Sheng Siong Group Ltd – Grocery Demand Remains Elevated

traderhub8

Publish date: Mon, 02 Nov 2020, 09:12 AM

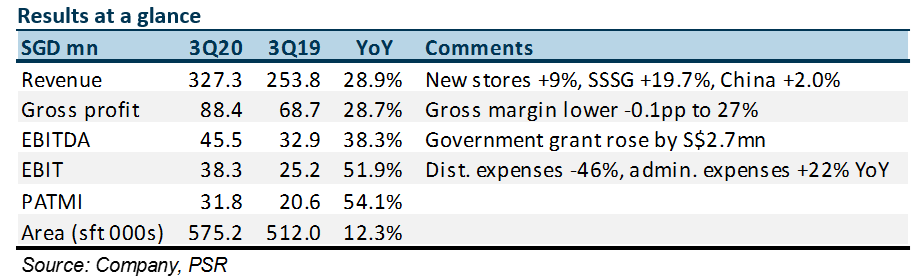

- 3Q20 earnings beat our estimates by 5% on the back of higher-than-expected same-store sales growth. Revenue rose 28.9% YoY to S$327mn. Net profit jumped 54% to S$31.8mn.

- Of the revenue growth, 20% points was from same-store sales (SSS) and 9% from new stores.

- With more time being spent at home, household cooking and eating should remain elevated, supporting grocery retailing. SSG’s positioning as an affordable and modern fresh-food store for the younger generation should enable it to take more wallet share from wet markets. We raise FY20e/FY21e net profits by 5%/4% to S$129mn/S$103mn. Our TP climbs to S$1.71 from S$1.65 with the rise in FY21e earnings. We use FY21e as it is more reflective of normalised earnings.

The Positives

+ Strong revenue, even with Phase 2 easing. Even as the lockdown eased with Phase 2 implemented on 19 June, revenue remained robust in 3Q20. Revenue expanded 28.9%, with around 20% points of the growth from SSS and 10% points from new stores opened in FY19/20. This testifies to households cooking and eating much more than pre-Covid 19 where the 5-year trend growth for supermarket sales was 1.3% p.a.

+ Record cash. Net cash as at September was S$180mn (3Q19: S$83mn). The huge YoY jump was due to S$218mn cash generated from operations. With a 70% payout, DPS in FY20e is expected to jump 70% to 6.1 cents.

The Negative

– Short hiatus in new-store openings. Due to the pandemic, HDB is temporarily freezing the award of new heartland stores. Tenders should resume in 2021 when new HDB BTO units are completed. Grocery stores are essential for neighbourhoods.

Outlook

The challenge for us is to fathom normalised supermarket sales, come FY21e. We think household spending will remain elevated with more home cooking. Border closure and working from home is likely to perpetuate this behaviour change. Consumers are also embracing e-commerce, with the industry’s market share doubling to around 10% in 2020. Although management understands the value of this channel, efficiency, scale and high logistics or platform costs are still major barriers to profitability in grocery e-commerce.

Maintain NEUTRAL with higher TP of S$1.71, from S$1.65

We have used FY21e to benchmark our target. It is more reflective of a normalised year for earnings. We believe investment merits of 28% ROEs, dividend yields of 2.9% and net cash have been priced into the stock for the near-term.

Source: Phillip Capital Research - 2 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024