StarHub Limited – Mobile Weakness Will Persist

traderhub8

Publish date: Tue, 11 Aug 2020, 09:35 AM

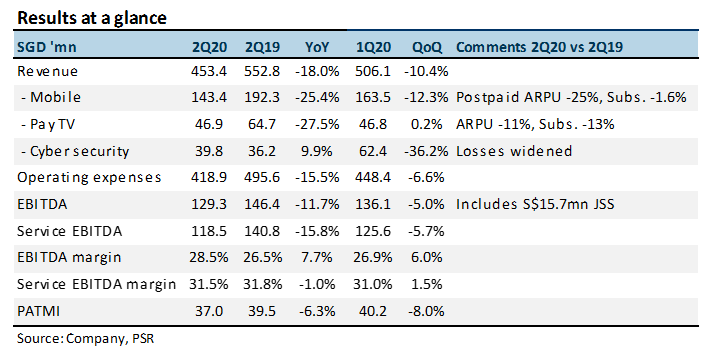

- 2Q20 results were below expectations. Revenue and EBITDA declined by 18% and 17% YoY respectively. EBITDA would have dropped 22% YoY, excluding the JSS grant of S$15.7mn.

- The interim dividend was cut 45% to 2.5 cents. But StarHub guided full-year FY20e dividends to be at least 5 cents.

- Mobile revenue dropped 25% YoY with ARPU declining 25% due to the loss in roaming revenue.

- Maintain NEUTRAL with a lower target price of TP S$1.24. We benchmark our valuations to 6x EV/EBITDA (excluding other income). We are lowering our FY20e EBITDA by only 3% after the inclusion of around S$30mn in grant income into our EBITDA. Our revenue estimates are reduced by 6% as we further cut our mobile ARPU and subscribers assumptions. Mobile will remain a drag even into 2H20 until the roaming revenues can recover. The dividend yield of at least 4% can provide some respite to the share price.

Positives

+ PayTV stable QoQ basis. PayTV revenue was unchanged on a QoQ basis at S$46.9mn. The contraction in subscribers is now at 2k to 3k per quarter compared to the average 20k per quarter in FY19. StarHub even managed to eke out a modest $1 QoQ rise in ARPU to S$39.

Negatives

– Mobile revenue was weak on lower ARPU and subscribers. 2Q20 mobile revenue fell 25% YoY to $143mn. Revenue was hurt by 25% YoY decline in postpaid ARPU to a record low S$30. The restriction on international travel led to a fall in roaming revenue. Prepaid subscriber declined by 18% YoY to 634k, a result the drop in tourist arrivals.

– Interim dividend cut to 2.5 cents. StarHub announced an interim dividend of 2.5 cents. This is a 45% decline from 1H19 4.5 cents. Recall that in FY19, StarHub was paying quarterly dividends of 2.25 cents.

– Cybersecurity and enterprise similarly weak. Cybersecurity operating losses widened to S$7m in 2Q20 (2Q19: S$1mn). 2Q20 is seasonally weaker as most government contracts are completed in March. Furthermore, the company is still investing in the business especially on regional capabilities. The enterprise business is faced with a decline in projects and delayed spending, especially in managed accounts. We were surprised by the 25% YoY fall in managed services revenue as it was supposed to be the annuity segment on the enterprise business.

Outlook

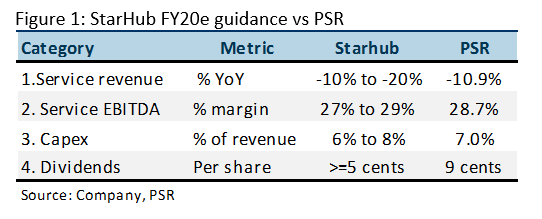

The outlook will be grim for at least the next two years. The loss in roaming and tourism-related revenue cannot be replaced until our international borders are reopened. We are lowering our FY20e EBITDA forecast by only 3% after incorporating around S$30mn of government grants. Figure 1 is management guidance compared to our forecast.

5G Update

StarHub provided an update of its 5G rollout:

- Commercial launch of 5G in 2021. The network will seamlessly work with 3G/4G services.

- End-2022, 50% nationwide network coverage and 2025 full nationwide coverage.

- A joint venture will be created on a 50:50 basis between StarHub and M1. The JV will own the 3.5GHx radio equipment and lease infrastructure (e.g. fibre, sites) from the parent or other parties.

- The JV will be equity accounted and not consolidate the debt.

- Capital expenditure is S$200mn over 5 years (StarHub share only) and front-loaded in 2H20 and 2021.

- JV is funded by 85% debt and 15% equity. Assuming $400mn capex plan, Starhub will need to inject $30mn equity.

- JV will have its own independent management.

- Some of the applications supported from 5G include mobile cloud gaming, AR/VR, IOT, AI and fixed wireless access.

Unclear at the present, how much 5G can uplift ARPU for StarHub. Faster and larger capacity connectivity will not be enticing enough. Any uplift will depend on rollout of new services that can be bundled for the consumer and enterprises, for instance, gaming apps bundled into 5G offerings.

Maintain NEUTRAL with lower TP of S$1.24 (previously S$1.45)

Our valuation is based on a 6X EV/EBITDA FY20e. We have excluded other income in our EBITDA valuation as we deem it to be one-off grants and compensation for the current environment.

Source: Phillip Capital Research - 11 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024