Ascott Residence Trust – Slow, Precarious Recovery

traderhub8

Publish date: Wed, 29 Jul 2020, 10:57 AM

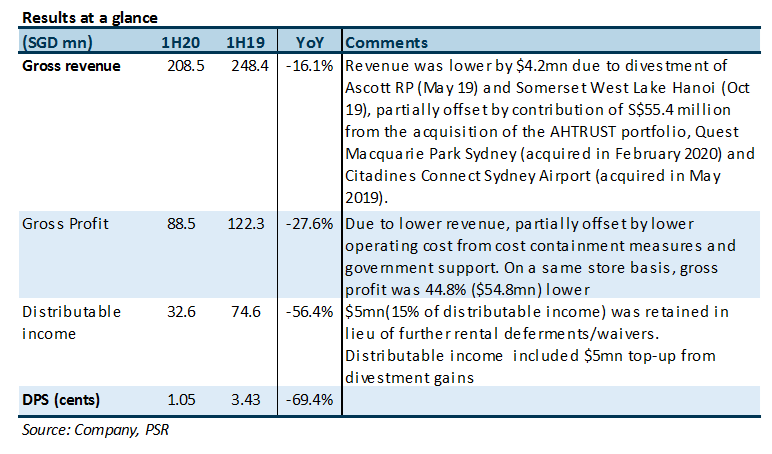

- 1H20 DPU of 1.05 cents formed 19.6% of FY20e DPU, $5mn of dist. income retained.

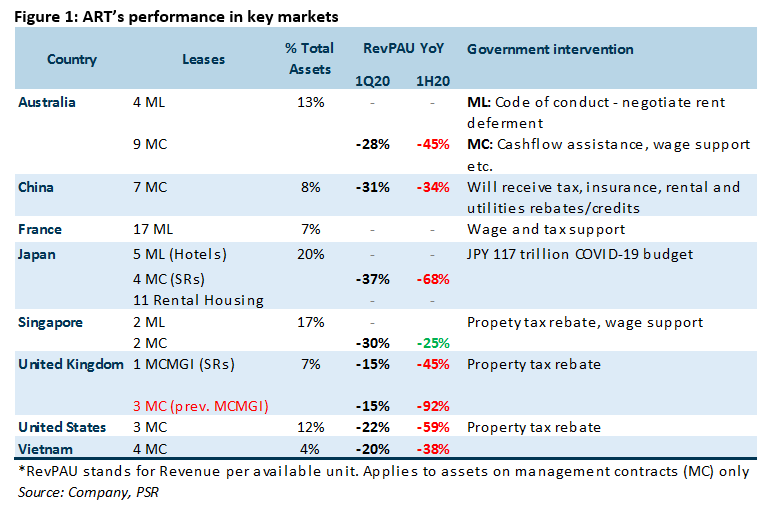

- RevPAU down 52% YoY in 1H20 (1Q20: 23%); 1H20 Gross Profit -28% YoY with ML/MCMGI/MC contributing 59%/7%/34% respectively.

- Erosion of “stable” revenues as 4 French ML and 3 UK MCMGI leases to Sponsor were renewed on variable terms.

- Maintain BUY with lower TP of $1.08 (prev. $1.25) as we lower revenue to reflect a slower recovery of international travel, the extension of 4 French ML and 3 UK MCMGI on variable terms, and the sale of AGZ and CDMP. FY20e DPU is lowered by 21.7% and represents a DPU yield of 6.0%.

The Positives

+ $843mn in cash and credit facilities sufficient to cover c.2 years of fixed cost, comprising $620mn in cash & committed credit facilities, $163mn in cash proceeds from divestment of Somerset Liang Court received in July 2020 and $60mn uncommitted credit facility secured in July 2020. We note that ART’s interest coverage ratio deteriorated QoQ from 5.1x to 3.6x, however the cash and credit facilities in place will help to weather this period of depressed earnings.

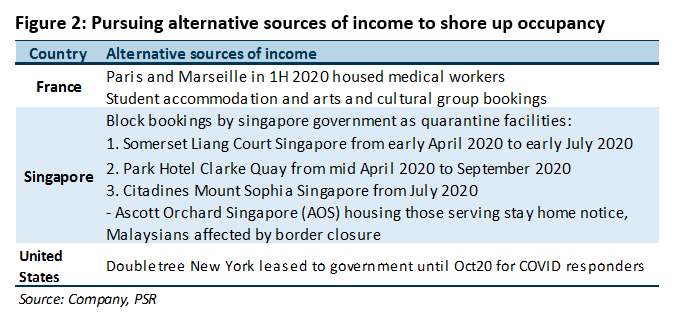

+ Alternative sources of revenue to help fill occupancy (1H20: c.50%, 1Q20: c.40%). International travel bans are still largely in place. However, ART has been able to tap into alternative sources of revenue such as government bookings as quarantine facilities (SG) and temporary facilities for healthcare workers and COVID responders (US). Figure 2 summarises sources of alternative revenue. ART may benefit from the lifting of domestic travel restrictions in certain countries and the respective government initiatives to spur domestic travel.

The Negatives

– 1H20 RevPAR fell 52% YoY; 12 properties remain closed, comprising 11 properties in France (ML), 6 in Japan (2 ML, 2 MC), and 1 each in Belgium (MGMGI), Spain (MCMGI) and South Korea (ML). Some of the properties were mandated to close by the government and others were close due to soft demand (Paris) or to optimise resources. RevPAR for all countries deteriorated further (Figure 1) due to lower occupancies (1H20: 50% vs 1H19: 80%) and room rates, except for SG, which improved 5ppts from -30% to -25%, largely due to block bookings by the government.

– Erosion of “stable” revenues as 4 French ML and 3 UK MCMGI leases were renewed on variable terms. ART extended 7 expiring leases with the sponsor, albeit on variable terms. 4 expired French master leases extended on variable rent terms for 1 year w.e.f. 25 March 2020 and 3 expired UK MCMGI converted to management contracts for 1 year w.e.f. 1 May 2020. In 1H20, ART received income top-up of GBP1.0mn for the MCMGIs in UK.

Outlook

WBF Hotels & Resorts (WBF), the master lessee in 3 Japan properties, has filed for civil rehabilitation (i.e. bankruptcy) on 27 April 2020. These 3 properties are located in Osaka (of which 2 are closed) and make up c.1.8% of ART’s valuation. They would have contributed S$6.7mn in rent on a full-year basis. WBF has paid rent up till April 2020 and 3 months’ worth of security deposits have been used to offset rent until July. WBF is Japanese owner-operator, with 15 properties on their books and managed 30 properties. ART is in discussions with WBF, Sponsor The Ascott Limited (TAL) and other operators, to take over operations, if necessary. TAL operates 8 SRs in Japan, 4 of which are under ART’s portfolio.

Apart from the 3 WBF ML, 10 other assets are master leased to third party operators.

Unlocking value through divestments

In July 2020, ART entered into two conditional agreements to divest Ascott Guangzhou (AGZ) and Citadines Didot Montparnasse Paris (CDMP) for c.S$191.4 million, at 52% and 69% above their respective book values. ART is expected to realise total estimated net gains of about S$23.2 million upon the completion of both transactions. The exit yields for AGZ and CDMP were 3% and 4% respectively. Including these transactions, ART will have

Maintain BUY with a lower target price of $1.08 (prev. $1.25).

We lower revenue to reflect a slower recovery of international travel, the extension of 4 French ML and 3 UK MCMGI on variable terms, and the sale of AGZ and CDMP. FY20e DPU is lowered 21.7% and represents a DPU yield of 6.0%.

Source: Phillip Capital Research - 29 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024