Clearbridge Health Limited – Revenue Tripled in 1H20

traderhub8

Publish date: Mon, 31 Aug 2020, 10:36 AM

- 1H20 revenue and EBITDA were within our expectation. 1H20 more than tripled to S$21.4mn and EBITDAR was a positive S$3.6mn. Operating cash-flow was $4.5mn in 1H20, a turnaround from the negative S$3.6mn in 1H19.

- Growth in 1H20 was driven by the acquisition of nine Singapore dental clinics in August 2019 and distribution of Biolidics COVID-19 Antibody Test Kits.

- Maintain BUY with an unchanged target price of S$0.26. We expect a stronger recovery in 2H20 for CBH. Almost all business segments suffered lower patient load in 1H20 due to the lockdown. Only renal care operations in Indonesia (i.e. TMJ) fared better as the daily dialysis treatment is essential for patients. The ability of CBH to widely and rapidly distribute the new test kit across their medical network in SE Asia was a positive surprise and represents a new growth opportunity for future products.

The Positives

+ Revenue growth driven by medical clinics and test kit. 1H20 revenue was supported by the acquisition of Dental Focus Group’s nine dental clinics in Singapore and distribution of Biolidics COVID-19 Antibody Test Kits. It was not disclosed the sales contribution from sales kit. However, we expect it to be significant because Biolidics sold S$6.3mn Antibody Test Kits in 1H20.

+ Operating cash-flow turnaround. In 1H20, operating cash-flow generated was S$4.5mn, a major turnaround from the negative S$3.6mn a year ago. In addition to the increased profitability, working capital improved due to lower receivables from the public sector for the Indonesian operations.

+ Positive operating leverage. Despite revenue tripling in 1H20, employee expenses only increased by 14% YoY. Distribution of the test kits tapped on the existing marketing team or network. The acquisition of dental clinics only incorporated nurses and back-end staff.

The Negative

– Pandemic disrupted 1H20. Several businesses were hit by the pandemic. IGM Labs operates 15 clinical laboratories in Indonesia, it faced weaker traffic as the patient admission in hospitals declined due to movement restrictions. Revenue in Singapore from dental and aesthetics was similarly weak due to lower patient load following the lockdown.

Outlook

We expect all divisions to experience stronger performance in 2H20.

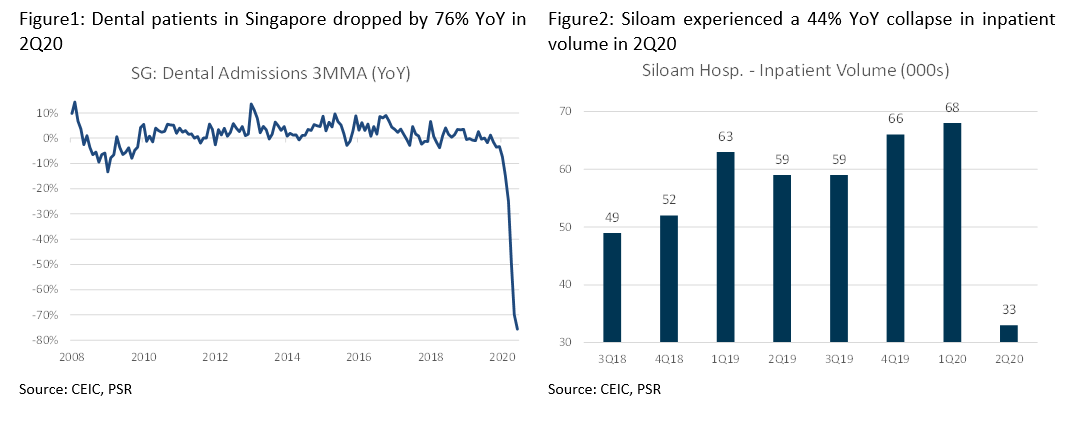

- Indonesia: As lockdown eases, patient traffic in the hospitals can recover from devastating 2Q20 (Figure 2), improving lab test activities for IGM Labs. TMJ revenue will remain stable and largely unaffected by the pandemic due to the need for patients to undergo daily hemodialysis treatment. With 23 facilities in operation and another 13 more pending permit or under renovation, growth will remain robust for TMJ.

- Philippines: There was a 14 days voluntary closure of the medical centre in July due to a COVID-19 infection amongst patients and staff. Operations have since resumed. Growth for the Philippines will be driven by COVID-19 related services.

- Hong Kong: The lockdown was negative for Hong Kong clinics as patient load from mainland China was adversely affected. The clinic has refocused its efforts on domestic patients and added another role as a gateway to source new products from China.

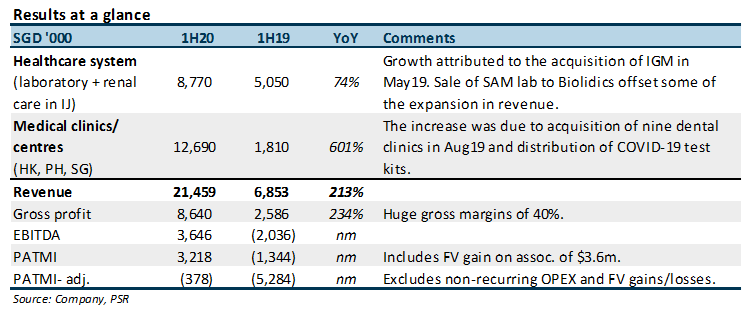

- Singapore: Based on industry data, the lockdown has severely curtailed patients into dental clinics (Figure 1) and aesthetics. We expect a recovery and pent-up demand as the lockdown eases. The dental business will benefit from having a larger presence in the heartlands, which provides greater convenience for patients.

Investment Actions

Maintain BUY with a target price of S$0.26. CBH continues to expand and leverage its network of medical centres throughout ASEAN. The stronger operating cash-flow and balance sheet will allow CBH to – (i) further grow via acquisition; (ii) expand their Indonesian operations faster where the capital expenditure and working capital requirements are much higher.

Overview of operations:

Healthcare Systems

- PT Tirta Medika Jaya (TMJ) – 55%: Acquired in April 2018, TMJ co-operates renal care facilities in 36 hospitals in Indonesia. These facilities offer renal care services through joint operations with equipment manufacturers and hospitals in Indonesia. The key feature of renal care is its recurrent revenue stream (dialysis is a lifetime treatment). The average utilisation rate of the renal care facilities was around 70%. Each patient requires dialysis around three times a week, 4 hours each treatment. The Group incurs CAPEX of S$60-80k to fit out each renal care centre. The Group currently focuses on ramping up occupancy instead of acquiring more contracts.

- PT Indo Genesis Medika (IGM Labs) – 89.6%: Provides laboratory services and located in Indonesia (acquired in May 2019). IGM operates laboratories with collaborating public hospitals in Indonesia under Joint Operation (JO) contracts. Currently co-operates 15 clinical laboratories with the pending novation of 1 joint operation contract. With an estimated 2,500 hospitals in Indonesia, only 16 are class A, and CBH has Jos with 6 class A hospitals in the most affluent locations. IGM Labs contracts with hospitals are for 5 to 7 years. The revenue share for IGM is 55% to 70%.

Medical clinics/ centres

- Clearbridge Medical, Hong Kong – 100%: Single medical clinic in Hong Kong, which achieved rapid patient volume growth in FY18 of >350 patients per month. Patients are mainly from China seeking health screening and vaccinations. CBH expanded collaborations with new local and Chinese agents to introduce more medical tourists from China. Renovation of the new clinic (that is double the size of the current clinic) has been completed in 2Q19 and will be able to cater to more patients.

- Medi Surgical and Laser Clinic – 85%: Provides aesthetic services and located at outskirts of the central business district (CBD). It delivers affordable and quality healthcare services to professionals working in CBD.

- Dental Focus, Singapore – 51%: The Group owns a 51% effective interest in 9 dental clinics under the “Dental Focus” brand name with the first right of refusal to acquire another 6 dental clinics and ancillary dental services providers. The acquisition is in line with the Group’s EBITDA-focused business strategy and increases its network of primary healthcare touchpoints. The 9 dental clinics collectively generated approximately S$6.3mn of revenue in the last financial year and are profitable.

- Clearbridge Medical Group Philippines (CMP) – Medical centre and pharmacy business in the Philippines called Marzan that was acquired in January 2018. CMP’s pharmacy is registered under DSWD to provide drugs at a subsidised rate to patients. CMP revenue may also receive a boost, pending the approval for accreditation by the Department of Health as an approved Overseas Foreign Worker screening facility and other major Health Management Organisations for private corporate clients.

Phillip Securities Research has received monetary compensation for the production of the report from the entity mentioned in the report. The report was previously under the ‘SGX StockFacts Research Programme’ (administered by SGX).

Source: Phillip Capital Research - 31 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024