Asian Pay Television Trust – Foreign Exchange Boost

traderhub8

Publish date: Tue, 11 Aug 2020, 09:34 AM

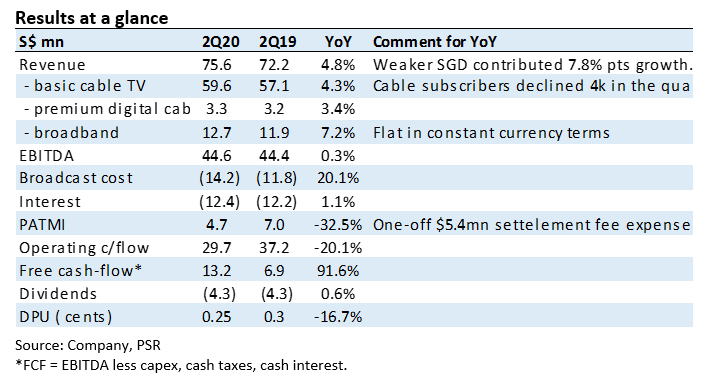

- 2Q20 revenue and EBITDA exceeded our estimates due to Taiwan dollar appreciation.

- Cable TV subscribers continue to decline. It contracted 4,000 during the quarter but was balanced out by higher broadband customers of 4,000.

- Dividends, as expected, was cut to 0.25 cent per quarter following the 25% increase in shares outstanding following the rights issue. We maintain our BUY recommendation with an unchanged target price of S$0.15. Despite the contraction in core cable TV business, we favour APTT because the dividends are sustainable, upside optionality from 5G (backhaul) revenue and growth in broadband subscribers to offset cable TV contraction.

The Positives

+ Free-cash flows (FCF) remains healthy. FCF of $13mn this quarter more than covers the dividend payment of $4.3mn. Dividends payable will rise to S$4.5mn per quarter after the higher share base post rights issue. The higher FCFs was due to a fall in capex by around S$5mn YoY.

+ Broadband subscriber still grows. Broadband subscribers continue its steady climb for the eleventh consecutive quarter to 246,000. Revenue rose 7% YoY but down 0.6% in constant currency terms following ARPU decline of 9% YoY compensated by subscribers rising 9.3% YoY.

The Negatives

– Dividend cut to 0.25 cents per quarter. As expected, following the rights issue, APTT lowered dividends to 0.25 cent per quarter (previously 0. 30 cents). APTT will announce their FY21 dividend policy in 3Q20 results.

– One-off S$5.4mn settlement expense. There was a S$5.4mn one-time programming settlement fee paid by APTT to the content agents. It is additional programming cost after negotiations that started in 2019.

– Jump in broadcasting cost. There was an unexpected jump in broadcast and production cost. The reason was timing in accruing the cost but will stabilize on an annual basis. We are assuming programming expense was lower last year on expectations that negotiations with broadcasters for lowering cost would be successful. This did not materialize.

Outlook

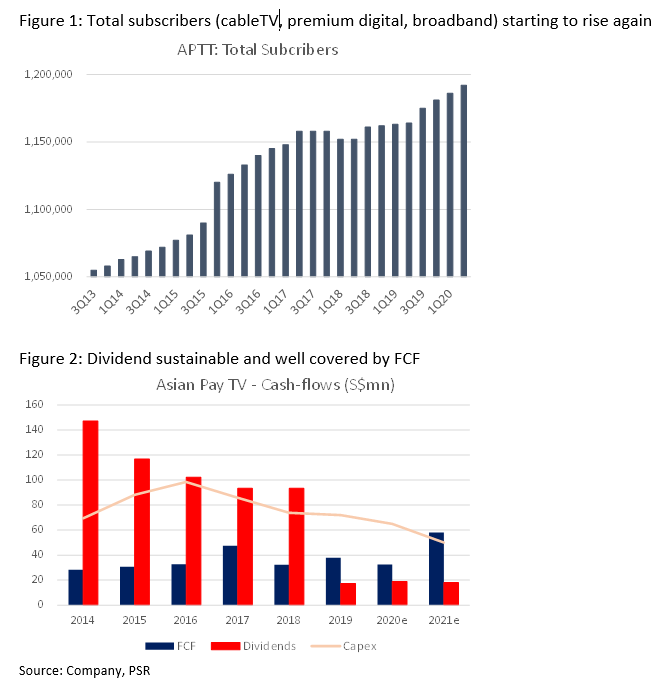

Cable TV remains the weak spot with subscribers contracting around 4,000 per quarter. But total subscribers for APTT, including broadband and premium digital TV, have started to rise (Figure 1). Total subscribers are rising around 2% per year but blended ARPU* is declining by 5%. We still expect total revenue to contract. We raised our EBITDA forecast by 4% due to the change in foreign exchange assumption. Other changes in our forecast were higher broadcast and programming cost, the inclusion of the settlement fee and incorporating proceeds from the rights issue.

*Blended ARPU based on total revenue less total subscribers

Maintain BUY and unchanged target price of S$0.15

The three reasons for our BUY recommendation are as follows:

- Dividends are sustainable: As per figure 2, dividends far exceeded FCF during FY14 to FY18. APTT had to gear up to pay dividends. Following the massive cut in dividend in FY19, we now expected dividend of S$18mn per year to be well covered by FCF of S$58mn. This makes the current yield of 7.8% attractive and maintainable, in our opinion.

- Upside from 5G: APTT capex is still elevated at S$65mn per year. We believe the capex is to increase capacity into their fibre backbone in preparation of 5G backhaul business. Mobile operators looking to launch 5G services will prefer to tap on APTT backhaul to connect to their base stations rather than using an incumbent and competitor network.

- Operational more stable: Subscriber growth in premium TV and broadband will help in stemming the decline in revenue. Broadband has higher margins as there is no content cost.

Source: Phillip Capital Research - 11 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024