IREIT GLOBAL – Visibility Amidst Uncertainty

traderhub8

Publish date: Fri, 15 May 2020, 11:28 AM

- IREIT did not release any financial results for 1Q20 as they move to semi-annual reporting with effect from FY20. However, IREIT has provided a business update for the quarter. The next financial reporting will be for the half-year period ending 30 June 2020.

- We still favor IREIT for its income visibility and stability. Overall occupancy remained stable QoQ at 94.7% with 95% of the leases locked-in till 2022. Portfolio WALE stands at 3.9 years.

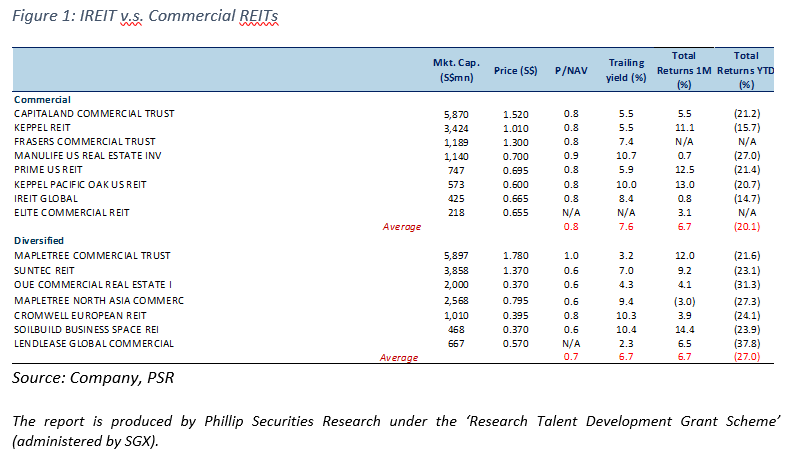

- FY20e yield remains attractive at 8.2%; Upgrade to BUY at a lower target price of S$0.770.

The Positives

+ Stable results expected; 1Q20 was minimally impacted by COVID-19. As IREIT usually collects rents 1 month in advance, 100% of rental income has been collected from tenants in 1Q20 given that the impact of the outbreak and lockdown measures were only evident at the end of the first quarter. With no dip in occupancy, top-line and NPI for 1Q20 is expected to remain stable. For 2Q20, April is expected to bear the brunt of the blow as lockdowns eased post-April. Regardless, 98% of April’s rents have already been collected, with only 2% of arrears from a handful of tenants from the Spanish portfolio.

+ Proactive asset management mitigated lease break fears of key tenants. GMG, one of IREIT’s key tenant, has exercised its break option to return 2 out of 6 floors of Munster South building in 28 Feb 2021. However, the manager has identified and secured a 9-yr future lease with another strong tenant for the entire 2 floors which will commence on 1 March 2021. As such, we are not expecting any dip in occupancy from this transfer of leases. Thereafter, the WALE of Munster Campus is to increase from 2.9 to 4.1 years, which will provide the portfolio with greater income visibility.

+ Sponsors and new strategic investor, AT investments, increased stake to show support; IREIT’s non-executive director bought shares from market. Tikehau Capital and CDL increased their unitholding to 29.2% and 20.87%, from 16.64% and 12.52% respectively. Along with AT Investments’ acquisition of a 5.5% stake in IREIT, sponsors and new strategic investor collectively own approximately 55% of IREIT’s shareholdings. The additional stake was purchased from Mr Tong Jinquan at S$0.49 per share, reducing his stake from 34.5% to 6.1%. Meanwhile, Mr Bruno de Pampelonne who is IREIT’s non-executive director, chairman of Tikehau Investment Management and senior partner at Tikehau Capital, purchased 200,000 units of IREIT at S$0.6075. These transactions are testament to the confidence in IREIT’s portfolio by sponsors, investors as well as the management alike.

The Negatives

– Limited growth expected from CPI-linked escalations. Low confidence in an economy usually reduces inflation expectation. As Germany’s and Spain’s GDP are expected to decline by 6.3% and 9.2% respectively in 2020 amidst the Covid’19 outbreak, we are less optimistic about IREIT’s portfolio growth that has most of the leases linked with their nations’ CPI.

– Depreciation of EUR to impact 2020 DPU. IREIT hedges approximately 80% of its income to be repatriated from overseas to Singapore on a quarterly basis, one year in advance. As such, we are expecting translation loss to impact DPU by 3-5% as EUR has depreciated against SGD throughout 2019.

Outlook through COVID-19

Since the implementation of lockdown measures in mid-March, most tenants at the German and Spanish properties commenced BCPs and work-from-home arrangements, with physical occupancies at around 10-30%. Cleaning, maintenance and repairs at the properties are still being carried out regularly. To date, the German portfolio has been resilient as the manager has not received any request for rental rebates or deferrals, but there have been a few of such requests from tenants in the Spanish portfolio. These tenants contribute less than 2% of IREIT’s total income.

Office take-up and leasing activity are expected to slow across both European states, as tenants

and investors take a more cautious approach towards relocation and expansion in this economic climate. Leasing demand and rental rates will face near term headwinds. Since occupancy for the German and Spanish portfolio are at 99.6% and 80.8% respectively, the lack of leasing demand is more worrying for the Spanish portfolio (which to date IREIT owns a 40% stake). Nevertheless, with only 0.9% and 2.6% of the leases due to expire and 2.6% and 2.4% eligible for lease break in FY20 and FY21 respectively, IREIT’s portfolio presents defensiveness given that 95% of the current income stream is locked in till 2022.

Upgrade to BUY with a lower TP of S$0.770.

Our target price translates to a FY20e distribution yield of 8.2% and a total upside of 25.1%. We revised our COE assumptions upwards by 80bps on the back of increased market risk and reduced our FY20-23 DPUs by 2-3% due to greater currency depreciation and lower rental growth assumptions.

Source: Phillip Capital Research - 15 May 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024