Keppel DC REIT – in Anticipation of Acquisitions

traderhub8

Publish date: Mon, 26 Oct 2020, 09:12 AM

- 9M20 DPU of 6.73 cents in line, forming 71.3% of our FY20e DPU estimate.

- Portfolio metrics healthy: long WALE of 7.2 years, portfolio occupancy of 96.7% and interest coverage ratio of 12.7x. AEI and rental escalations to provide organic growth.

- Reiterate NEUTRAL with a higher DDM-based target price of S$2.91 from S$2.57 after incorporating S$500mn of acquisitions for 1Q21e. Despite strong metrics and future-ready asset classes, reiterate Neutral as we believe the market has priced in potential catalysts from acquisitions and STI inclusion. Prefer Ascendas REIT (AREIT SP, Accumulate, TP: S$3.63) in the sector.

The Positives

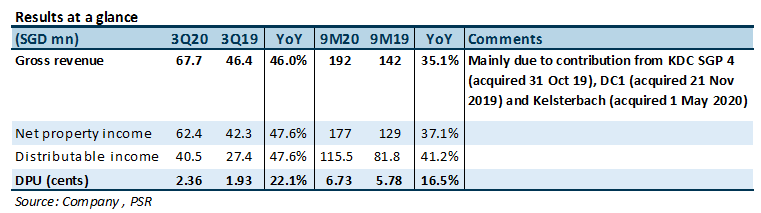

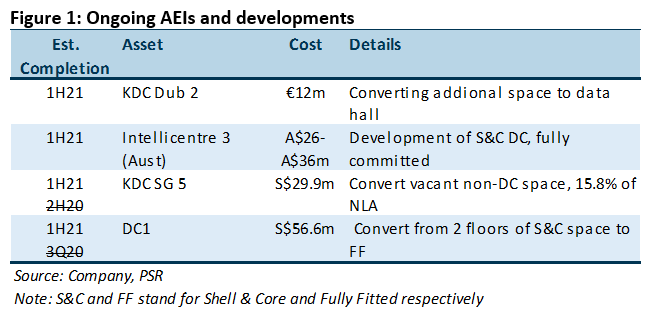

- 3Q20 DPU grew +22.1% YoY. This was mainly driven by its acquisitions of KDC SG 4 and DC1 in 4Q19 and Kelsterbach DC in March 2020, tax savings from attainment of tax transparency for KDC SG 4 and higher rents charged on the conversion of non-DC space to DC at KDC SG 5. DPU was up 16.5% YoY in 9M20. KDC has several AEIs underway (Figure 1), which should continue to drive revenue.

- Strong leasing quarter, occupancy inched up from 96.1% to 96.7%. KDC Dub 1’s Asset Enhancement Initiative (AEI) was completed despite a 2-month delay to bring more power onsite. Occupancy increased from 63.3% to 81.1% upon the power upgrade. The space has been leased to a new telco tenant. Despite large take-up of 12,125 sq ft, no discounts were offered. Client expansion at KDC SG 1 is expected to lift occupancy from 89.2% to 91.0% (1,975 sq ft) and from 93.5% to 98.2% (1,809 sq ft) at KDC SG 2, both of which commenced on 1 October 2020. KDC also managed to secure an early lease renewal for its iSeek Data Centre in Australia, terming out its iSeek’s WALE from six years to 10.7 years.

The Negatives

- AEIs and development completions pushed to 1H21; intermittent disruptions. Most of KDC’s AEIs was disrupted by construction delays due to COVID-19 lockdowns in 1H20. Client fit-out at DC 1 has also been delayed to 1H21. While construction has resumed, delays in certain supplies and manpower scheduling have resulted in intermittent disruptions.

Outlook

Still awaiting acquisitions. KDC is still negotiating several third-party deals with cap rates of 4-7%, some in advance stages. However, its deal process has been stalled by travel restrictions. Management shared that the number of deals and size have increased. While demand for data centres has compressed cap rates, asking prices for deals under negotiation are unchanged.

Demand-supply gap to lift market rents. Demand-supply gaps exist in many markets due to government restrictions on the supply of data centres. Globally, demand for data centres is being driven by big data, 5G and cloud adoption. Singapore has attracted Chinese tech companies looking to set up headquarters and operations here to perform big data analytics. We understand, however, that the Chinese tech players were unsuccessful in securing land from the government for data-centre development. Given the moratoriums on data centres in Singapore, we expect market rents to be bid up in the coming two years. While KDC’s high portfolio occupancy of 96.7% and long WALE of 7.2 years translate to low expiries in 2021/22 and leave little opportunity for positive rental reversions, many of its existing leases and co-location arrangements have built-in periodic rental escalations averaging 2-4% p.a.

Maintain NEUTRAL with higher target price of S$2.91, from S$2.57.

Our DDM-based TP has been raised from S$2.57 to S$2.91 following our assumption of S$500mn of acquisitions with an NPI yield of 6% and LTV of 30% for 1Q21e. This translates to DPU accretion of 5.0%/ 5.8% for FY21e/FY22e and gearing of 35% in FY21e. Despite strong portfolio metrics and future-ready asset classes, we reiterate our Neutral view as we believe the market has priced in potential catalysts from acquisitions and STI inclusion. KDC is trading at an all-time high and DPU yield of 3.1%/3.6% for FY20e/21e is not compelling. Prefer Ascendas REIT (AREIT SP, Accumulate, TP: S$3.63) in the sector.

Source: Phillip Capital Research - 26 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024