Frasers Centrepoint Trust – Navigating Choppy Cashflows

traderhub8

Publish date: Mon, 27 Apr 2020, 04:10 PM

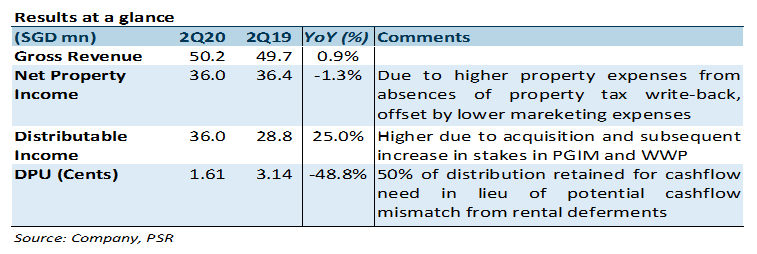

- DPU of 1.61cents was 48.7% lower YoY due to retention of 50% of 2Q20’s distributable income ($18mn).

- Lower rental reversions and longer negotiation periods expected on the remaining 11% of GRI due for renewal in FY20; portfolio reversions for leases concluded came in at c.5%

- Maintain ACCUMULATE with a lower TP of S$2.24. We lower our forecast to reflect the rental rebates and weaker retail outlook and increase our cost of equity assumption by 105bps to 7.6%. FY20e DPU cut by 2.88cents (-22.6%).

The Positives

+ 23.1% of NLA renewed YTD with reversions of c.5%. Of the 35.7% of GRI (32.7% of NLA, 312 leases) up for renewal in FY20, FCT has renewed 23.1% of NLA (142 leases) YTD. The average reversion was c.5%. 11% of GRI (9.6% of NLA) remain for the year. Management is expecting longer lease renewal negotiations and weaker reversion for the remaining leases given the weakened financial standing of tenants.

The Negatives

– 2Q20 tenant sales down 2% to 10% for larger malls. Footfall was lower by 10% for larger malls and 5% for smaller malls as shoppers avoided crowded areas. FCT’s tenant sales outperformed those of central peers (Suntec REIT -20.2% in 1Q20, OUECT -30 to -40% in Feb20).

– Portfolio occupancy fell by 0.4ppts to 96.1%. This was due to 2 non-renewals and one pre-termination of space at CCP.

Outlook

Singapore announced the extension of the circuit breaker by 1 month on 21 April, two days before the FCT released its results. Prior to the extension of the lockdown, the Frasers Group had announced 1 month rental rebate for tenants which will cost FCT c.$17mn. With the extension of the circuit breaker, Frasers Group will likely offer additional relief, especially for tenants who are unable to trade during the circuit breaker. One additional month of rental rebates will lower our FY20e DPU by c.11%.

So far only one tenant has indicated that they may seek rental deferment under the COVID-19 Bill. The low number of requests could be due to the tenant support package where tenants do not have to pay rent in May. However, there is a risk this number could rise once the tenant rebate/waiver periods are over.

Maintain ACCUMULATE with and lower TP of S$2.24.

We lower our forecast to reflect the rental rebates and weaker retail outlook. Our cost of equity assumption is raised by 105bps to 7.6%. The 1-month rental rebates will lower FY20e DPU by 11%, however taking into consideration the potential retention of distributable income into FY21, FY20e DPU was cut by 2.88cents (-22.6%).

Source: Phillip Capital Research - 27 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024