Sheng Siong Group Ltd – Stellar Quarter Should Continue

traderhub8

Publish date: Thu, 30 Apr 2020, 09:05 AM

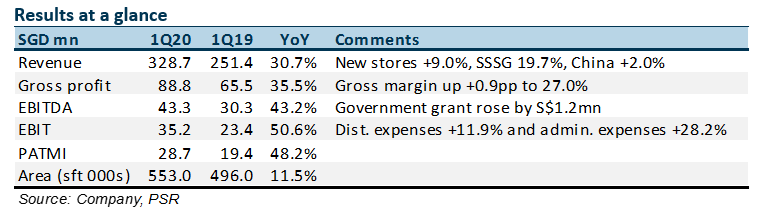

- 1Q20 revenue and earnings beat our estimates. 1Q20 PATMI surged 48% YoY to S$29mn

- 1Q20 benefited from a general improvement in consumer sentiment during the festive period and pantry loading when DORSCON was raised to orange.

- The positive sales momentum should continue into 2Q20 due to increased dining at home by households following the circuit breaker that begun in Singapore on 7 April and likely to end on 1 June.

- We are raising our FY20e PATMI by 12% as we increased our revenue forecast by S$100mn. Our revised FY20e earnings has even exceeded our previous FY21e forecast. We think the outbreak generated incremental S$50mn in revenue in for 1Q20. with an additional S$50mn for 2Q20e. Our ACCUMULATE recommendation is maintained and target price raised to S$1.58 (previously S$1.41). We also expect dividends in FY20e to be raised by 26% to 4.5 cents, as we use 70% dividend payout ratio as a guide.

The Positives

+ 1Q20 revenue surged 30.7% YoY, driven by same-store sales recovery. Same-store sales spiked 19.7% YoY in 1Q20 (1Q19: -1%). The jump in sales was attributed to better consumer sentiment during the festive period, pantry stocking following the outbreak, as well as contributions from new stores opened (+9.0%).

+ House brands the new margin driver. In 1Q20, SSG managed to grow their house brands of essential products (e.g. rice, cooking oil, detergents). Margins on such house brand can be 30% higher than the typical non-fresh product margins.

The Negative

– Higher variability in admin expenses than expected. Administrative expenses jumped 28% YoY to S$54mn, mainly attributable to staff cost. Staff cost rose due to the increased working hours and higher bonus provision. We were a little surprised by the variability of the expenses and were expecting more operating leverage for this cost item.

– Slowdown in roll-out of new stores. Due to the outbreak, SSG cannot physically sign leases or renovate the new store secured via tender. Also, the circuit breaker has meant the postponement of new site tenders. There were two new stores opened in January totalling 23,540 sft. Another three new stores were secured of 22,140 sft, but yet to open. In summary, there will be at least 45,680 sft of additional retail space (or 5 new stores) in FY20. This represents an 8.6% growth in store footprint.

Outlook

The exceptional growth will persist into 2Q20.

- Sales momentum – The key driver in sales growth in 2Q20 will be less pantry stocking but more home dining by households due to the circuit breaker.

- Gross margins – We were pleasantly surprised that gross margins expanded due to the growth of house brands. This outbreak has introduced SSG house brands of essential products more pervasively to its customers. But a negative driver to margin will be the weakness in Singapore dollar as a larger percentage of purchases are in US dollar.

- Operating expenses – SSG will reward its well-deserving employees one month of bonus in 2Q20. Some of these expenses will be supplement by the job support scheme to be paid from April onwards.

In terms of the longer-term outlook, growth for SSG will come from new stores, capturing market share (from wet markets and malls) and scaling further house brands penetration will be the positives for SSG.

- Online sales: During this period, SSG focus was on brick and mortars where the demand for resources was more critical. Nevertheless, management understands the importance of this channel and will raise the capacity of this channel significantly. But with many standalone e-grocers yet to be profitable, there is the need to balance offline and online initiatives.

- China: Both stores have turned profitable. The outbreak in China has seen a somewhat similar phenomenon of households stocking up and eating at home. SSG is unlikely to open new stores until the environment stabilises.

Maintain ACCUMULATE with higher TP of S$1.58 (previously S$1.41).

It is a challenge to ascertain the normalised earnings that excludes the outbreak. 1Q20 revenues exceeded our forecast by around S$50mn. This is around ½ month of incremental revenue in 1Q20. We are assuming a similar incremental rise in 2Q20. Therefore, we are raising our forecast for FY20e by around S$100mn. Our TP is raised to S$1.58 as we peg the company to historical average of 25x PE.

Worth noting that FY20e earnings will in effect have two one-offs – the pantry loading and increase in home dining by households, plus the government grants expected in 2Q20. We have not incorporated job support grant into our earnings.

Source: Phillip Capital Research - 30 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024