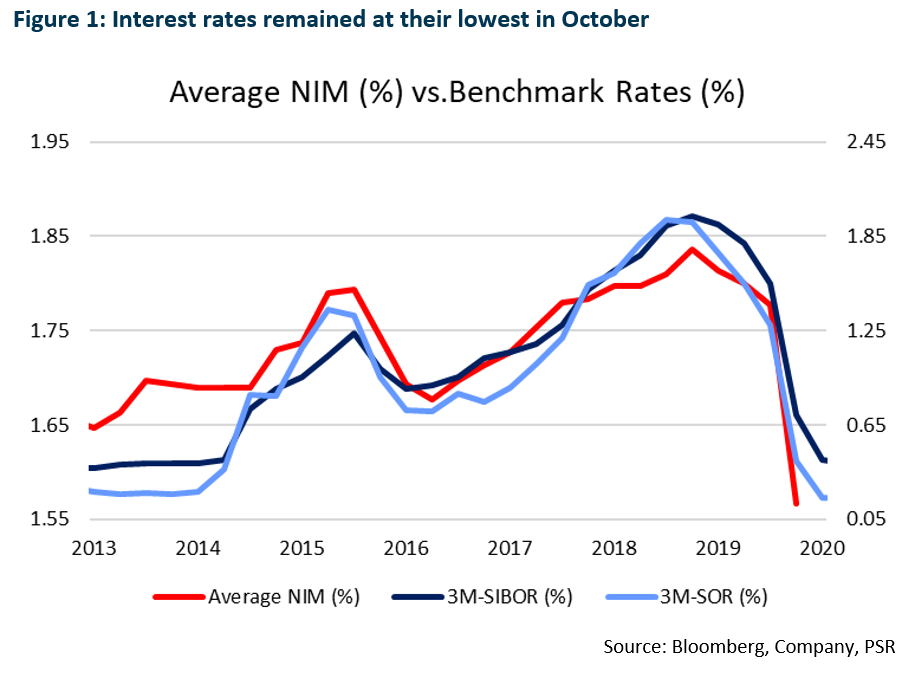

- October interest rates remained at their lowest since 2014.

- Loans shrank for the third consecutive month (-1.03% YoY), as business loans dipped 0.2% and consumer loans, 2.4% YoY.

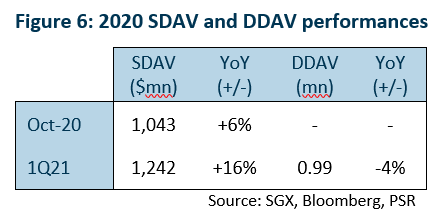

- SDAV grew at its slowest 6% YoY since 2020. Top equity derivatives value slipped 9% YoY.

- Maintain NEUTRAL. Lukewarm 3Q20 expected, with MoM improvements from better NIM management following asset repricing and end of CB.

Persistent headwind for NIMs

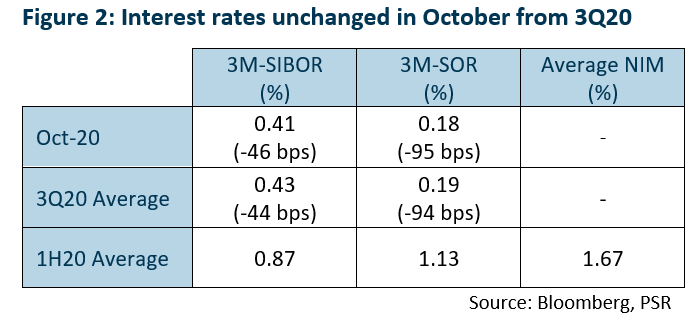

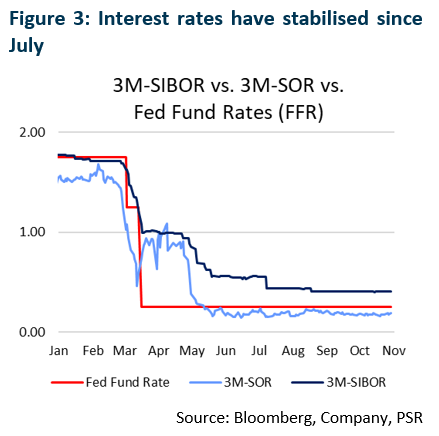

Interest rates stayed low in 3Q20 (3M-SIBOR: 0.43%, 3M-SOR: 0.19%), with 3M-SIBOR and 3M-SOR at 0.41% and 0.18% respectively in October (Figure 1). Banks are likely to report flat NIMs in 3Q that will likely persist with low interest rates.

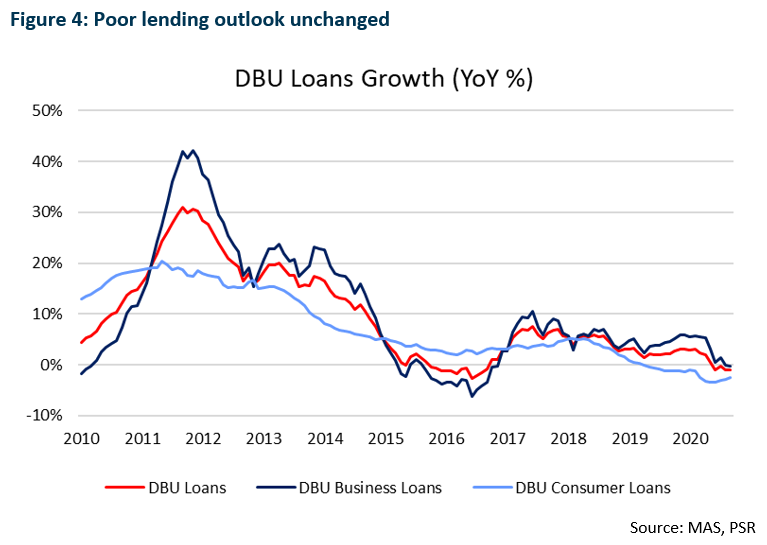

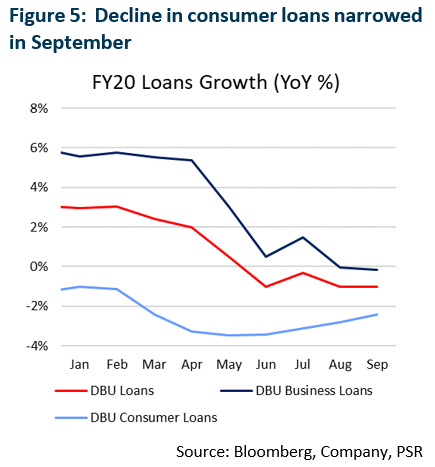

Weak lending environment persisted in September

Loans contracted 1.03% YoY in September, as outstanding loans shrank for the seventh consecutive month (Figure 4). The main culprit was business loans, which dipped 0.2% YoY for the second consecutive month while consumer loans shrank 2.4% YoY.

MoM though, consumer loans have started to recover. They grew 0.3% in October, their third consecutive growth (Figure 5). All segments added loans, which helped stave off a bigger loan-book contraction.

As Singapore resumes economic activities, a turnaround in business loans could revert loan growth to healthier levels observed in 2019.

Local capital markets weakened in October

Preliminary SDAV of S$1,043mn indicates a YoY increase of 6% from S$980mn a year ago in October (Figure 6), the slowest growth since the start of 2020.

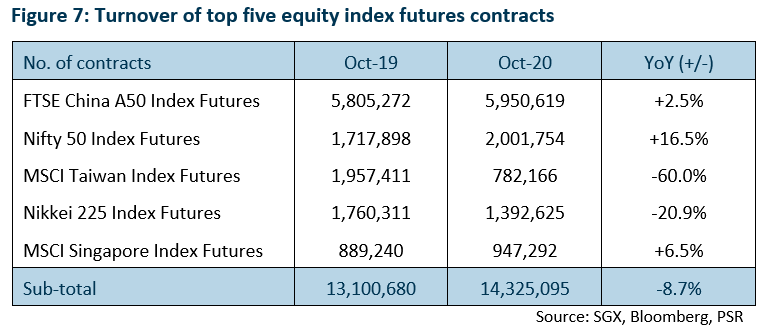

Similar weakness was observed for derivatives volumes, which retreated 8.7% YoY in October for the top five equity index futures contracts (Figure 7). This echoed the overall sluggish market as we enter the final quarter of 2020.

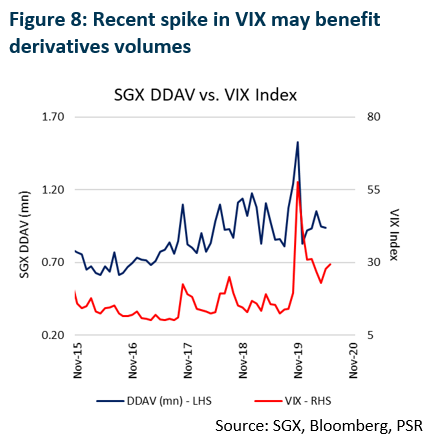

That said, the recent spike in the VIX (Figure 8) arising from uncertainty from the US election uncertainties and a global resurgence of COVID-19 cases may benefit derivatives as a risk-management tool.

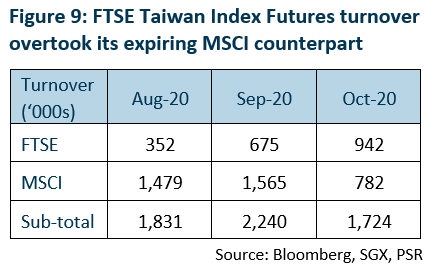

October volume for the FTSE Taiwan Index Futures overtook its MSCI counterpart (Figure 9), ahead of the MSCI Taiwan Index Futures’ expiry in February 2021. SGX continued to roll out an extensive suite of equity derivatives products to replace its expiring MSCI contracts. These included replacement contracts and contracts with expanded exposure to other market segments (Annex A).

Investment Action

Maintain Neutral. Banks are likely to report lukewarm results in 3Q20, with a slight recovery from their lows in 2Q20 due to interest-rate shocks and the circuit breaker (CB). For sector exposure, we prefer DBS (SGX:D05, Accumulate, S$21.00), given its war chest of S$1bn in unrealised gains from fixed income assets that may be realised to offset top-line weakness.

The rate of recovery in non-interest income and updates of loans under moratorium will be key to watch for possible re-rating catalysts.

Source: Phillip Capital Research - 3 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024