JEP Holdings Ltd – Aviation to Hibernate

traderhub8

Publish date: Fri, 21 Aug 2020, 02:38 PM

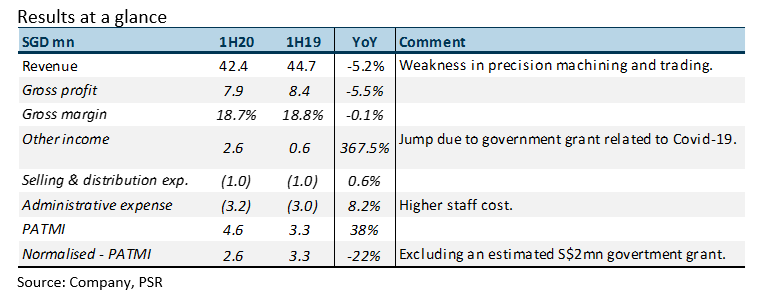

- 1H20 results were below expectations, excluding the government grant, PATMI would have declined 22% YoY to an estimated S$2.6mn.

- The collapse in international air travel has reversed from the previous insufficiency in aircraft production capacity to the current overcapacity. Orders have been mothballed.

- We are downgrading to REDUCE. Aerospace was around 60% of JEP revenues. We are not expecting any recovery in aerospace orders until end 2022. Semiconductor project and cost restructuring will be the company focus in the medium term, in our opinion. Our target price is now cut to S$0.158 and benchmarked to the book value of the company.

The Positive

+ Revenue was relatively resilient. Weakness in revenue came from precision manufacturing and trading whilst equipment manufacturing expanded. The sales breakdown of these divisions were not disclosed. Total revenue only declined by 5% despite the disruption in operations from the lockdown in Malaysia and Singapore.

The Negative

– Rise in administrative expenses. We were surprised that administrative expenses rose 8% YoY to S$3.2mn despite the decline in revenue. The increase was due to higher provision of staff cost related to performance.

Outlook

It will be a rough 18 months for JEP as aviation equipment orders have frozen. The Boeing Company reported aircraft deliveries of only 19 in 2Q20, a 80% YoY drop from 90 in 2Q19. We expect JEP to now pivot more to semiconductor orders especially with the support from UMS. Some of the initiatives we believe JEP will undergo during this period of consolidation in aviation are: (i) UMS can tap on JEP to utilise their excess capacity for semiconductor orders; (ii) Further realign cost and production into the Malaysian factories; (iii) Pursue more semiconductor equipment and printing projects, in particular customers looking to shift out of China.

Downgrade to REDUCE from BUY with reduced TP of S$0.158 (prev. S$0.26)

With the lack of visibility, we are benchmarking our target price to book value. We still expect to be profitable but depressed in the medium term. Any valuation based on earnings would understate the earnings potential of the aircraft machining operations.

Source: Phillip Capital Research - 21 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024