StarHub Limited – Less Travel Hurts the Business

traderhub8

Publish date: Fri, 08 May 2020, 09:39 AM

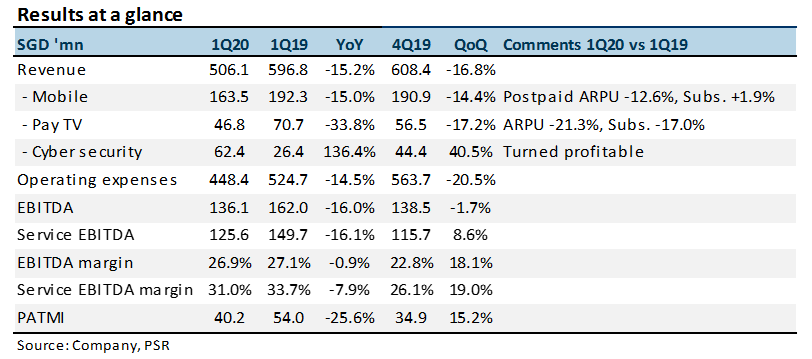

- Revenue and EBITDA were below our expectations. EBITDA is 1Q20 fell 16% YoY.

- StarHub withdrew their FY20 financial guidance, including dividends.

- Mobile revenue was down 15% YoY due to lower roaming revenue and higher SIM-only plans. Post-paid ARPU at a historical low.

- Downgrade to NEUTRAL with a lower target price of TP S$1.45. We are lowering our FY20e EBITDA by 6%, as we cut our mobile revenue estimate. The outbreak has negatively impacted the business more than we had anticipated. The higher margin inbound and outbound roaming revenues virtually disappeared with this outbreak. Furthermore, the softer economic backdrop meant lower handset sales, longer sales cycle for enterprise business and a higher proportion of SIM-only plans.

Positives

+ EBITDA was stable on a QoQ basis. Service EBITDA increased by almost 9% QoQ. The company has been able to remove fixed cost that enabled margins to remain relatively stable despite the drop in revenues. There were declines in various operating expense including staff costs, repairs & maintenance, marketing and operating leases.

+ Cyber security turned profitable. Cyber security profit was $5mn against $11.4mn losses a year ago. Management remains cautious on future profitability because the business is still investing heavily in headcount and research and development.

Negatives

– Collapse in post-paid ARPU. Post-paid ARPU was relatively stable at S$39 to S$40 for the past four quarters. It dropped 12.6% YoY to S$34 in 1Q20. Multiple reasons were given, but we believe the loss of roaming revenue and higher SIM-only plans were the key drivers for the ARPU decline. Even post-paid subscriber growth of 2% YoY was not enough to contain the 15% YoY drop in mobile revenues. Pre-paid also suffered from both ARPU and subscribers falling 10.7% and 15.3% YoY respectively. The disappearance of tourist arrivals hurt revenues.

– FY20e guidance is withdrawn. Due to the uncertain environment, the management is withdrawing the FY20e guidance.

Outlook

Whilst management has withdrawn FY20e financial guidance, we still expect dividend per share of 9 cents for FY20e (or S$155mn) to be maintained. We expect free-cash flow (FCF) of S$350mn in FY20e to sustain the dividends. 1Q20 FCF was S$119mn. Also, the job support grant from the government in 2Q20 will supplement cash-flows for this year.

Apart from the mobile business, the outbreak also negatively impacted the enterprise business. The uncertain outlook has resulted in a longer sales cycle and corporates lowering their IT budgets.

Downgrade to NEUTRAL with lower TP of S$1.45 (previously S$1.70)

We are lowering our FY20e EBITDA by 6%, as we cut our mobile revenue estimate. Our valuation is based on a 6X EV/EBITDA FY20e (previously 6.5x). Admittedly, such a target price values Starhub under a COVID-19 scenario where earnings will be depressed in the near-term. Worth noting, our target price implies a 5.5x EV/EBITDA for FY21e.

Source: Phillip Capital Research - 8 May 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024