KOUFU GROUP LIMITED – 2H20 Recovery on Track

traderhub8

Publish date: Fri, 14 Aug 2020, 08:48 AM

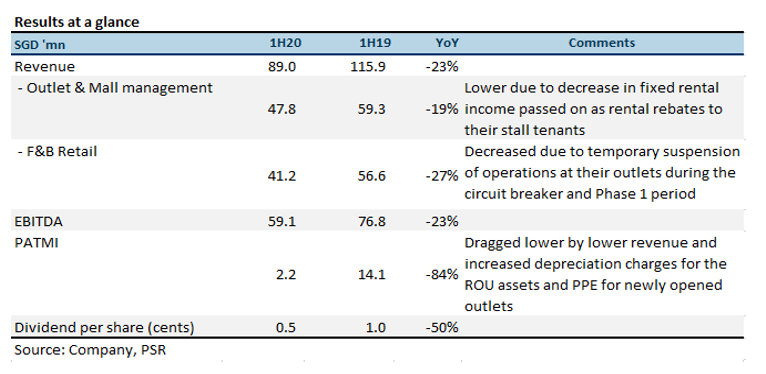

- 1H20 results were in-line. Revenue and EBITDA formed 46% and 43% of our estimates respectively for FY20e as the lower footfall and closure of outlets during the circuit breaker in April and May put a drag on revenue.

- Outlet & Mall management and F&B retail declined by 19% and 27% respectively with the former more resilient because of fixed rental to cushion the impact from COVID-19.

- The interim dividend was cut to 0.5 cents from 1.0 cents last year. Koufu expects 2H20 to be much better as outlets reopened.

- We are maintaining our BUY rating with a lower target price of S$0.77 (previously S$0.80). We benchmark our valuation to 18.5x FY21e as we tweak our earnings estimates for FY21e down by 3.2% as the TOP of the Group’s Integrated Facility gets delayed to 4Q20 from 3Q20 previously.

Positives

+ Marked improvement in footfall in Phase 2 of Singapore’s reopening after the circuit breaker. We estimate that Outlets & Mall management saw a 20% fall in footfall in the heartland areas during the circuit breaker period. Footfalls and revenue of the food courts and coffee shops located in the heartlands have seen significant improvements – to about 90% pre-COVID-19 levels – after the resumption of dine-in services. Business operations in Macau have also resumed operations albeit at significantly lower footfall.

+ F&B retail that saw the greatest hit in 1H20 sees marked recovery. The F&B retail segment was the biggest drag on 1H20 revenue from as it does not have fixed rental income from stall tenants like the Outlet & Mall management segment. The temporary suspension of 10 food courts, 3 quick-service restaurants (QSR), 2 full-service restaurants and 26 R&B tea kiosks/QSR during the circuit breaker and Phase 1 periods have also reopened and have seen a significant uptick in takings after the circuit breaker.

+ New store openings resumed. The Group secured and opened two new coffeeshops and one R&B Tea kiosk in 1H20. They also opened their first R&B Tea kiosk in Indonesia on 4 July 2020. The opening of one new food court at Le Quest, Bukit Batok initially slated for opening has been delayed to the fourth quarter of 2020. The Group expects to open one quick service restaurant at Canberra Plaza and three new R&B Tea kiosks at Fusionpolis, Change Alley Mall and Le Quest in 2H20. The opening of one new food court at Nova City in Macau is also slated for opening in 3Q20.

Negatives

– Expected TOP of Integrated Facility (IF) pushed to 4Q20, at the earliest. The progress of the construction of the IF has been delayed due to the COVID-19 measures introduced in both Singapore and Malaysia (where certain materials have been sourced from). The Group expects further delay in the TOP to be in the fourth quarter of 2020, at the earliest, as the commencement of construction has been delayed. On a positive note, management informed that construction has resumed and they expect to move into the IF in the first quarter of 2021. In light of this new development, we have revised downwards our earnings estimate for FY21e and FY22e by 3.2% and 2.9% respectively.

– Footfalls at food courts located near offices, down-town areas, tertiary institutions as well as tourist hot-spots continue to remain low. With the resumption of most of the operations, footfalls at food courts located near offices, down-town areas, tertiary institutions as well as their Rasapura Masters and Elemen Restaurant at Marina Bay Sands continue to see low footfall which is expected to persist in 2H20.

Update on Deli Asia acquisition

Koufu has completed the acquisition of Deli Asia on 30 July 2020. The acquisition of Deli Asia is expected to fast-track Koufu’s revenue diversification and network expansion in complementary dim sum snacks, fried food and dough products. The acquisition will allow them to gain access to new markets through the supply of frozen and partial fried food products to third party businesses, including supermarkets and exports to overseas markets. According to management, they have plans to further expand their network of seven retail outlets under Dough Culture brand to 20 in the next five years.

Cost savings expected from move into IF. They also expect to move the manufacturing of Deli Asia’s food products to the new IF, which will allow them to benefit from rental savings from the two facilities that Deli Asia is currently operating in.

Outlook

We continue to remain positive on the Group’s outlook post circuit breaker. We believe the recovery in consumption post circuit breaker will continue to improve footfalls and revenue of the food courts and coffee shops in 2H20. We expect the completion of the Group’s new IF in 4Q20 to see cost savings and an additional revenue source for them. Koufu has announced a dividend of 0.5 cents per share against 1H20 earnings per share of 0.46 cents, signaling their confidence in the 2H20 recovery.

Maintain BUY with lower TP of S$0.77 (previously S$0.80)

We are maintaining our BUY rating with a lower TP of S$0.77. We tweak our FY21e and FY22e earnings estimates down slightly by 3.2% and 2.9% respectively as the TOP of the Group’s IF gets delayed to 4Q20 from 3Q20 previously.

Source: Phillip Capital Research - 14 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024