United Overseas Bank Limited – Business Headwinds Weigh in

traderhub8

Publish date: Tue, 11 Aug 2020, 09:33 AM

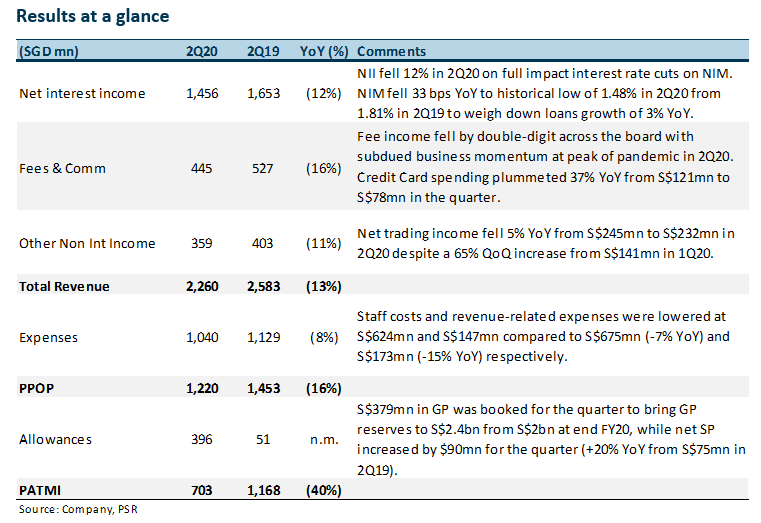

- 2Q20 earnings of S$703mn was 18% below our previous estimates of S$857mn due weaker-than-expected fees income amidst Circuit Breaker period in the quarter.

- NIM fell 33 bps YoY in 2Q20 on low interest rates and huge inflow of deposits.

- Weakness observed across non-interest income as fee income fell 16% YoY while other non-interest income fell 11% YoY.

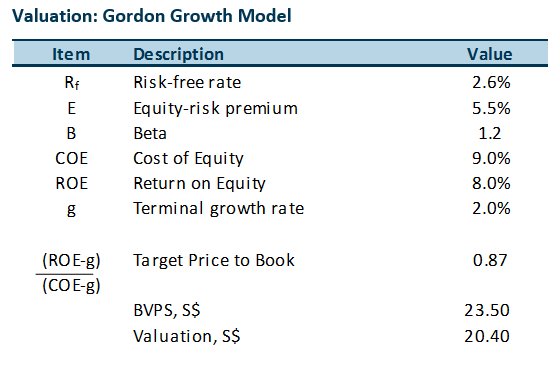

- Maintain ACCUMULATE with a reduced target price of S$20.40 (previously S$20.70). We revised FY20e earnings downwards by 5% to reflect business disruptions from COVID-19.

Positives

+ S$90mn of allowances recognised on impaired loans in 2Q20 represents only 13 bps of credit costs.

13 bps of SP recognised in the quarter is lower than the quarterly average of 20 bps recognised over the past four quarters. Remaining S$378mn of GP represents 54 bps of credit cost is within previous credit cost guidance of 50 – 60 bps in both FY20 and FY21.

Negatives

– NII fell 12% YoY in 2Q20 as NIM contracted to historical low of 1.48% from 1.81% a year ago (-33 bps).

Apart from the low interest rate environment experienced throughout the quarter, deposit growth of 7% YoY outpaced loans growth of 3% loans growth within the same period, exacerbating the sharp fall in NIM. NIM for 1H20 came in at 1.60%, down 20 bps YoY from 1.80% in 1H19, buffered by a better 1Q20 NIM performance of 1.71%.

Lag effect from re-pricing of deposits and cycling of liquidity from deposits into interbank assets will lift downward pressures on NIM in 2H20, as we expect NIM to recover from 2Q20 lows to 1.58% for the entire FY20.

– Weakness observed across non-interest income.

Net fee and commission income saw all segments fall by double digit with the exception of fund management (-3% from S$59mn to S$57mn) in 2Q20. Weakness was most pronounced in credit card fees and wealth management fees, which fell by 37% YoY and 17% YoY from S$121mn and S$160mn to S$76mn and S$133mn respectively as business activity was heavily impacted during the Circuit Breaker period during 2Q20.

Other non-interest income also fell by 11% in 2Q20, affected by lower net trading income (-5% YoY from S$245mn to S$232mn).

Outlook

Semi-annual dividend of S$0.39 per share declared in compliance of 60% cap on FY19 dividends (S$1.30) by MAS.

Revised dividend amount provides an annualised S$0.78 in dividends for FY20. This represents a Scrip dividend will also be provided without discount as the bank does not feel the need to shore up additional capital while their CET-1 remains at healthy level of 14.0% from 14.1% observed in 1Q20.

We expect the bank to resume 50% payout ratio in FY21, which will see dividend resume to at least S$1.10 per share.

Recognition of allowances to remain at current run-rate over the next two years.

Previous guidance of 50 – 60 bps in credit cost per year (approx. S$1.5bn per year) represents S$350 – S$420mn of allowances per quarter for the next two years. Held together with RLAR of S$379mn, the bank should be well-hedged against asset quality deterioration from the COVID-19 pandemic.

Investment Actions

We maintain our ACCUMULATE recommendation with a reduced target price of S$20.40 (previously S$20.70).

We revise earnings estimate for FY20e downwards by 5% to reflect a slower recovery from business disruptions from COVID-19.

Source: Phillip Capital Research - 11 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024