Thai Beverage PLC – Margins Expanded During the Lockdown

traderhub8

Publish date: Tue, 18 Aug 2020, 08:46 AM

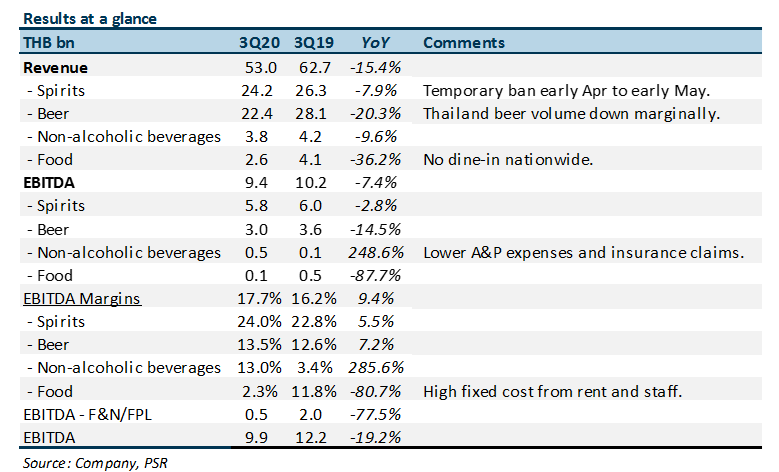

- 3Q20 revenue and EBITDA were within expectations. Revenue and EBITDA were down 15% and 7% YoY respectively due to the alcohol ban for almost a month from early April.

- Spirits volumes recovered in May and June to cover most of the loss in April.

- Beer volumes were down around 20% YoY in 3Q20 due to SABECO.

- We are maintaining our BUY recommendation and target price at S$0.82. THBEV has coped well with the lockdown and ban in alcohol sales with significant cost controls namely in advertising and marketing cost. The stock is attractively priced 14x PE FY21e against a historical average of 18x PE.

The Positive

+ EBITDA margins expanded despite the drop in revenue. Revenue was down 15% YoY but EBITDA margins managed to expand due to aggressive cost-cutting especially in marketing and promotion expenses. EBITDA for the key spirits business only fell 3% YoY.

The Negative

– SABECO is the weakest link. In the 3Q20, beer volumes contracted almost 20% due to SABECO. Domestic beer volume declined only marginally and market share is at a record high. The regulatory ban on drink driving continues to curb beer consumption in Vietnam.

Outlook

Post the alcohol ban and temporary closure of entertainment venues and restaurants in Thailand, spirit sales have recovered most of the losses in April. As restaurants and entertainment venues reopen, we expect a recovery for THBEV operations in 4Q20. Beer sales in SABECO remains a concern, as the impact from regulation will weigh on consumption in the medium term.

Maintain BUY with unchanged PE-derived TP of S$0.82

We maintain our BUY recommendation. FY20e PATMI is cut by 11% as we expect SABECO beer sales to remain sluggish. We are rolling over our target 18x PE to a normalised FY21e earning.

Source: Phillip Capital Research - 18 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024