US OFFICE REITS (Initiation)- Resilience Amid New Normal

traderhub8

Publish date: Mon, 20 Jul 2020, 09:01 AM

- Attractive dividend yield of 8% in US office REITs, 94-97% occupancy, built-in rental escalation, freehold assets and WALEs of 4.9-5.7 years.

- Tenant demand supported by key industries (tech, financial and professional services) that account for more than 30% of rental income.

- Initiate coverage on Manulife US REIT and Prime US REIT with a BUY and a target price of US$0.80 and US$0.88 respectively.

Sector Background

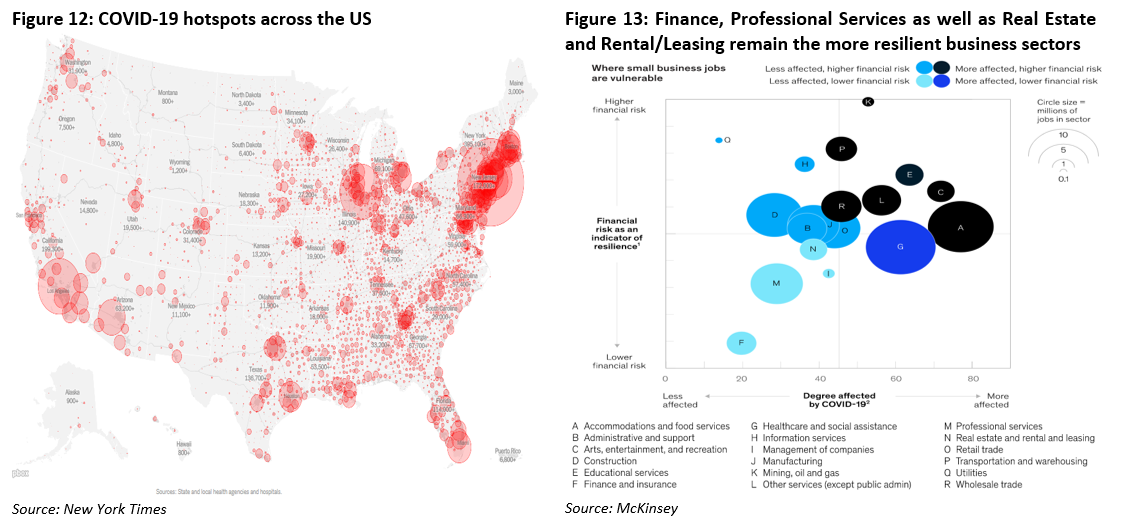

The US economy faced a rough start to 2020, as the year opened with a global pandemic. US GDP shrank 4.8% in the first quarter – the biggest contraction since the financial crisis, and the economy is expected to contract between 3.6% and 7.4% in 2020. In the near-term, the pandemic has resulted in fewer workers in the office and more satellite offices being built up in the suburbs. We believe working from home is not a permanent solution that can replace physical office materially. Firstly, office remains the most productive environment to work. The potential to guide, innovate and collaborate effectively peaks in a physical office. Secondly, we expect the multi-year trend towards densification of office space to pause, providing near-term support for leasing demand.

Sector Merits

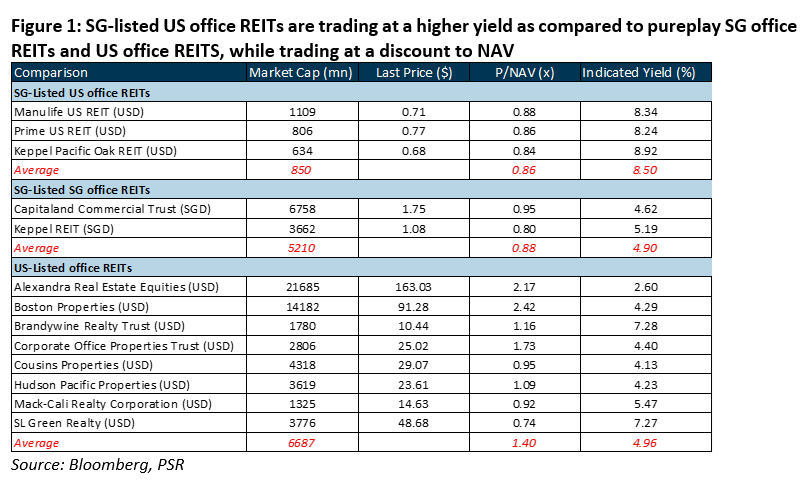

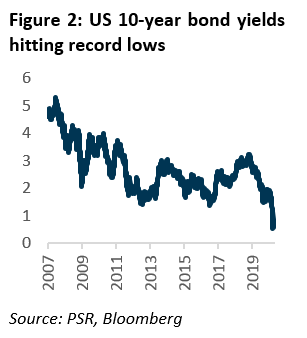

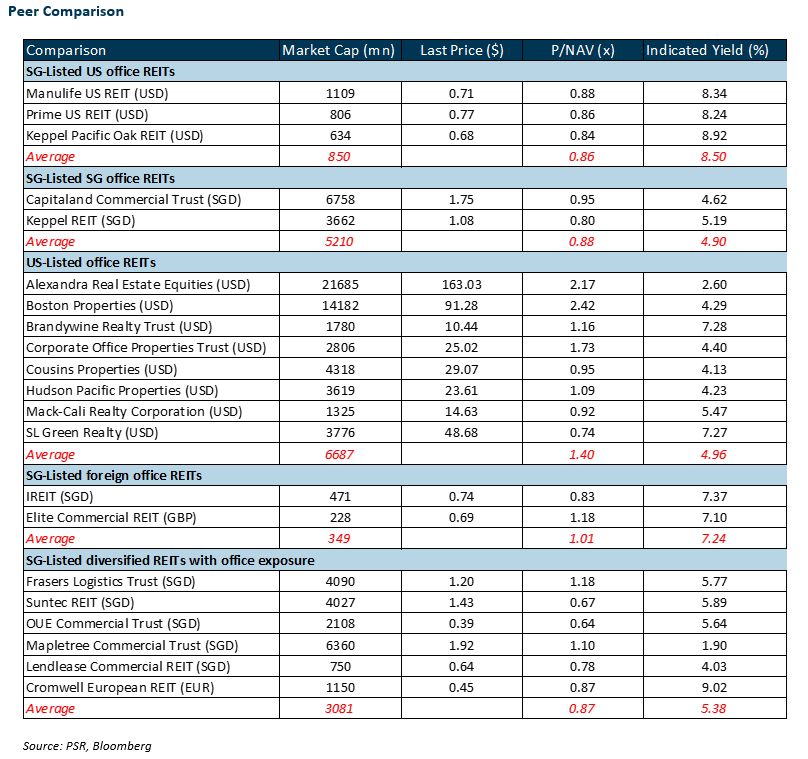

- Attractive dividend In this economic climate where interest rates globally are depressed, US office REITs present attractive yield spreads of 7-9% to the US 10-year treasury yields. The yields of SG-listed US office REITs also outperform that of both SG office REITS and US-listed US office REITs by 1.7x.

- Collaborative work in a dynamic environment to hold demand for office; long WALEs to support. Albeit COVID-19 has accelerated trends like remote working and telecommuting, the US has employed a substantial percentage of remote-working even pre-COVID. Employers do see merits in a dynamic working environment. Coupled with long WALEs, the income stream for office REITs is usually predictable for 5-10 years into the future.

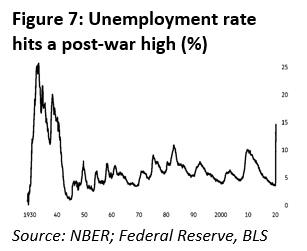

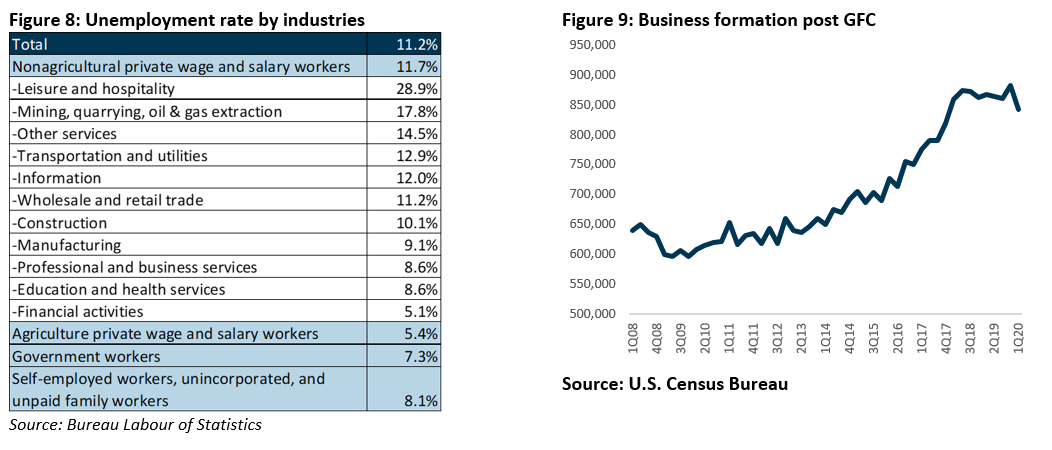

- Office-using jobs less affected by unemployment; Looking forward to a stabilised normal. Amidst the outbreak, the U.S. unemployment rate surged to its peak of 14.7% in April before declining to 11.2% in June. However, the unemployment rates in June for the anchor industries in the office – Financial Activities and Professional & Business services was 5.1% and 8.6% respectively, which is the lowest few amongst the industries. Using 2008 GFC as a recent crisis proxy, business formations in the U.S. grew steadily over 10 years at a CAGR of 4% as the US economy recovered.

- Office space demand by Top 3 leasing drivers (Tech, financial and professional services) will moderate not abate. These long-standing pillars of the economy have a long heritage of refining how they do business. The existence of virtual conferencing tools predates COVID, but the fact that these sectors still choose to conduct certain functions/elements of business in the flesh implies that these sectors are best served by office premise and explains the pre-disposition for the office environment. We believe that the structural shifts in the office landscape will be gradual rather than immediate, with the desire for physical collaboration and networking resulting in the maintenance of an office address.

Key Risks

Weaker economic outlook and takeaways from COVID-19 to push companies towards a more mobile operating model. The successful implementation of telecommuting has heightened the possibility of moving towards a premise-light business model. Additionally, consolidation/downsizing within industries may lead to greater ‘shadow market’ space should current tenants be allowed to sublet their space. Held together, this points to a softer leasing environment.

Market Outlook

Attractive dividend yields. In this economic climate where interest rates globally are depressed, SG-Listed US office REITs present attractive yield spreads of 7-8% to the US 10-year treasury yields. The yields of SG-listed US office REITs also outperform that of both SG office REITS and US-listed US office REITs by 1.7x. In terms of its risk-reward, we believe that US office REITs are worth the investment in the long run.

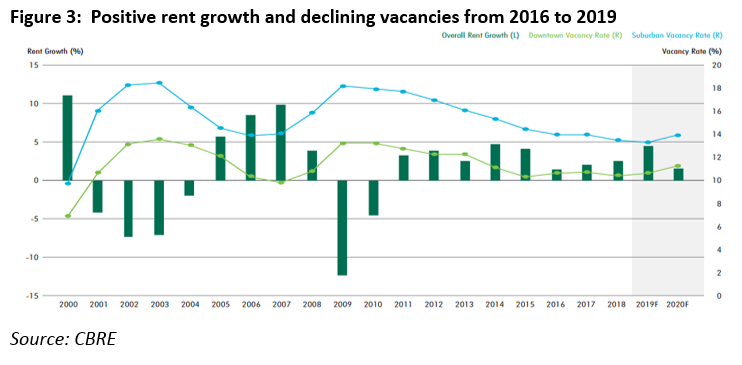

Collaborative work in a dynamic environment to hold demand for office; long WALEs to support. Albeit COVID-19 has accelerated trends like remote working and telecommuting, the US is one of the markets that has employed a substantial percentage of remote-working even before the outbreak. According to Gensler’s US Workplace Survey, since 2016, office work has evolved from an individualistic mode (2016: 50%; 2019: 45%) to one that is more learning and collaborative (2016: 50%; 2019: 55%). Employees have spent 14-15% of their work time telecommuting. In the same timeframe, the office market was experiencing positive rent growth and declining vacancies. This shows that telecommuting and office may not be mutually exclusive. (Fig. 3).

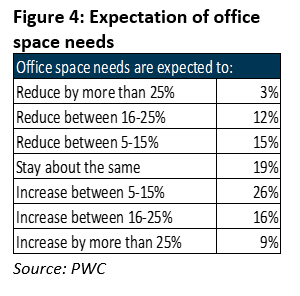

Additionally, employers do see merits in a dynamic working environment such as cross-functional collaboration, which lead to mixed responses in their view of needing an office in 3 years. According to PWC US Remote Work Survey (Fig. 4), 30% of employers anticipate they’ll need less total office space, primarily due to remote work. However, 19% foresee no change and 50% are anticipating an increase in office space needs due to physical distancing requirements.

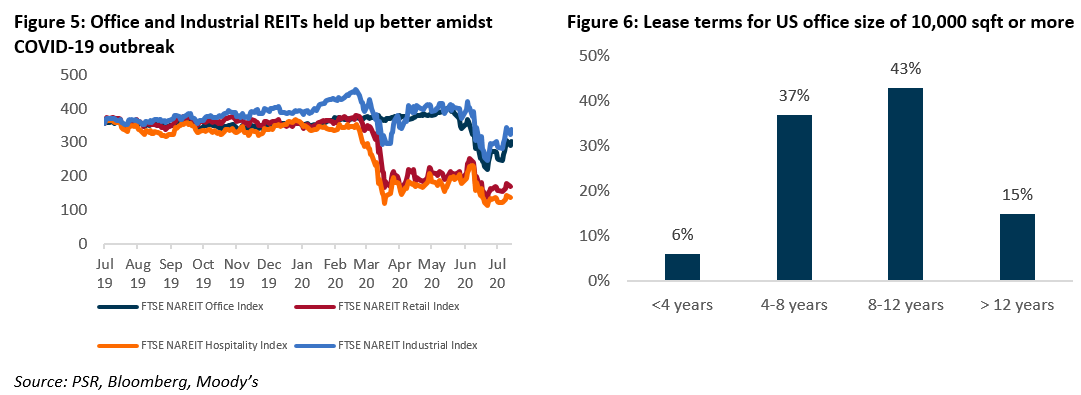

Nevertheless, we believe that office is one of the more resilient subsectors (Fig. 5) Generally leased for a duration of 5-10 years, the income stream for office REITs is usually predictable for years into the future. According to Moody’s Investor Service (Fig. 6), 94% of the larger office leases will only start to expire 4 years from now, which suggests that landlords do have time to adjust to the future of work. Concentration risk can be mitigated through an enlarged property base. Additionally, a diversified tenant mix which comprises larger and more established tenants in growing/defensive sectors can provide the REITs with greater income stability.

Office-using jobs less affected by unemployment; Looking forward to a stabilised normal. Amidst the COVID-19 outbreak, the U.S. unemployment rate surged to its peak of 14.7% in April before declining to 11.2% in June, which is higher than its peak of 10% during the 2008 Global Financial Crisis (GFC). While the economic data paints a gloomy outlook, the unemployment rates for the heavy-weight anchor industries in the office – Financial Activities and Professional & Business services in June was 5.1% and 8.6% respectively, which is the lowest and third lowest amongst the industries (Fig. 8), according to Bureau Labour of Statistics. We also note that a second stimulus check may be in the books given that the new weekly jobless claims exceed 1mn for 16 weeks since the week of 21 March 2020. Using the 2008 GFC as a recent crisis proxy, business formations in the U.S. grew at a CAGR of 4% over 10 years as the US economy recovered.

Demand for Office Space by Top 3 Leasing Drivers will moderate not abate

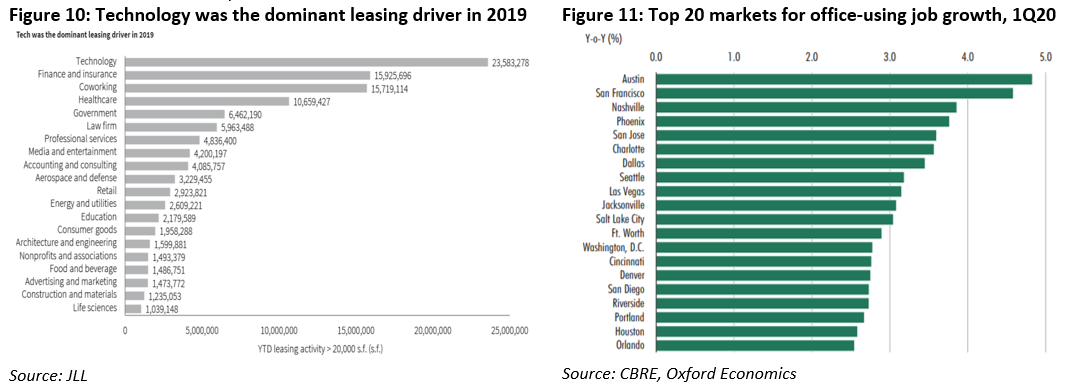

1. Technology: Growing Technology, Advertising, Media and Information (TAMI) industry to support office-using job growth. In 1H19, the technology industry accounted for 21.6% of overall leasing activity (Fig. 10). Amid COVID-19, trends like e-commerce, gaming, remote working and distance learning has been accelerated. Second to healthcare and consumer staples, technology has become essential service on top of simply being a sector for growth. According to CBRE, key technology markets like Austin, San Jose, San Francisco, Nashville and Salt Lake City saw greater office-using job growth and higher rates of net absorption in 1Q20. The top 3 markets for Q1 2020 job growth were Austin, San Francisco and Nashville as well.

While a growing sector, the tech and media sectors seem to be the most receptive to working-from-home. However, the collaborative and enterprising culture has been the narrative for the demand of office space for tech firms.

2. Financial Services: Financial services industry remains hardy. The Finance and Insurance sector is a cornerstone of the economy and is responsible for 8.4% of the US GDP in 2019, a mild 1ppt growth from 2018. Physical interaction and rapport are generally preferred when dealing in large quantum transactions. These long-standing pillars of the economy have a long heritage of refining how they do business. Despite the existence of virtual conferencing pre-COVID, certain functions/elements of business still require the physical touch. This offers and explanation as to why the financial and profession services sectors may have a pre-disposition for the office environment.

The largest U.S. bank by assets, JPMorgan Chase & Co has established a task force to help locations establish plans for reopening, whereas Citigroup is weighing the option of opening satellite offices outside New York City through short-term leases. However, we do note that the desire to return to the office is higher for the US finance sector than the profession services sector.

3. Professional services: Long-term leasing headwinds for the Legal industry. Professional services are also a traditional anchor of the economy and account for 11.4% of the of the US GDP in 2019, a modest 2ppt growth from 2018. According to Cushman and Wakefield, the legal sector traditionally operated with 300-400sqft per employee, while most sectors have adapted to under 150 sqft per employee. This means that law firms generally subscribe up to double of the space taken by a similar-sized non-legal company. We suspect the sensitive nature and critical function of lawyers, along with high quantum deals, necessitates a physical discussions and collaboration in an uncompromised and dedicated space. However, the historical excessive utilisation of space may change and hence, we think that the legal sector presents the greatest right-sizing risk.

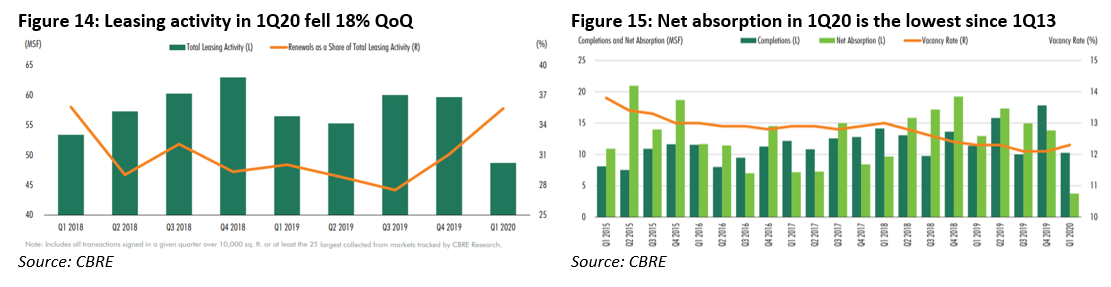

While structural shifts are expected, a study by McKinsey concludes that the Finance, Professional Services as well as Real Estate and Rental/Leasing remain the more resilient business sectors (Fig. 13).

Key risks

Structural change: Weaker economic outlook and takeaways from COVID-19 to push companies towards a more mobile operating model. Containment measures have forced companies to implement remote working and highlighted the need for more robust business continuity plans. Counteracting leasing strategies have emerged. The successful implementation of telecommuting has heightened the possibility of moving towards a premise-light business model. Additionally, consolidation/downsizing within industries may lead to greater ‘shadow market’ space should current tenants be allowed to sublet their space. Held together, this points to a softer leasing environment. On the other hand, companies may look to reduce office-concentration risk by having split offices and lower desk density, increasing the need for flex space.

Leasing and supply headwinds. According to CBRE, leasing activity fell by 18% QoQ and 14% YoY as businesses take on a more cautious approach with regards to relocations and expansions. Overall, office vacancy rate increased by 20bps as new supply outpaced demand in 1Q20. Net absorption for the quarter was the lowest since 1Q13. Rental growth is expected to remain weak, as the landlord’s pricing power is highly reliant on demand for office space which is at the mercy of its markets’ employment growth and economic health.

Comments:

The nature of business, utilisation of space and workforce demographic differs across trade sectors, as such, so will the response and occupier strategies. While the office landscape will experience structural change, we believe that it will be gradual rather than immediate, with the desire for physical collaboration and networking resulting in the maintenance of an office address.

Why Manulife US and Prime US

1. Flight to Quality. Trophy and Class A assets have historically outperformed all office types in terms of average rents and occupancy, especially in prime areas located in/near the CBDs. Furbished in high quality architecture and amenities fitting for prestigious tenants to set up their headquarters, these high-classed assets are often part of the tenants’ branding strategy to resonate confidence and financial health. MUST and PRIME’s portfolio comprises of assets that minimally Class A and above, with no sector or tenant concentration exceeding 22.1% and 15.1% respectively. In times of uncertainty, we believe it is more worthwhile to stick to diversified REITs with high quality assets.

2. Equipped with strong sponsors recognised for their track record in real estate. MUST’s sponsor, Manulife, has more than 90 years of real estate development experience and manages over 60mn sqft of commercial real estate daily. As a private equity real estate company, PRIME’s sponsor – KBS is one of the largest owners of premier commercial real estate in the nation, with transactional activity exceeding $41bn. Both MUST and PRIME are backed by reputable sponsors with extensive expertise and track record in weathering through disruptive events, which may provide comfort to investors in this economic climate.

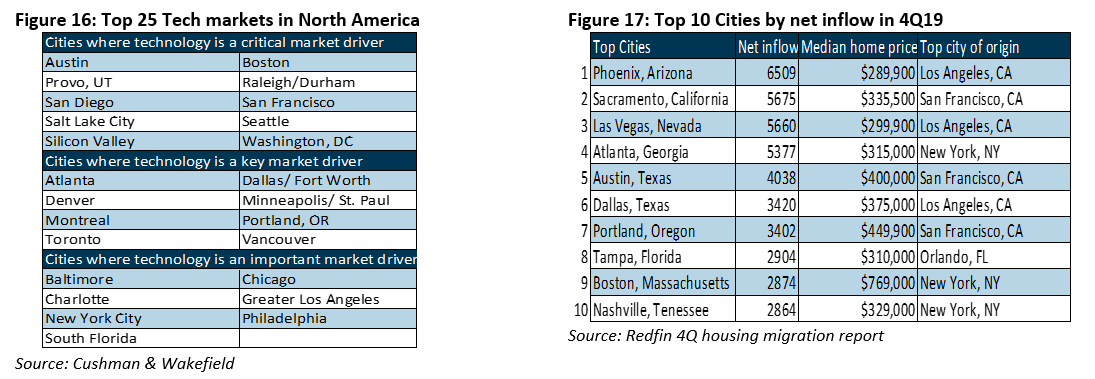

3. Many of Manulife’s and Prime’s assets are in the top 25 tech cities in North America (Fig. 16). According to Cushman & Wakefield, the average asking rents in the top 25 tech cities have increased nearly 50% since 2010, almost twice as fast as the whole U.S. In addition, property values in the top 25 tech cities increased roughly 60% in price per square foot during the same period, which is more than double the rate of the national average. We are expecting the valuation and income stream of MUST’s and PRIME’s assets to benefit similarly from the growth of technology companies, especially in key cities like Salt Lake City and Atlanta where there is a significant expansion in VC funding.

4. Riding on ‘Hipsturbia’; Appealing live-work-play suburbs/ second-tiered cities with big city charms. There is a growing attractiveness in ‘cool’ suburbs / second-tiered cities (e.g. Sacramento, Atlanta) which offer better affordability and similar city-life amenities as that of the major cities (e.g. New York, San Francisco and Chicago). MUST and PRIME have substantial presence in these markets. In addition, these markets are also home to a young population and a highly educated workforce which are key qualities companies gravitate to as they poised themselves for growth. According to Redfin, Atlanta and Sacramento are within the list of top 10 cities Americans are moving into in 4Q19 (Fig. 17).

The rebirth of the new live-work-play neighbourhoods in old school cities, agile office designs and massive capex in older office inventory is expected to flourish these key markets with new and refreshed opportunities. We believe that under-rated cities with amenities and attributes of a major city will be more attractive to US companies and citizens moving forward, exacerbated by more permissive policies around remote work and an overall shift towards greater affordability during times of duress.

Manulife US REIT – Quality that speak for itself

- Favourable portfolio attributes – occupancy of 96.5%, long WALE of 5.7 years, built-in rental escalation (c.2% p.a.), low expiries (4.4%/6.4% FY20/FY21), and high tenant retention of 76% in FY19.

- Relevance and preference for a physical workplace to continue; demand for office to moderate not abate.

- Initiate coverage with a BUY and TP of US$0.78; attractive FY20e/FY21e yield of 8.8%/9.0% and 0.88x P/NAV trading close to historical low (0.8x).

Company Background

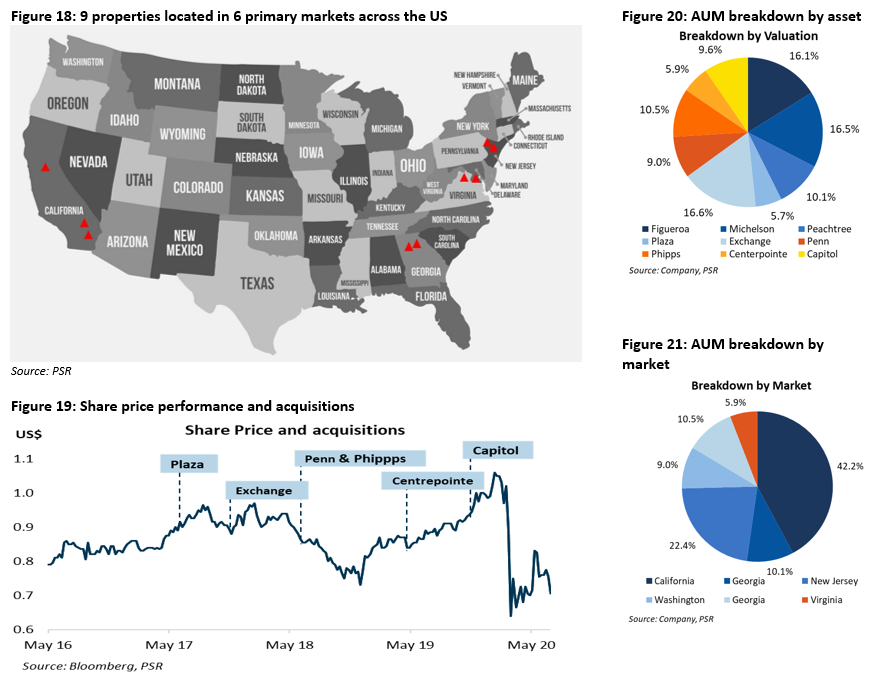

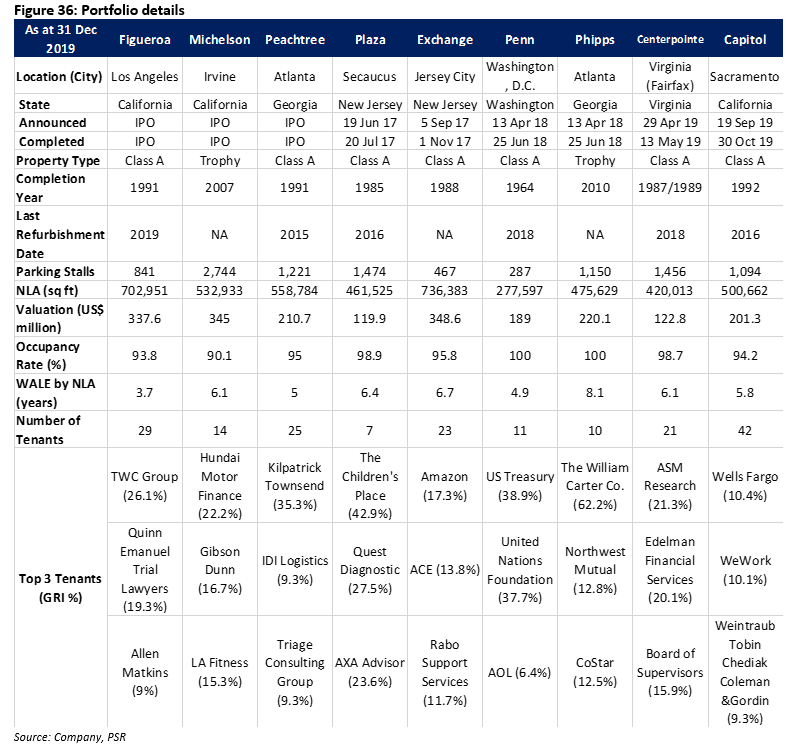

Manulife US Real Estate Investment Trust (MUST) is a Singapore real estate investment trust (REIT) listed on the SGX since 20 May 2016. It has expanded the portfolio by acquiring 6 properties since listing. As at 31 March 2020, Manulife US REIT’s portfolio comprises nine prime freehold office properties strategically located in Los Angeles, Irvine, Atlanta, Secaucus, Jersey City, Washington, D.C. and Virginia with a combined asset value of US$2.1 billion as at 31 December 2019.

Investment Merits

- Favourable portfolio attributes – Income visibility and growth embedded in the portfolio. Occupancy of 96.5%, long WALE of 5.7 years, 95.6% of leases have built-in rental escalation (c.2% p.a.), low expiries (4.4%/6.4% FY20/FY21) and high tenant retention of 76% in FY19. MUST’s high occupancy is attributed to its portfolio of Grade A and Trophy assets which are well-amenitised, located in cities with skilled work force and work-live-play characteristics. These assets usually attract HQ and mid-to-large tenants who tend to have stronger balance sheets.

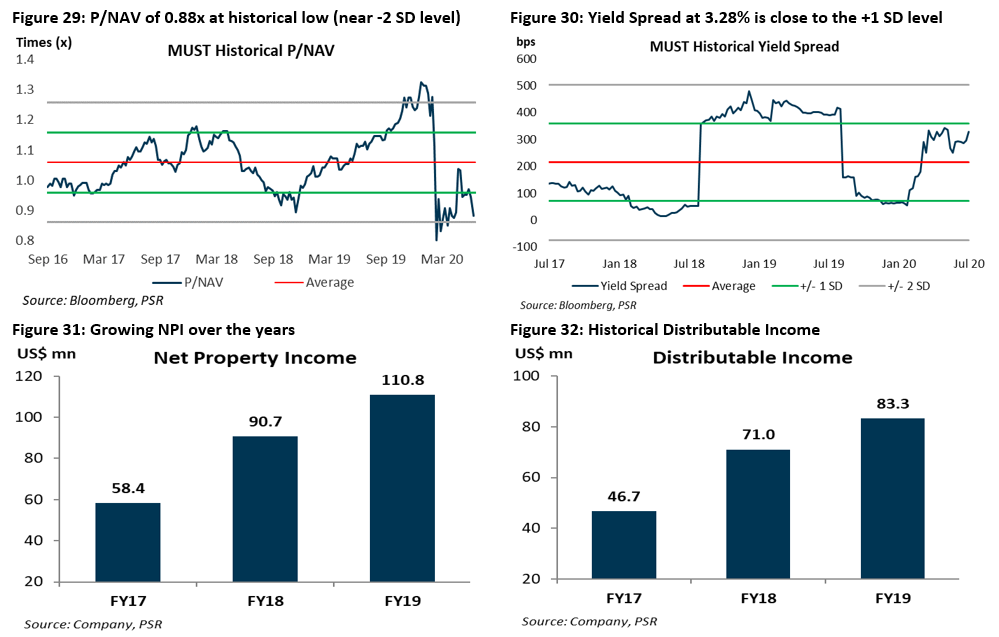

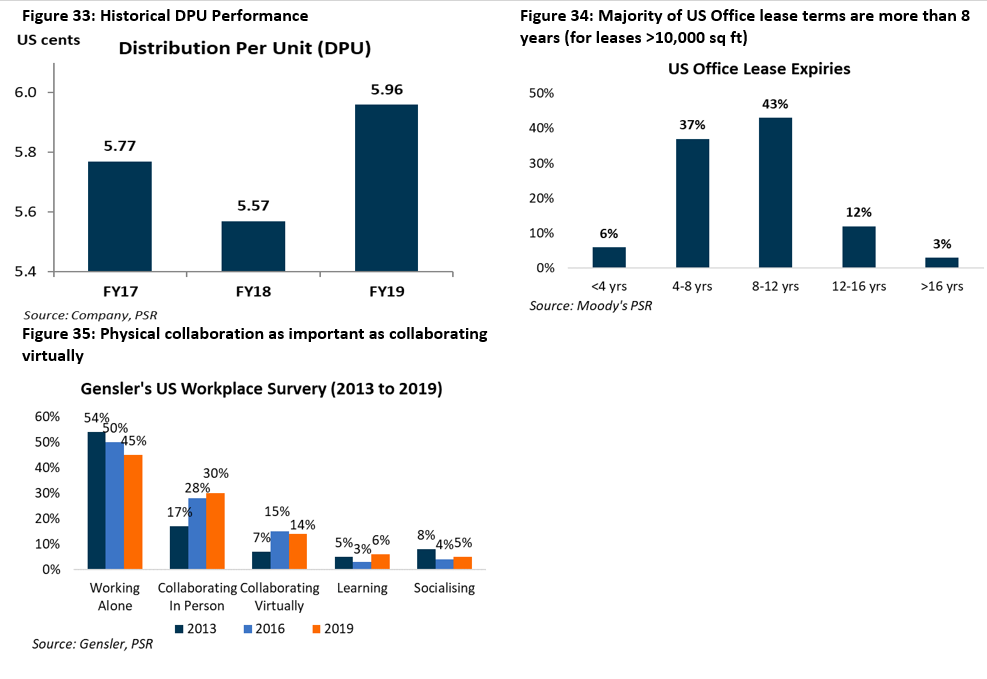

- Attractive valuations of 0.88x P/NAV near -2 standard deviation (SD) level, 3.28% yield spread at +1 SD level. Valuations are near historical lows and attractive given MUST’s resilient portfolio. Office valuations will be more stable due to the stronger the financials of office landlords, as most office-using tenants experience lower business disruption in this COVID-19 environment, leading to higher collectability of rent and lower amounts of rental waivers and deferments.

- Continued relevance and demand for office space; demand for office to moderate not abate. Top 3 leasing drivers (tech, financial and professional services) are the cornerstone of the economy and exhibit a predisposition for the office workplace setting. Proponents of the office environment continues to view the office setting as a more ideal workplace for efficiency, productivity, collaboration, and creativity. Additionally, trend study show that the while collaboration amongst employees is on the rise, the physical face-to-face mode of collaboration is as valued as virtual collaboration.

Key Risks

- Higher than expected adoption of remote working and weaker than expected leasing environment.

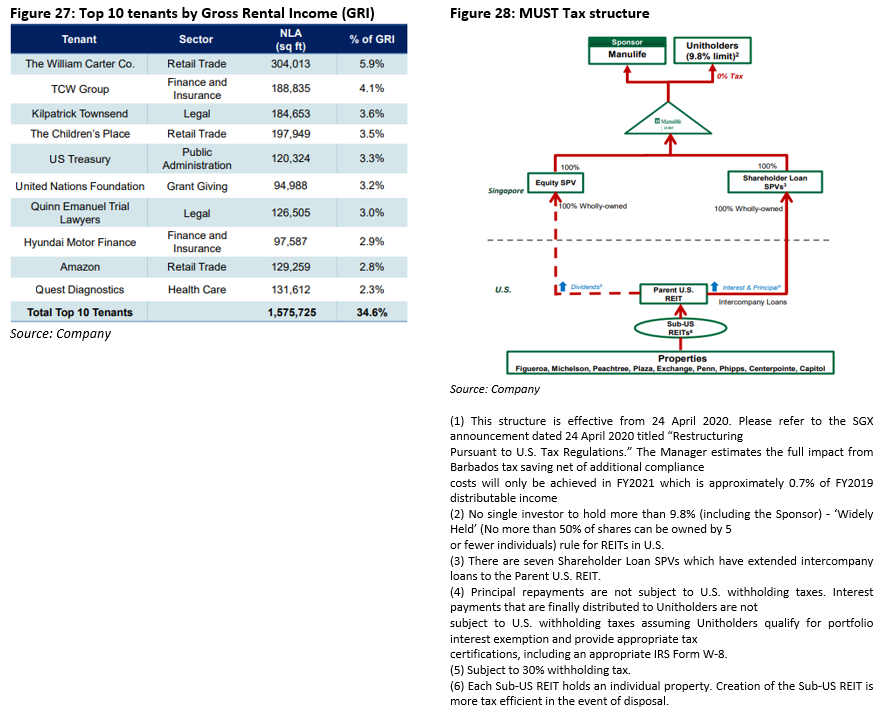

- Changes in tax regulations, affecting tax exemption and deductibility of dividends.

Initiate coverage on Manulife US REIT with a BUY and TP of US$0.80

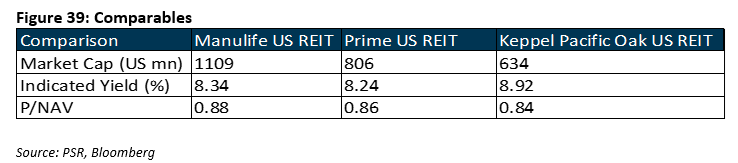

Our DDM-derived target price is based on a five-year projection, cost of equity of 10.0% and terminal growth rate of 2%. It translates to a FY20e dividend yield of 8.8% and a total return of 19.1%. MUST is currently trading at attractive valuations, P/NAV of 0.88x is at the -2 SD level. US Office demand is expected to remain largely stable due to demand from cornerstone trade sectors (financial, legal, tech).

Investment Thesis

1. Favourable portfolio attributes – occupancy of 96.5%, long WALE of 5.7 years, built-in rental escalation (c.2% p.a.), low expiries (4.4%/6.4% FY20/FY21) and high tenant retention of 76% in FY19.

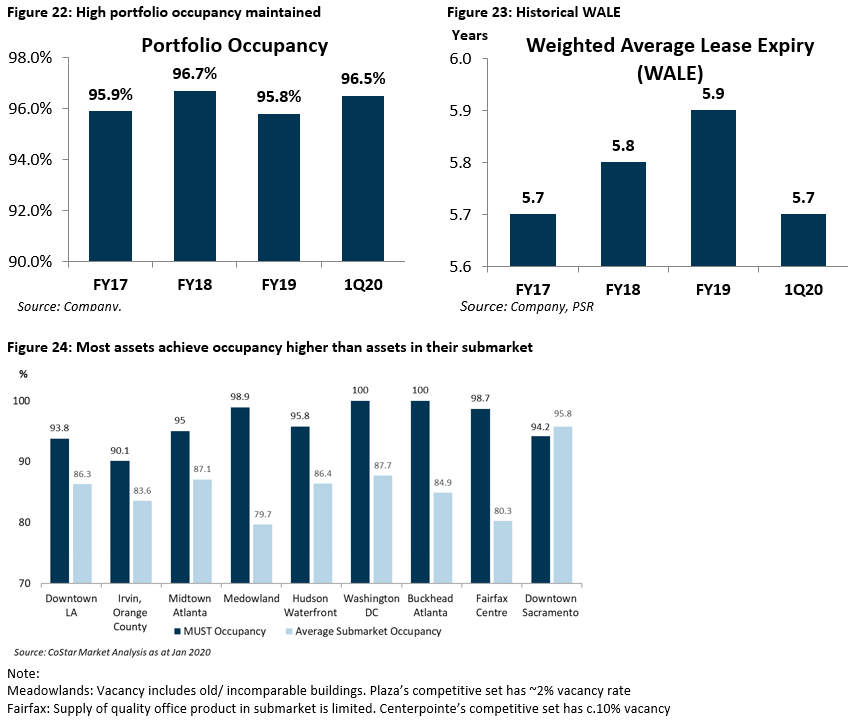

Income visibility owing to portfolio WALE of 5.7 years and built-in rental escalation (c.2% p.a.). Smaller tenants (occupiers of space) typically enter 3 to 5-year leases, mid-sized tenants opt for 5 to 7-year leases and large tenants will commit to longer leases of c.10 years. MUST’s WALE of 5.7 years is long compared to the WALE of office SREIT and is due to the proportion of large tenants in the portfolio. Due to the higher percentage of leases with long terms, lease expires for FY20 and FY21 are 4.4% and 6.4% by GRI respectively (Figure 25), which is favourable given the weaker business sentiment induced by the COVID-19 pandemic, which is expected to put pressure on leasing demand.

Longer leases tend to have rental escalations written into them. 95.6% of MUST’s leases have embedded rental escalations which average 2.0% per annum (p.a.), providing rental growth.

Quality attracts quality. MUST’s has maintained high portfolio occupancy above 95% since listing (Figure 22) and its portfolio enjoys and above-average occupancy for the majority of its comparable submarket (Figure 24).

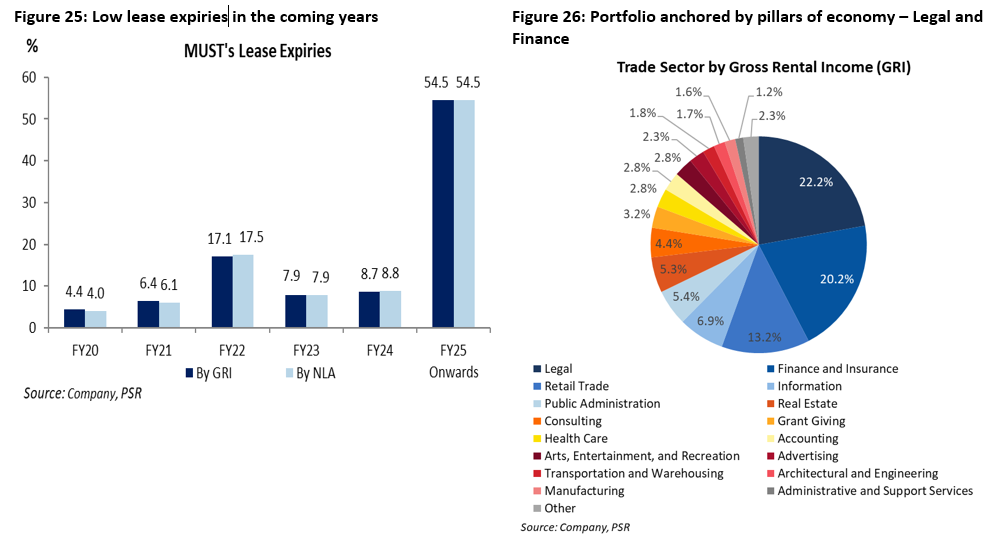

MUST’s high occupancy is attributed to its portfolio of Grade A and Trophy assets which are well-amenitised, located in cities with skilled work force and work-live-play characteristics. These assets usually attract HQ and mid-to-large tenants who tend to have stronger balance sheets. The top 10 tenants contribute 14.6% to GRI (Figure 27) and have WALE of 6.7 years, majority of which are listed entities and/or use the space as HQ locations.

Portfolio anchored by trade sectors that are the pillars of the economy (Legal 22.2%, Finance 20.2%). While lockdowns have resulted in only 10-20% of tenants operating within MUST’s properties, business disruptions have been mitigated by the ability to telecommute. A vast majority of MUST’s rents up to June have been collected, with only 2% of rental deferments provided to retail and F&B tenants in April. Regardless of the economic cycle, the Finance and Legal sectors will remain a resilient cornerstone of the economy and we think that a portfolio anchored by tenants in these trade sectors will prove more stable (Figure 26).

2. Attractive valuations – 0.88x P/NAV near -2 standard deviation (SD) level, 3.28% yield spread at +1 SD level.

P/NAV of 0.88x at historical lows and attractive for MUST’s portfolio quality (Figure 29). We deem MUST’s portfolio as strong due to the visible income from rental escalations (2.0% pa), low expiries in the coming years and long WALE of 5.7 years. The high collectability of rents (only 2% of rental deferments provided in April) is also indicative of the quality of tenants in MUST’s portfolio. And as such, while we do expect a softer leasing environment, the income visibility from existing leases is high.

MUST will provide high yields of 8.8%/9.0% for FY20e/FY21e in the current low-interest rate environment. With interest rates expected to remain low (MAS10YSGS below 1% since May 2020), we think that the 8.8% yield MUST provide are attractive, especially given MUST’s stable stream of rental income. Yield spread of 3.28% is close to the +1 SD level (Figure 30).

The resilience of office assets. Credit report by Moody’s Investor Services highlighted that pockets of distress can be seen in lodging properties, where 22% of loans in CMBS deals were delinquent as of June, followed by 17% for retail properties but only 2.2% for office buildings, according to S&P Global Ratings. We think that office valuations will be more stable due to the stronger the financials of office landlords, as most office-using tenants experience lower business disruption in this COVID-19 environment, leading to higher collectability of rent and lower amounts of rental waivers and deferments.

Longer leases in the US office market to provide support for leasing demand. According to Moody’s, majority of lease terms are longer than 8 years – 37% of larger office leases will not expire until the next four to eight years, and a more significant 43% have lease terms of 8 to 12 years (Figure 34). The muted supply in the submarkets where MUST operates bodes well for the REIT and will help to support rents.

Unemployment data is not so bleak for office tenants. Unemployment data showed marginal improvement, declining from a peak of 14% in March to 11.1% in June 2020. However, the unemployment rates for Financial activities and Professional & Business services was 5.1% and 8.6% respectively, the lowest and third lowest amongst the industries. Nonetheless, unemployment rates for these two sectors were 3.1ppts and 5.0ppts higher as compared to June 2019. Tenants in the Legal (22.2%) and Finance & Insurance (20.2%) are the top 2 contributing trade sectors for MUST.

3. Continued relevance and demand for office space; demand for office to moderate not abate

Office space demand by Top 3 leasing drivers (tech, financial and professional services) which have a predisposition for the office workplace setting. Tech, finance and insurance and legal were the first, second and sixth driver of tenant demand in 2019. Legal (22.2%) and Finance (20.2%) are the two largest trade categories for MUST.

The finance and legal sectors are long-standing pillars of the economy have a long heritage of refining how they do business. The existence of virtual conferencing tools predates COVID, but the fact that these sectors still choose to conduct certain functions/elements of business in the flesh implies that these sectors are best served by office premise and explains the predisposition for the office environment. We believe that the structural shifts in the office landscape will be gradual rather than immediate, with the desire for physical collaboration and networking resulting in the maintenance of an office address.

The desire to return to the office is higher for the US finance sector. The largest U.S. bank by assets, JPMorgan Chase & Co has established a task force to help locations establish plans for reopening, whereas Citigroup is weighing the option of opening satellite offices outside New York City through short-term leases.

Physical interaction viewed as the most effective mode for mentoring, collaboration, and innovation. The US is one of the developed markets with the highest telecommuting workforce pre-COVID. US is one of the markets that has employed a substantial c.15% of remote-working pre-COVID. Proponents of the office environment continues to view the office setting as a more ideal workplace for efficiency, productivity, collaboration, and creativity.

According to Gensler’s US Workplace Survey from 2013 to 2019 (Figure 35), office work has evolved from an individualistic mode (2013: 50%; 2019: 45%) to one that is more learning and collaborative. While collaborating virtually has doubled to 14% in 2019 since 7% in 2013, physical collaboration has also roughly doubled (201: 17%; 2019: 30%). Barring containment measures imposed by the COVID-19 pandemic, the trend study show that the while collaboration amongst employees is on the rise, the physical face-to-face mode of collaboration is as valued as virtual collaboration.

Offices are the traditional choice for high value-add activities which require problem solving and creativity as the dedicated and open structure of modern office spaces encourages cross-functional collaboration and idea-sharing. It is also believed that a well-amentised and dynamic work environment helps to attract and retain employees, which in part explains how MUST’s Grade A and Trophy assets continue to outperform its competitive set in the various submarkets.

Key risks

- Higher than expected adoption of remote working and weaker than expected leasing environment. We have projected for a softer leasing environment owning to lower business formation/expansions and structural shifts towards a more office-light model. A weaker-than-expected leasing environment will result in underperformance versus our estimates.

- Changes in tax regulations, affecting tax exemption and deductibility of dividends. MUST’s tax structure is efficient in that it minimises taxes. However, it is susceptible to adverse policy changes that may result in tax leakages.

Initiate coverage on Manulife US REIT with a BUY rating and a TP of US$0.78.

Our DDM-derived target price is based on a five-year projection, cost of equity of 10.0% and terminal growth rate of 2%. It translates to a FY20e dividend yield of 8.8% and a total return of 19.1%. In our models, we estimated a 1-2% annual escalation rate for the leases. In light of a softer leasing environment going forward, we have accounted for a portfolio vacancy to increase by c. 2%.

PRIME US REIT – Prime for resilience

- Attractive yields of 8.9% underpinned by resilient portfolio attributes.

- Long WALE with minimal lease expiry in FY20, diversified income contribution and built-in rental escalation to support the portfolio’s gross rental and distributable income.

- Initiate coverage with a BUY and a target price of US$0.88.

Investment Merits

- Attractive dividend In this economic climate where global interest rates have fallen, Prime presents attractive yield spread of 8% to the US 10-year treasury yields. Prime is currently trading at 0.86x by P/NAV. Our forward dividend yield for Prime in FY20e and FY21e is 8.9% and 9.5% respectively.

- Resilient portfolio attributes – Long WALE with minimal lease expiry in FY20, diversified income contribution and built-in rental escalation to support GRI. Income visibility and stability is supported by long portfolio WALE of 4.9 years, with only 5.7% of the leases are expiring in FY20. With no market and sector contribution exceeding 13.4% and 15.1% respectively, Prime offers high levels of diversification in terms of its market, asset and tenants mix. Approximately 98% of the leases have in-built rental escalations of 1-3% p.a.

- Robust balance sheet through proactive capital management; efficient tax structure. Prime continues to maintain its gearing ratio at a healthy level of 33.7%. There will be no refinancing required until 2024. Prime’s headline tax expenses mostly reflect deferred tax expenses, which will only be realized upon sale of the properties. This reduces cash taxes payable, which results in more distributable income for unitholders. Additionally, Prime’s REIT structure has no tax leakage through federal income or withholding taxes, provided that the unitholders comply and furnish the required documents.

- Reputable sponsor and management team associated with one of the largest U.S. commercial real estate managers. Associated with KBS, one of the largest commercial real estate managers in the U.S., KBS Asia Partners (KAP) is the sponsor of Prime. KAP owns 40% of Prime’s manager, KBS US Prime Property Management. KBS-affiliated entities invest in and manage commercial real estate assets on behalf of clients. To date, KBS has registered $41.7bn worth of transactional volume with over $8bn of AUM since inception.

Risk Factors

- Debilitated economy to slow leasing activities for Prime in 2020. Slower global growth is expected in 2020; we expect leasing activities to weaken as businesses are impacted by the recent escalation of events from COVID-19. While at least half of Prime’s expiring leases (5.7% of GRI) are expected to be renewed, greater investor caution and selectivity coupled with lockdown inconveniences will increase the time required to close new leases.

- Weakness in co-working spaces. Co-working tenants are expected to be hit hard by the outbreak, due to their focus on short-term leases and a reliance on users coming into the office. Demand for co-working spaces is expected to remain soft, which poses uncertainty to Prime’s income stream. Nevertheless, the total proportion of co-working spaces in the portfolio is only 3.7%.

Prime’s Portfolio

Investment Merits

We like the REIT for the following reasons.

1. Attractive FY20 dividend yields at 8.9%, 8% higher than that of US treasury yields. In this economic climate where global interest rates have fallen, Prime presents attractive yield spread of 8% to the US 10-year treasury yields. Prime is currently trading at 0.86x by P/NAV. Our forward dividend yield for Prime in FY20e and FY21e is 8.9% and 9.5% respectively.

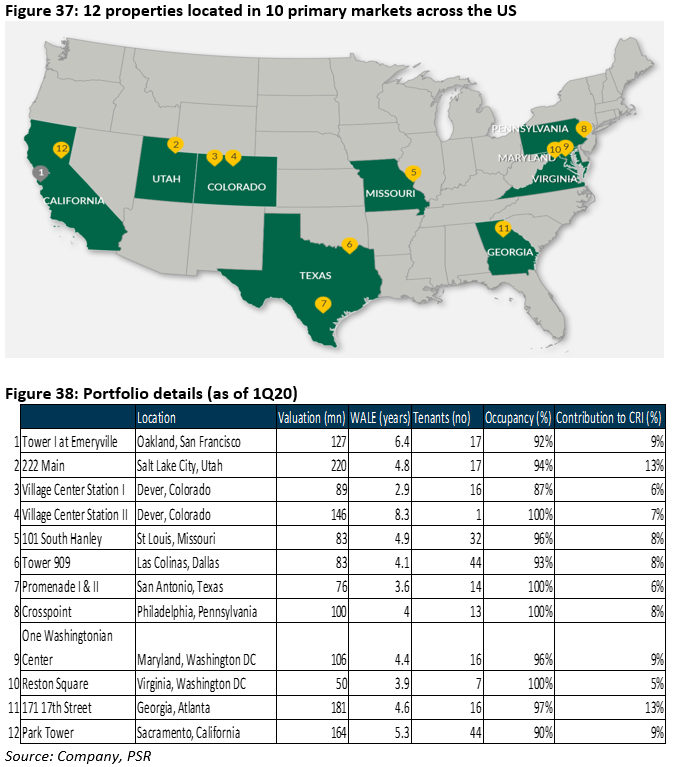

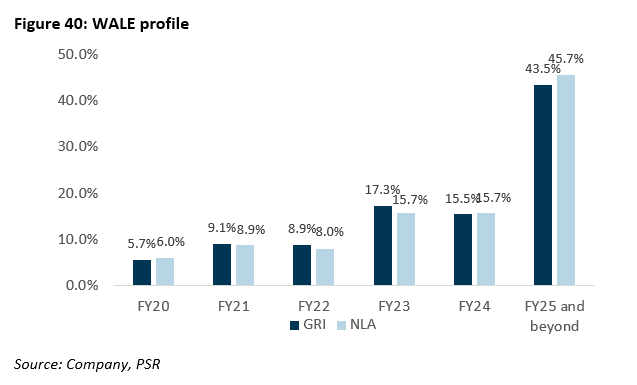

2. Resilient portfolio attributes – Long WALE with minimal lease expiry in FY20, diversified income contribution and built-in rental escalation to support GRI. Income visibility and stability is supported by long portfolio WALE of 4.9 years, with only 5.7% of the leases are expiring in FY20. Lease expiries are also well staggered, with a maximum of 17.3% of leases expiring in the next 4 years.

Approximately 98% of the leases have in-built rental escalations of 1-3% p.a, which provides a clear organic growth outlook for the REIT. Majority of leases by net leasable area (NLA)

are on a triple-net or modified gross basis, shielding PRIME from increases in real estate taxes and property expenses. To top it off, the leases expiring in FY20 and FY21 are leased at an average of 7% below market, hence there may be potential rental reversions to help drive rental and distributable income.

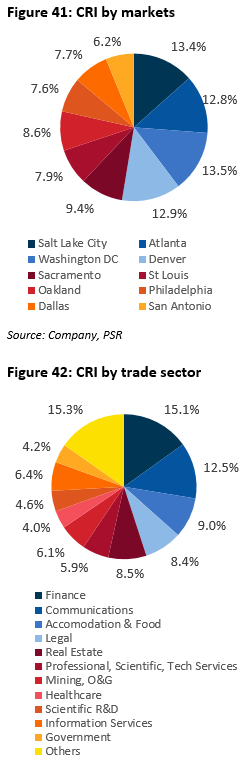

With no market and sector contribution exceeding 13.4% and 15.1% respectively (Fig. 5 and 6), Prime offers high levels of diversification in terms of its market, asset and tenants mix. 33.4% of the tenant mix is exposed to the Science, Technology, Engineering, Math (STEM) and Technology, Advertising, Media and Information (TAMI) sectors, which is the growing segment in the US. Additionally, all of Prime’s properties are Class A buildings. We believe that a high quality and diversified office portfolio offers more resilience in times of uncertainty.

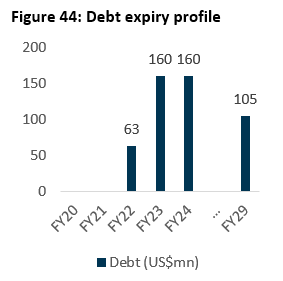

3. Robust balance sheet through proactive capital management… As of 1Q20, Prime continues to maintain its gearing ratio at a healthy level of 33.7% and interest coverage ratio of 5.8x. There will be no refinancing required until 2024 as extension options are available to extend both Revolving Credit Facilities and Term Loans maturing in FY22 and FY23. Near term interest rate risks are also mitigated as close to 89% of the debt is locked into fixed interest rates. Separately, Prime restructured its existing interest rate swaps by entering into a new agreement on its borrowings through 2026. It effectively lowers the weighted average interest rate for the portfolio from 3.3% to 2.8%. Hence, subject to new loans from additional capex needs, we are not expecting interest costs to weigh heavily on Prime’s cost front.

With a tax-efficient REIT structure. Prime’s headline tax expenses mostly reflect deferred tax expenses, which will only be realized upon sale of the properties in the portfolio. This reduces cash taxes payable, which results in more distributable income for unitholders. Additionally, Prime’s REIT structure has no tax leakage through federal income or withholding taxes, provided that the unitholders comply and furnish the required documents for Portfolio Interest Exemption. [Refer to Appendix II – Prime US REIT’s Structure for more details]

4. Reputable sponsor and management team associated with one of the largest U.S. commercial real estate managers. Associated with KBS, one of the largest commercial real estate managers in the U.S., KBS Asia Partners (KAP) is the sponsor of Prime. KAP owns 40% of Prime’s manager, KBS US Prime Property Management. The remaining stake is held by Keppel Capital (30%), Singapore Press Holdings (20%) and AT Holdings (10%). KBS-affiliated entities invest in and manage commercial real estate assets on behalf of clients. To date, KBS has registered $41.7bn worth of transactional volume with over $8bn of AUM since inception.

KBS has presence in all the states that Prime has presence in. Given that KBS has successfully managed properties through 4 disruptive events, its expertise and track record present more value to Prime’s organic growth potential through troubled times. Separately, Prime will also be able to benefit from KBS’ deal sourcing, deal screening and deal execution capabilities for inorganic growth opportunities. We believe that KBS will be able to help Prime navigate through occupancy woes in times of stress and offer a platform for future growth prospects when the market turns around.

5. Prime’s properties are situated in areas where the office market is attractive and still “landlord favourable”. Many Americans are looking to leave expensive coastal cities, including San Francisco, Los Angeles and New York for more affordable areas that still offer the amenities of a major city. Similarly, attributes like being home to a young population, a highly educated workforce and better affordability are key qualities in a city companies gravitate to as they poised themselves for growth.

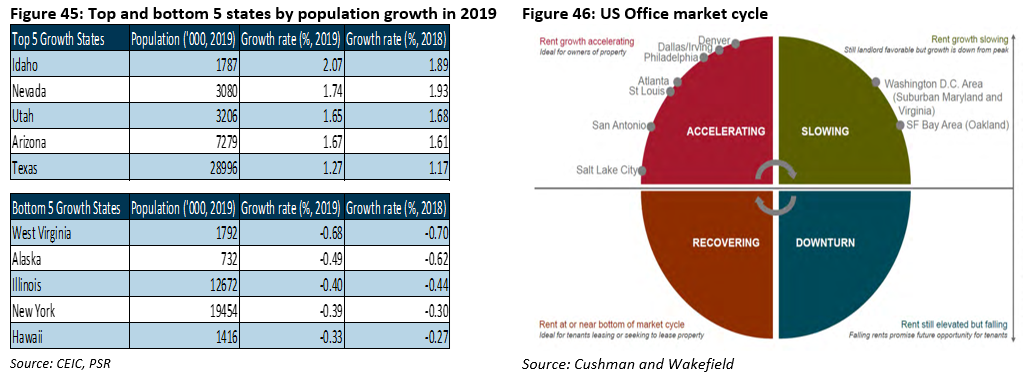

These attributes are evident in the markets where Prime is in. According to Redfin, Dallas (7.7% of CRI), Atlanta (12.8% of CRI) and Prime’s newest market, Sacramento (9.4% of CRI) are within the list of top 10 cities Americans are moving into in 4Q19. For the whole of 2019, we see Utah (13.4% of CRI) and Texas (6.2% of CRI) sustain a high population growth rate (Fig. 9), while none of Prime’s key markets fall within the bottom 5 states by population growth. We expect under-rated cities with amenities and attributes of a major city to be more attractive to US companies and citizens moving forward, exacerbated by more permissive policies around remote work and an overall shift towards greater affordability during times of duress.

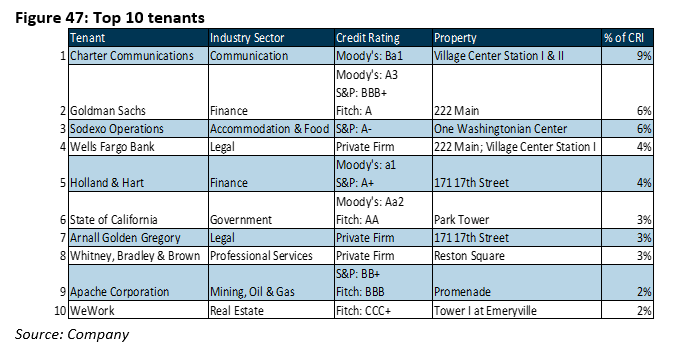

According to Cushman and Wakefield, Prime’s portfolio is in the stage of the office market cycle where it is “landlord favorable” (Fig. 10). Sacramento, its newest market is in the accelerating stage of the office market cycle, like that of Dallas’ and Philadelphia’s. Overall, Prime has exposure in 8 markets where rent growth is expected to accelerate, and 2 markets where rent growth will still be slow but positive.

6. COVID-19 Update: No rent forgiveness; rent collections for May and June are at 99%, with June’s collections on track. Most of the leases do not have pre-termination clauses, so tenants are obliged to compensate till their leases expire in a case of lease break. As of date, only 11 rental deferments are provided to small retail tenants which contribute less than 1% of the GRI. These businesses are amenities to the buildings. Majority of the rent deferrals are expected to be recouped this and next year, while the remaining deferrals included lease extensions equivalent to the number of months’ rent that was deferred.

Apart from Sodexo, Apache and WeWork, majority of Prime’s top 10 tenants are established tenants. All of Prime’s top 25 tenants which constitute 64% by CRI have paid 100% of April’s and May’s rent. Amidst uncertainty in the outlook for co-working spaces, it may comfort investors to know that the rents from all co-working entities (WeWork + 3 smaller operators) have been collected. Additionally, Prime holds a letter of credit and corporate guarantee equivalent to USD$2mn (~8 months of rent) should WeWork default on their obligations. Prime holds approximately 3 months of the portfolio’s gross rental income in the form of security deposits, letter of credit and bank guarantees.

Risk Factors

1. Debilitated economy to slow leasing activities for Prime in 2020. Slower global growth is expected in 2020; we expect leasing activities to weaken as businesses are impacted by the recent escalation of events from COVID-19. While at least half of Prime’s expiring leases (5.7% of GRI) are expected to be renewed, greater investor caution and selectivity coupled with lockdown inconveniences will increase the time required to close new leases.

2. Weakness in co-working spaces. Co-working tenants are expected to be hit hard by the outbreak, due to their focus on short-term leases and a reliance on users coming into the office. Demand for co-working spaces is expected to remain soft, which poses uncertainty to Prime’s income stream. Nevertheless, the total proportion of co-working spaces in the portfolio is only 3.7%.

Initiate coverage on Prime US REIT with a BUY rating and a TP of $0.88.

Our DDM-derived target price is based on a five-year projection, cost of equity of 9.96% and terminal growth rate of 2%. It translates to a FY20e dividend yield of 8.9% and a total return of 24%. In our models, we estimated a 1-3% annual escalation rate for the leases. In light of a lacklustre leasing environment going forward, we accounted for a 5% impact to NPI through an increase in property expenses, as well as a 50% renewal rate for the expiring leases in FY20.

Source: Phillip Capital Research - 20 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024