APAC Realty Ltd – Tepid Rebound

traderhub8

Publish date: Mon, 17 Aug 2020, 08:47 AM

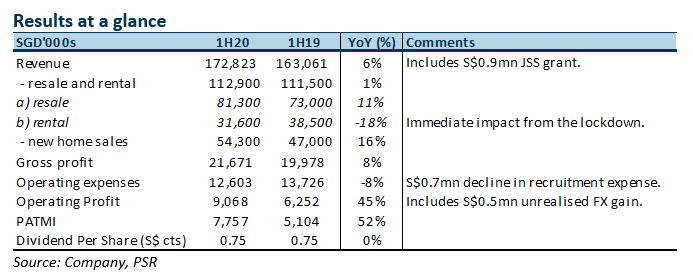

- 1H20 results was below expectations. PATMI rose 52% to S$7.7mn with revenue rising 6% to S$172mn.

- Several one-off items supported earnings including S$0.9mn JSS grant, absence of recruitment expense S$0.7mn and unrealised FX gain of S$0.5mn.

- Market share for APAC was maintained around 26%.

- We downgrade to NEUTRAL with a lower target price of S$0.365. We are lowering our FY20e earnings by 17% to account for slower 2H20. The impact from the lockdown will only materialise in 2H20.

The Positives

+ New homes sales revenue the anchor for growth. Commission revenue from new launches rose 16% YoY in 1H20. It was the fastest-growing revenue segment for the company.

The Negatives

– Interim dividend unchanged. Despite the improvement in earnings, the interim dividend was kept unchanged. Despite the rebound in property transactions in July and August, concerns remain whether the weak economy will hurt buying sentiment in 4Q20.

Outlook

2H20 will bear the brunt of the lockdown especially new home sales and resale. There was no viewing of units from 7 April to 19 June. Another S$0.7mn from JSS grant can be expected in 2H20. A positive has been the company efforts to expand more aggressively the ERA model into SE Asia, such as Malaysia, Indonesia and Vietnam. This will lay the foundation for future growth outside Singapore.

Downgrade to NEUTRAL from ACCUMULATE with a lower target price of S$0.365 (prev. S$0.55)

We are lowering our recommendation due to the weaker than expected results and reducing our earnings estimates for FY20e and FY21e.

Source: Phillip Capital Research - 17 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024