SATS Ltd – Operations Bottomed But Recovery Subdued

traderhub8

Publish date: Tue, 25 Aug 2020, 10:35 AM

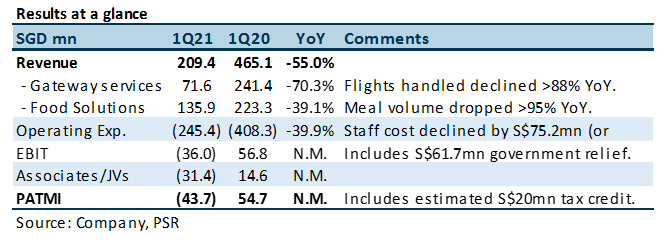

- 1Q21 results were within expectations. Revenue declined 55% YoY to S$209mn with a net loss of S$43mn in 1Q21.

- The net loss was after tax credit and government relief of totalling around S$80mn.

- Operationally the airport traffic has bottomed but any recovery will be tepid. We maintain our SELL recommendation with an unchanged target price of S$1.95. Our valuations are pegged to P/B average of 1.35x during the global financial crisis in 2009. The trajectory for any meaningful recovery in air traffic is uncertain and prolonged.

The Positives

+ Restructuring staff cost. Staff cost excluding the S$61.7mn government relief was cut by around 32% YoY in 1Q21. The number of employees has been lowered by 19% YoY to 13,500.

+ Cargo is relatively stronger. Cargo segment has performed relatively better than other segments. Cargo handled declined 51% to 221k in 1Q21, in comparison passengers handled tumbled 99% to 0.2mn.

The Negatives

– Associates a major source of weakness. With government relief, SATS suffered an operating loss of S$36mn. It was comparable to the S$31mn losses by associates and joint venture. China was the largest drag to associates. The closure of Beijing Daxing Airport was a reason for the losses in China.

Outlook

FCF in 1Q21 was a negative $71mn. With a cash balance of S$723mn (net debt: S$152mn), SATS can easily ride out the current downturn or another 10 quarters of the similar level of FCF cash burn-rate. SATS has likely bottomed out operationally but we worry such listless conditions may persist for another three to four quarters.

Maintain SELL with a target price of S$1.95

Without any clarity of a sustainable and material improvement in air travel and net losses to persist for the company, we maintain our SELL recommendation with an unchanged target price of S$1.95. Our forecast is unchanged.

Source: Phillip Capital Research - 25 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024