SATS Ltd – a Long Road to Recovery

traderhub8

Publish date: Mon, 13 Jul 2020, 09:31 AM

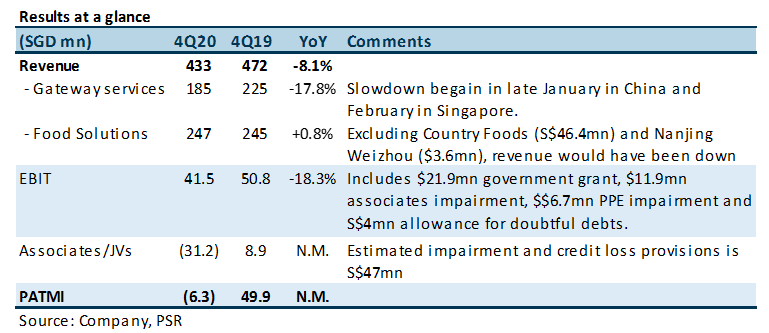

- 4Q20 PATMI was a loss compares against the profit guidance of S$15mn to S$20mn. Earnings was negatively impacted by S$22mn worth of impairments and government grants to be recognised over 11 months.

- IATA forecast of full recovery in air traffic only in 2023 is the baseline assumption.

- Downgrade to SELL from NEUTRAL with a lower target price of S$1.95. We benchmark our valuations to P/B average of 1.35x during the global financial crisis in 2009. The outlook ultimately depends on the trajectory of the virus and even the ability to find an effective treatment for this pandemic. The path to recovery for aviation will be long. Profitability will be elusive, and the focus will be on the liquidity of the company.

The Positives

+ Responding with aggressive cost cuts. Excluding the government grant of S$21.9mn (two months) in 4Q20, SATS has managed to lower staff cost by 16% YoY, more than the 8% decline in revenues. Some of the lower cost driven by pay cut from management in late February, less overtime, reduced contract services, foreign worker levy rebates and property tax / rental rebates.

+ Other sources of revenue. Some of the new areas of revenue includes wholesale supplier to cloud kitchens catering to home deliveries. Another source of revenue was cruise centre support to house foreign workers in cruise ships.

The Negatives

– No final dividend. The was no final dividend compared with 13 cents a year ago. The company needs to be prudent and retain cash due to the uncertainties.

Outlook

Liquidity will more critical than any elusive profitability this year. We expect a severe contraction in aviation revenues, which accounts for 76% of 4Q20 revenues. The company geared up with S$305mn loan proceeds in 4Q20 to amass S$549mn of cash on its balance sheet. If we annualised 4Q20 fixed cash operating cost (staff, utilities, other costs), the run-rate will be around S$1bn. More aggressive cost cuts are needed. SATS is temporarily closing Inflight Catering Centre 1 (ITC 1) and consolidate operations at ITC 2. 1Q20 guidance is for a net loss of S$50mn.

Downgrade to SELL from NEUTRAL; Lower target price to S$1.95

The path to recovery is unclear. Absence of dividends and net losses to persist, a more conservative benchmark to valuations will be the price to book ratio. We have taken the average of 1.35x during the global financial crisis in 2009 as a benchmark for our valuation.

Source: Phillip Capital Research - 13 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024