Dasin Retail Trust – Recovery Underway

traderhub8

Publish date: Wed, 27 May 2020, 10:48 AM

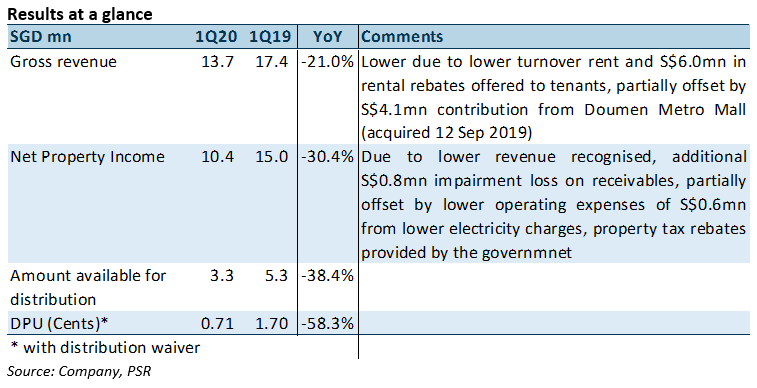

- 1Q20 revenue came in below our forecasts due to S$6.0mn in rental rebates offered to tenants, as well as the delayed acquisition of Shunde and Tanbei Metro Mall, which seems to be headed for a 3Q20 completion.

- S$7.9mn in rental rebates (including S$1.9mn which will be recognized in 2Q20) translates to roughly 1 month of rental rebates for tenants. Dasin does not expect to provide further relief.

- Maintain ACCUMULATE with higher TP of S$0.91. We push back the acquisition of Shunde and Tanbei Metro Malls from 1Q20 to 3Q20. Along with the S$7.9mn in rental rebates for FY20, higher vacancy rates and lower rental reversions, our FY20e DPU was slashed by 16.9%. Our DPU translates to a yield of 6.3% for FY20e and 6.8% FY21e.

The Positive

+ Healthy portfolio metrics, protected by lease structure. Dasin’s portfolio is underpinned by assets with high occupancy of 96.8% and long WALE by GRI of 4.5 years. Only 4% of leases by GRI are on pure turnover terms, 20% of leases are structured as higher of base rent or turnover rent, 12% of leases are fixed while 64% of leases are fixed with built-in escalation ranging 3% to 10% per annum. For reference, on a same-store basis, 4Q19 revenue grew by 6.5% in RMB terms and 4.5% in SGD terms, due to built-in escalations.

+ Creating opportunity through crisis. 42 live broadcasts were hosted by influencers and tenants via the live streaming on the “Dasin Hui” app, which has a membership base of 420,000. These broadcasts were conducted from 2 March to 28 April 2020 to drive tenant sales.

The Negative

– Malls resumed normal operating hours by March, but March and April turnover rent was still 37% and 32% below 4Q19 levels. All 5 of Dasin’s malls remained operational throughout 1Q20, although operating hours were shortened from 10AM to 4PM from 26 January 2020, except for tenants providing essential services such as supermarkets and certain F&B outlets. Trades that attract larger crows such as cinemas, KTVs, skating rings and bookstores were temporarily closed. Shiqi Metro Mall, Xiaolan Metro Mall, Dasin E-Colour and Doumen Metro Mall resumed normal operating hours since 24 February 2020, while Ocean Metro Mall reverted to its normal operating hours on 2 March 2020, after 31 and 43 days of shortened operating hours respectively. KTVs at all 4 malls resumed operation on 15 May 2020 after 111 days of closure, however tuition and enrichment centres remain closed. Turnover rent, as a proxy for tenant sales, fell by 64% in February when the operating hours were shortened, but recovered to -37% and 32% after normal operating hours were reinstated.

– Portfolio occupancy fell by 2.0ppts QoQ to 96.8% due to lower occupancy across all malls. Dasin managed to renew 74% of the leases expiring in 1Q20. However, occupancy was lower due to non-renewals, as well as space that was vacant due to ongoing AEIs.

Outlook

AEI works for 9,085sqm (13.2%) of space at Ocean Metro Mall commence in 4Q19. The completion of the AEI has been delayed from 1Q20 to 2Q20 due to the COVID-19 outbreak. Approximately 70% of construction work was completed as at 31 March 2020. The AEI was undertaken in a bid to enhance the mall’s competitiveness. Trustee-Manager undertook a market research study and negotiated the early termination of lease with a “furniture and finishing” tenant. The space returned will be carved up and leased out to tenants providing goods and services targeted at children. The space has been full committed, securing rental reversion of 47% over previous rents. 2,500sqm of space will be leased out to children’s playground operator, with the remaining space leased to children education and enrichment tenants.

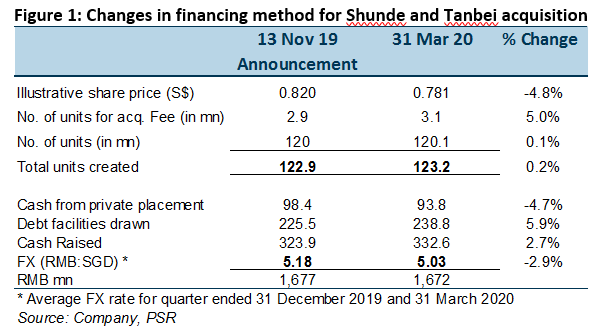

The joint acquisition of Shunde Metro Mall and Tanbei Metro Mall were approved at the EGM on 20 December 2019. We were anticipating a mid-1Q20 completion. However, the COVID-19-induced volatility in the global markets has resulted in delays in the private placement, and consequently the completion of the acquisition. Financing of the acquisition has been adjusted in light of the depreciation of share price and weakening of the Singapore dollar against Renminbi. We think the acquisition is headed for a 3Q20 completion.

We remain positive on the inorganic growth prospects for Dasin. There remains a ROFR pipeline of 18 properties spanning four cities – six of which are still under construction, which will help to mitigate the DPU gap as the distribution waiver progressively falls off. The number of units under distribution waivers was 38.2% in 2019 and will fall to 24.3% and 19.3% in FY20e and FY21e, increasing the number of units that are entitled distributions over the years.

Key risks to our valuation include: slowdown in discretionary consumption, second wave of virus and lingering fear and deferment of discretionary spending.

Maintain ACCUMULATE with higher target price of S$0.91.

We push back the acquisition of Shunde and Tanbei Metro Malls from 1Q20 to 3Q20. Along with the S$7.9mn in rental rebates for FY20, our FY20e DPU was slashed by 16.9%. We also factored in higher vacancy rates for FY20e and FY21e, as well as lower rental reversions. Our DPU translates to a yield of 6.3% for FY20e and 6.8% FY21e.

We expect Dasin to acquire 2 to 3 more assets in order to maintain a c.8% DPU yield by the time the distribution waiver falls off completely in FY22. As such we raise our terminal growth rate from 0.5% to 1.5% to better reflect the pace of acquisitions. The adjustments to our forecasts resulted in a higher TP of $0.91.

Phillip Securities Research has received monetary compensation for the production of the report from the entity mentioned in the report.

Source: Phillip Capital Research - 27 May 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024