Penguin International Ltd – Cash to Ride This Cycle

traderhub8

Publish date: Wed, 03 Jun 2020, 09:46 AM

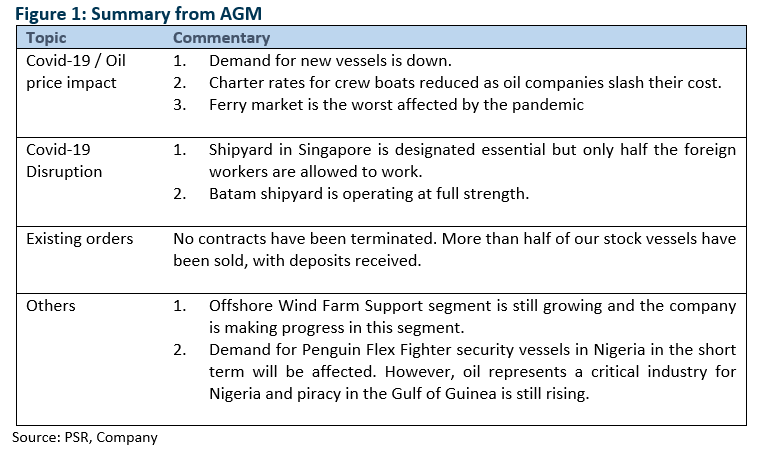

- Penguin provided some business updates in their recent AGM. The outlook is challenging due to Covid-19 and collapse in oil prices.

- Charter rate for crew boats will be under pressure, demand for new vessels is down and ferry customers will suffer from the pandemic.

- We downgrade to ACCUMULATE from BUY. Our FY20e earnings is cut by 52%. The target price is dropped to S$0.55 (prev. S$0.88). We change our methodology from 5x PE (excluding cash) to a P/BV of 0.7x FY20e (historical 10-year average). The net cash of S$60mn (end-Dec19) will allow the company to ride through this turbulence. Net cash is now 52% of market capitalisation.

Downgrade to ACCUMULATE with a lower target price of S$0.55 (prev. S$0.88).

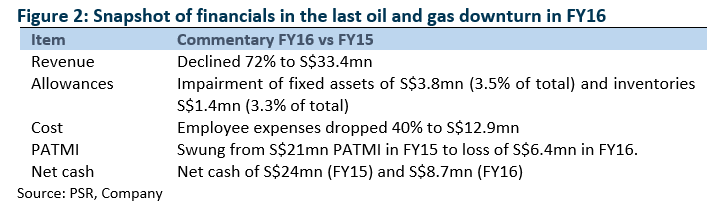

The biggest worry will be trade receivables and inventory of vessels built to stock. During such a stressed environment, the risk will be elevated from customers defaulting payments and inventory becoming unsold. In 2016 downturn, Penguin swung into losses and revenues plunged by 72% (Figure 2). The difference in this cycle is the larger net cash on the balance sheet (from S$24mn end 2015 to S$60mn end 2019) and a more diverse portfolio of vessels built.

With such an uncertain earnings outlook, we will use price to book as a gauge to valuations.

The 10-year price to book average is 0.7x, with a range of 0.5x to 1x. Penguin can ride out the downtrend in the industry with their large cash hoard.

Source: Phillip Capital Research - 3 Jun 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024