IREIT GLOBAL (Initiation)- New Parent, New Acquisition, New Outlook

traderhub8

Publish date: Wed, 22 Jan 2020, 07:01 PM

- New shareholders provide acquisition pipeline, financial support and operational expertise

- Attractive yield of 6.9% and recent acquisition to add scale, growth and de-risk portfolio

- Initiate coverage with an ACCUMULATE and a target price of S$0.885.

KEY HIGHLIGHTS

Company Background

IREIT Global (“IREIT”) primarily invests in income-producing real estate in Europe, used for office, retail, industrial and logistics purposes. Listed in 2014, IREIT did not gain much traction with investors due to limited portfolio size and growth prospects. In Nov 2016, Tikehau Capital became a major shareholder in IREIT’s trust manager IREIT Global Group Pte. Ltd. (IGG) with an 80% stake. Since then, IREIT made a series of management changes which provided IREIT better vantage point and control of the operations in Germany. Another milestone was reached in Apr 2019, when City Developments Ltd (CDL) invested S$59.4mn to acquire a 12.3% stake in IREIT at S$0.76 per share. CDL also purchased a 50% stake from Tikehau Capital in IGG, at S$18.4mn.

IREIT continues to seek diversification and scale by leveraging on Tikehau Capital’s local presence and CDL’s funding capabilities. In Dec 2019, IREIT announced its largest acquisition in Spain through a 40:60 joint venture with Tikehau Capital. The deal includes 4 multi-tenanted freehold office buildings across Madrid and Barcelona, which will be acquired for €138.2mn.

Investment Merits

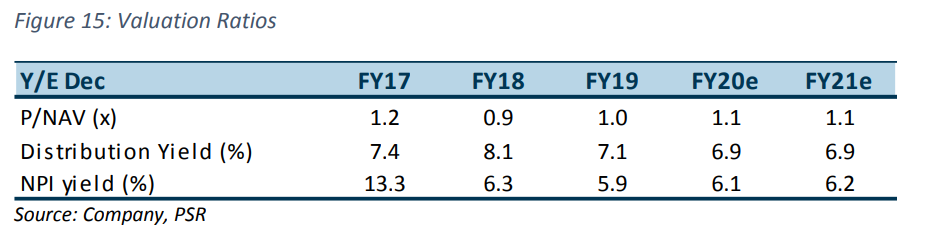

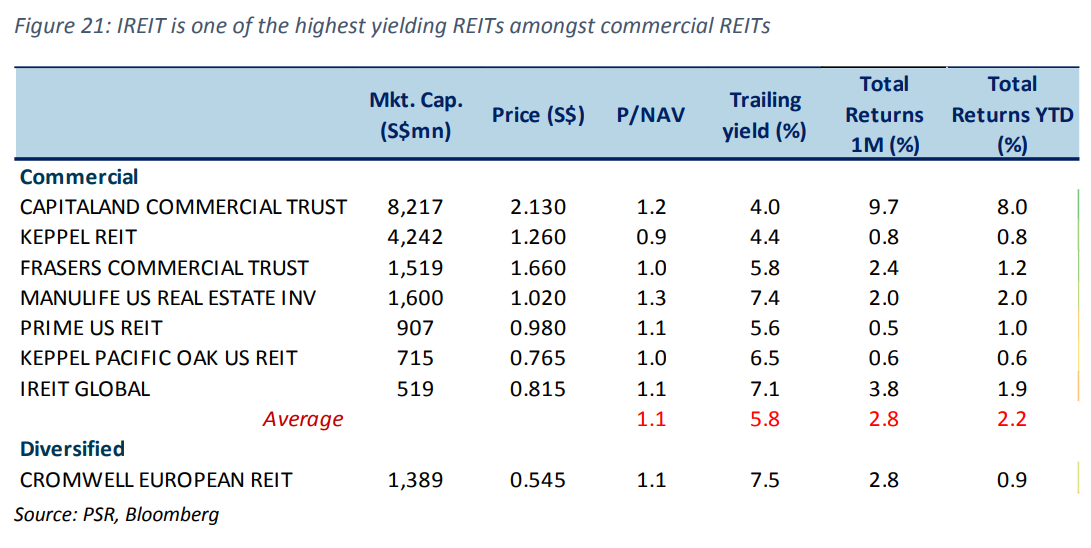

- Attractive dividend yield supported by stable leases. We expect to deliver dividends yields of 6.9% in FY20 and FY21. High income stability is expected with IREIT’s portfolio WALE of 4.4 years, average occupancy of 99.7% underpinned by blue-chip tenants, interest rates hedged for 7-years and no refinancing required till 2026.

- Ability to leverage on financial support, expertise and acquisition deals from Tikehau Capital and CDL. In the recent acquisition, CDL extended a bridging loan to fund IREIT’s newest acquisition. Tikehau Capital secured the acquisition and even warehoused the portfolio (via a call option) for IREIT.

- Acquisition to add scale, growth and diversification to IREIT. The Spanish portfolio will add scale and diversify IREIT’s assets in terms of location, property and tenants. The option to acquire the remaining 60% stake in the Spanish portfolio will spur growth for IREIT.

RISK FACTORS

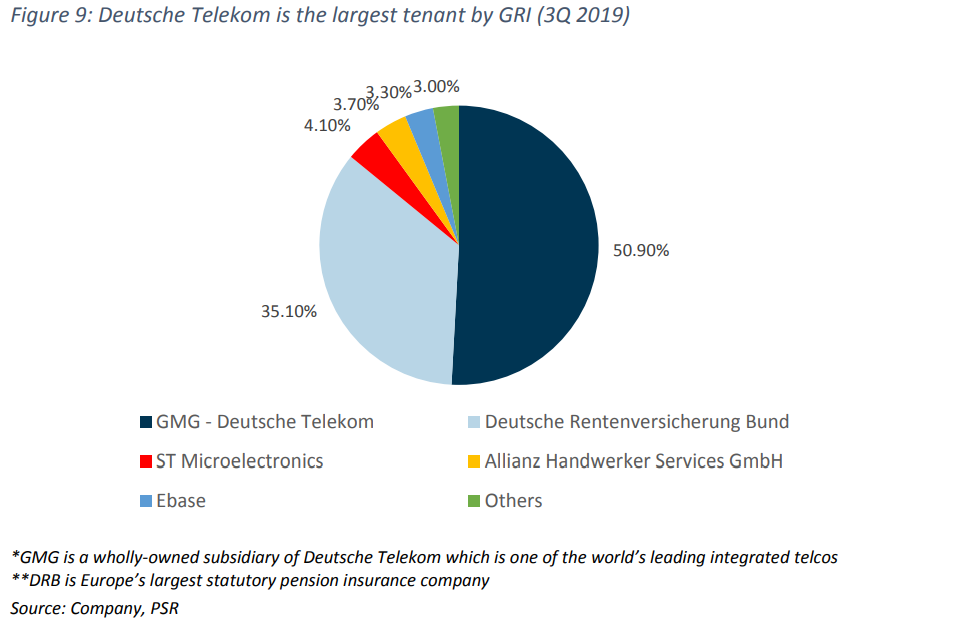

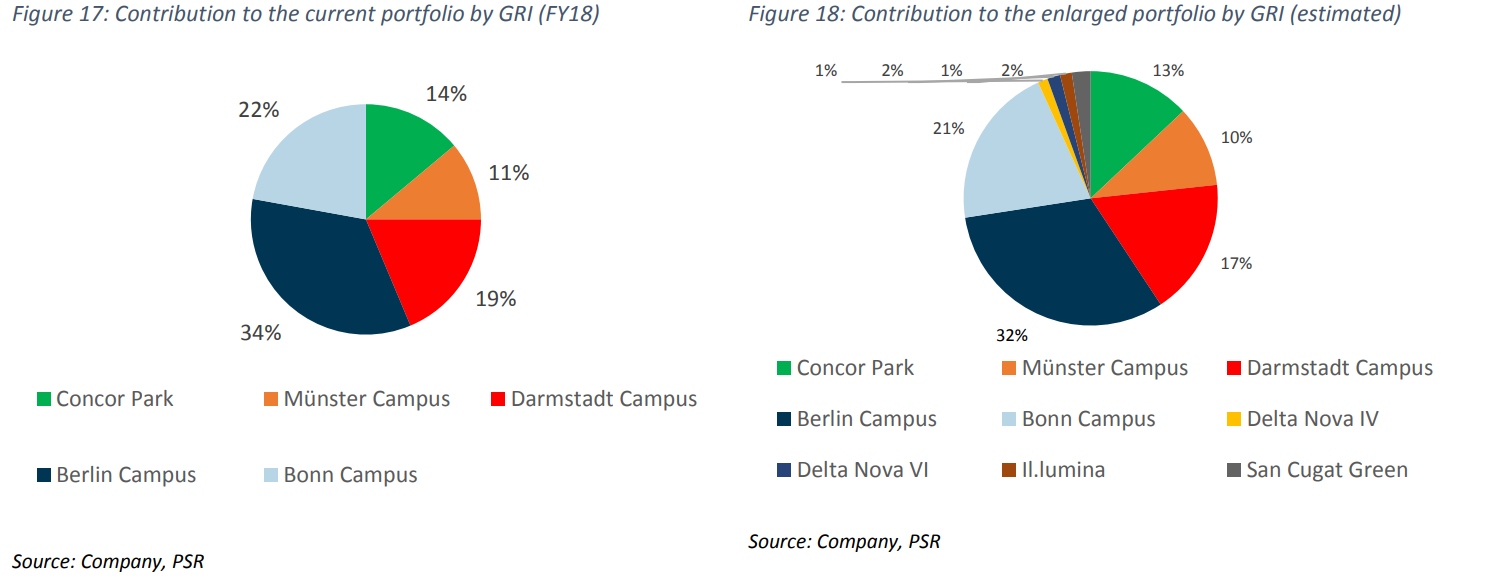

- Concentration risk by country, asset and tenant mix: All the properties in IREIT’s current portfolio are based in Germany, with GMG holding more than 50% of the tenant mix. Post-acquisition, the enlarged portfolio still has an exposure of 90.5% by valuation to Germany. Berlin Campus, which is IREIT’s largest asset, contributes 32% of the portfolio’s GRI.

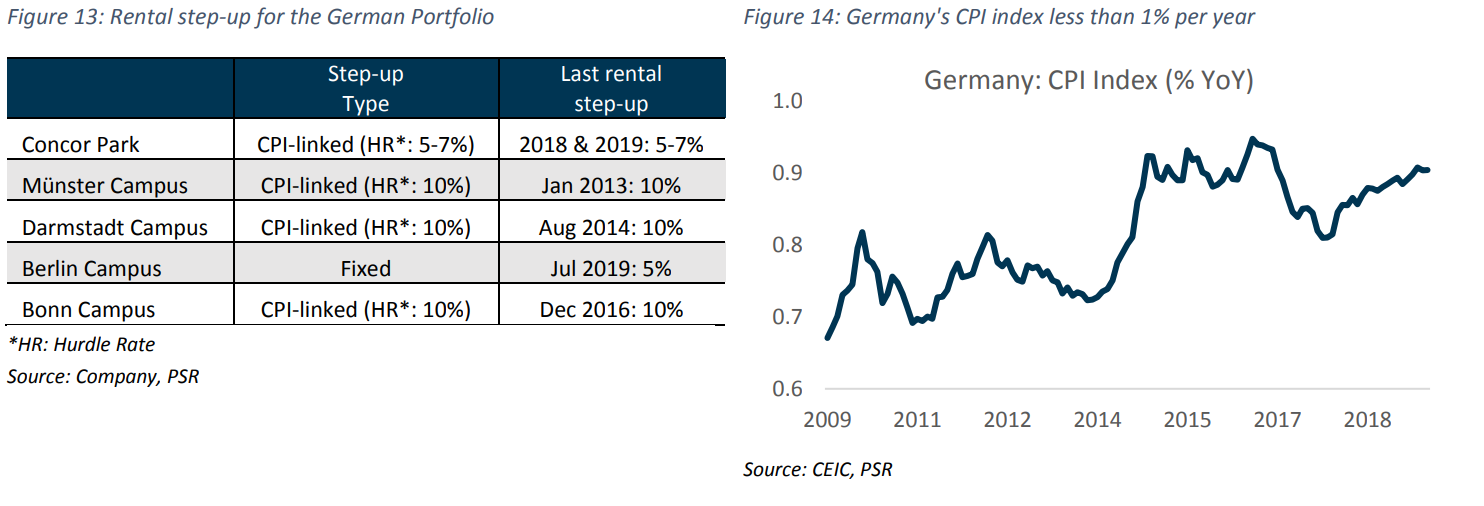

- Less organic growth opportunities: Rental escalations for most of the properties are based on an inflation mechanism tagged to the Germany’s Consumer Price Index (CPI), with the exception of Berlin Campus which is based on a fixed step-up rate. Most of the leases are also locked in till 2022. German CPI remains muted, averaging at 1.1% p.a. over the past 7 years. This can weigh on rental escalation rates.

We initiate IREIT with an ACCUMULATE. Our target price is S$0.885, implying an 8.5% upside coupled with a dividend yield of 6.9% (FY20e).

The report is produced by Phillip Securities Research under the ‘Research Talent Development Grant Scheme’ (administered by SGX).

THE REIT IREIT was listed on 13 August 2014 on the main board of SGX at S$0.88 per share. Its current portfolio consists of 5 free-hold office properties in Germany which are valued at €526.4mn as at 30 June 2019. The properties are located in the cities of Berlin, Bonn, Darmstadt, Munich and Münster. In Dec 2019, IREIT announced that it will enter in a 40:60 joint venture with Tikehau Capital to acquire 4 multi-tenanted freehold office buildings in established office areas of Madrid and Barcelona for €133.8mn. Tikehau will offer IREIT with a call option to acquire its 60% stake, while CDL will provide a €32mn bridging loan to finance IREIT’s investment of 40% of the portfolio. |

STRATEGIC INVESTORS: TIKEHAU CAPITAL AND CDL IREIT is managed by IGG, which is jointly owned by Tikehau Capital and CDL. Tikehau Capital and CDL each own 50% stake in the trust manager IGG, and 16.3% and 12.3% in IREIT respectively. |

Tikehau Capital is an asset management and investment group which manages €23.4 bn of assets under management and is supported by shareholders’ equity of €3.1 bn as at 30 June 2019. It is listed on Euronext Paris (Ticker: TKO.FP) and employs more than 480 staff in 11 offices. Most of its offices are situated in Europe. Tikehau Capital operates four business segments – Private Debt, Real Estate, Private Equity and Liquid Strategies. The real estate portfolio under management is valued at €8.5bn, which is relatively on par with private debt – its biggest business segment – at around €8.6bn. Its mandate in real estate is to invest primarily in European commercial real estate in order to achieve higher returns through active asset management. This is in line with IREIT’s investment strategy to focus on European real estate. |

CDL is a leading Singapore-listed real estate operating company with a global network spanning across 103 locations in 29 countries and regions. CDL’s key markets include China, United Kingdom, Japan and Australia. The group’s London-based hospitality arm, Millennium & Copthorne Hotels Limited is one of the world’s largest hotel chains with over 145 hotels worldwide. CDL is also developing a fund management business and aim to achieve US$5 billion in Assets Under Management (AUM) by 2023. |

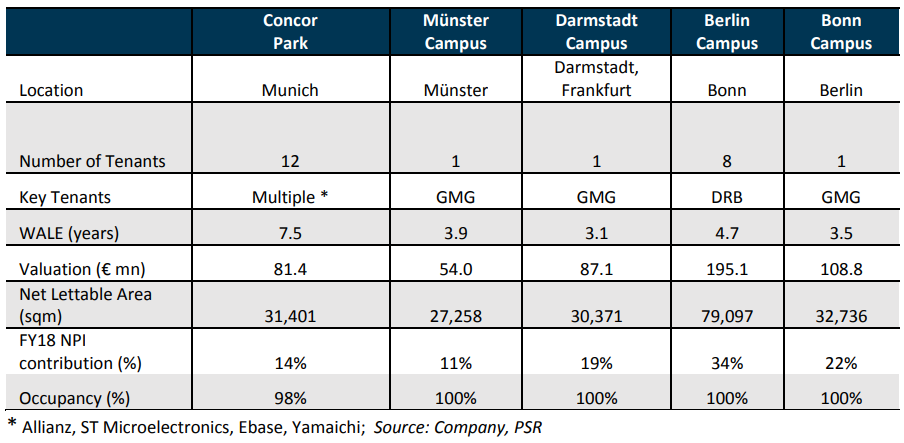

THE GERMAN ASSETS IREIT currently holds 5 freehold office properties in its portfolio: Figure 3: Overview of IREIT’s German portfolio |

a. Concor Park (Figure 4) – Property with the longest WALE. The property is located in the Aschheim-Dornach commercial area within a large suburban business park about 10km from Munich city centre, the third-largest city in Germany. The 5-storey building with three independent wings and entrances was fully refurbished with a modern office fit-out in 2011. The property operates as a multi-tenanted business park with a central canteen and coffee bar. b. Münster Campus (Figure 5) – Smallest property in the portfolio by valuation and GRI. Located in Zentrum Nord, one of the largest office locations in Münster approximately 2.5km from the Münster city centre, the campus is within walking distance to the nearest train and bus depot. The development comprises two independent office buildings, Münster North and Münster South. Each 6-storey building is built around an open courtyard for maximum light. The property will be undergoing light modifications to be converted from a single-tenant property to a multi-tenanted office block. c. Darmstadt Campus (Figure 6) – Property has enjoyed 100% occupancy since IPO. Located in TZ Rhein Main Business Park of Darmstadt, a prime office location approximately 30km south of Frankfurt, the campus is 100m from the nearest bus stop and 1km from the Darmstadt central railway station. The development operates as a single-tenant property and forms the home to the second largest Deutsche Telekom campus in Germany. The property is well-incorporated into the overall Deutsche Telekom campus which provides canteen and other services in the surrounding buildings. d. Bonn Campus (Figure 7) – Second largest property in the portfolio by valuation and GRI. Located in the Bundesviertel (federal quarter), the prime office area within Bonn. Centrally located in Bonn’s prime office area of Bundesviertel (federal quarter), the campus is well-served by regular bus services with the nearest underground train station, U-Bahn, only 100m away. A dedicated footbridge links the development to the global headquarters of Deutsche Telekom. The U-shaped development comprises four 2-, 4- and 6-storey blocks that can be easily subdivided into smaller offices, or function as independent self-contained units. It currently operates as a single-tenant property with a central entrance and a canteen facility for employees e. Berlin Campus (Figure 8) – Largest property in the portfolio by valuation and GRI. The campus is located in Schreiberhauer Straße in the Lichtenberg district, 6 km east of Berlin city centre. It is also located near the well-established Media Spree commercial centre. Within walking distance to the Ostkreuz railway station, the two fully connected 8- and 13-storey blocks are tailored to the requirements of Deutsche Rentenversicherung Bund, the current single office tenant. The ground floor units are leased to local retailers and service providers. |

INVESTMENT MERITS We find IREIT attractive at for several reasons: 1. Attractive dividend yield supported by stable leases. We can expect IREIT to deliver dividends at yields of 6.9% in FY20 and FY21 driven by the following portfolio attributes: |

Blue-chip tenant mix – IREIT’s current portfolio is largely made up of single-tenanted leases, with key tenants such as GMG* and Deutsche Rentenversicherung Bund (DRB)** that contributes 86% of the portfolio’s GRI. Both are blue-chip tenants with leases secured on an initial tenure of 15-years coupled with various options for extension.

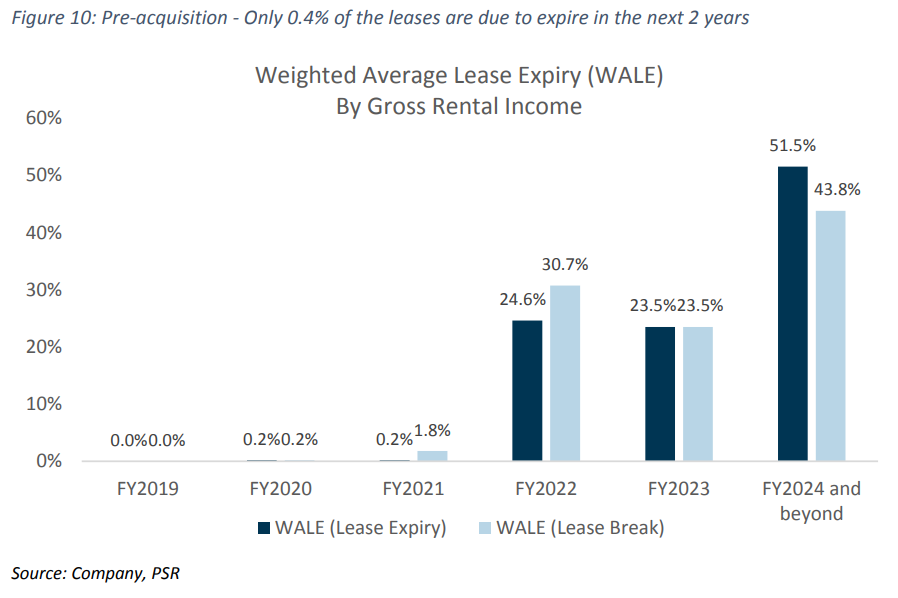

Long WALE – The portfolio exhibits an average portfolio WALE by gross rental income (GRI) of 4.4 years, which is higher than the average WALE of 2-3 years for commercial S-REITs. In terms of the portfolio WALE profile, only 0.4% of the leases are due to expire in the next 2 years and only 2% of leases are eligible for a lease break. This structure will provide income stability in the portfolio for at least 2 years. |

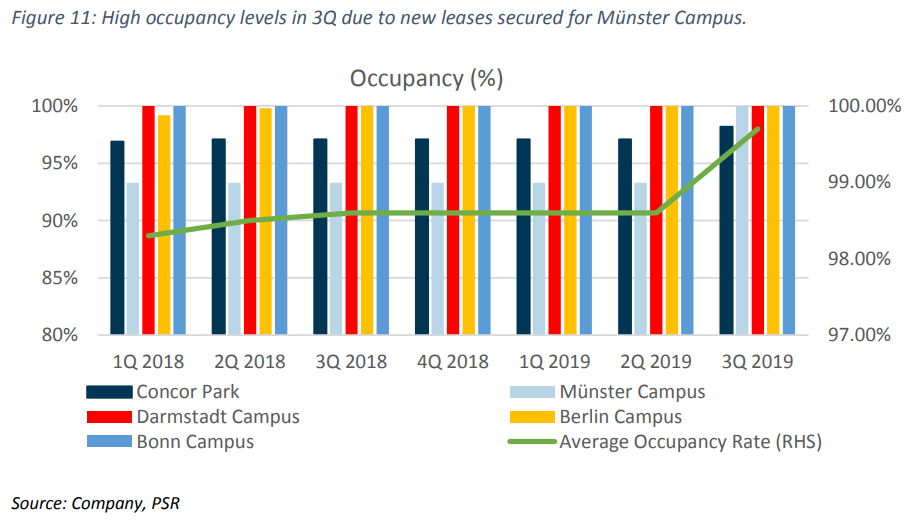

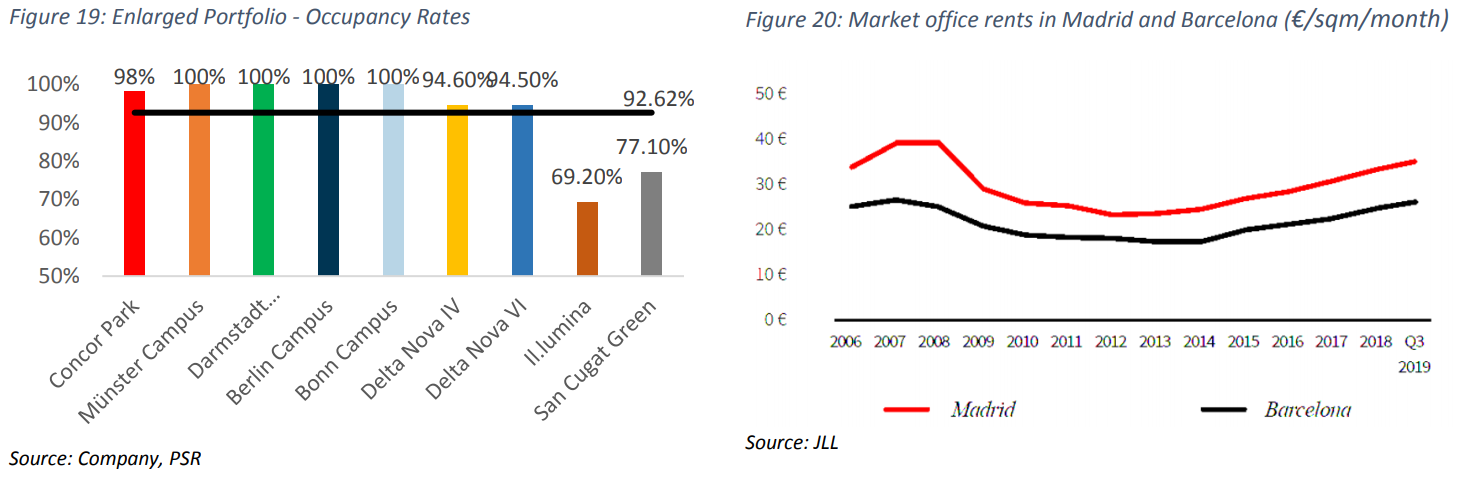

High occupancy levels – Münster Campus (which had a vacant floor since 2017) is currently 100% occupied as at July 2019, bringing the average occupancy of the portfolio up to 99.70%. |

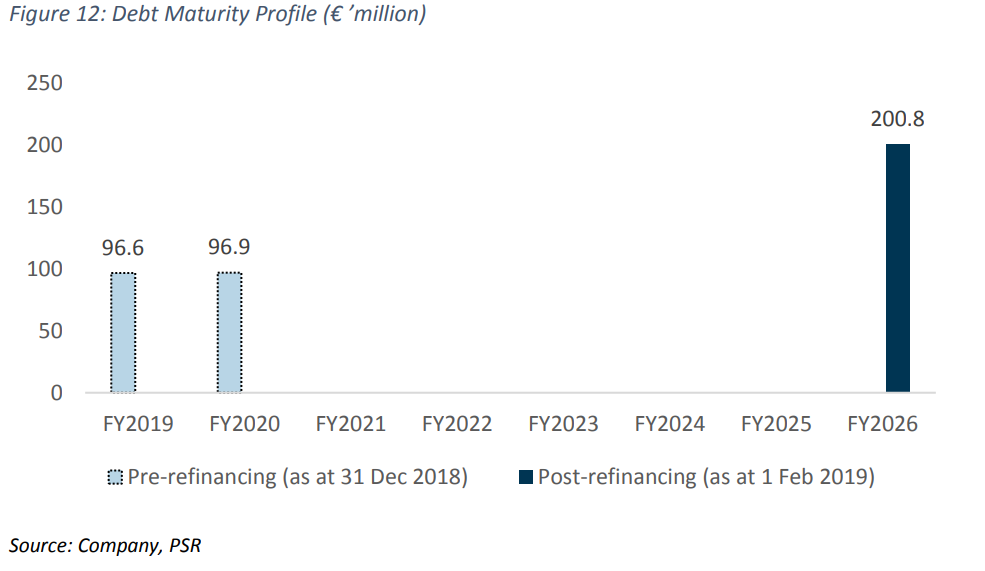

Healthy gearing levels – IREIT’s gearing stands at a healthy level of 36.5%. Interest rate swaps were entered at an all-in cost of debt of 1.5% p.a over 7 years to hedge 100% of the interest of the new loan facilities. There will be no refinancing for its existing debt facilities till FY26. |

IREIT is currently leasing its properties at market rates – We do not expect to see positive rental reversions when the leases expire. However, we do expect rental step-ups for the properties when they are due.

Rental escalations for most of the properties are based on an inflation mechanism tagged to Germany’s Consumer Price Index (CPI), with the exception of Berlin Campus which is based on fixed step-up rates. The hurdle rates for these properties range between 5-10%. CPI inflation is recognised on a cumulative basis and rental uplift is registered when the cumulative inflation meets the respective hurdle rate. For instance, if inflation increases at 1% per year and the property has a 10% hurdle rate, rental for the property will only see an uplift of 10% at the 10th year. The next rental step-up for Berlin Campus is expected to be 2.5% at 2022. |

With high cashflow visibility stemming from IREIT’s long portfolio WALE (4.4 years), high portfolio occupancy levels (99.7%) and blue-chip tenants locked in for the next 2 years, we can expect IREIT to deliver dividends at yields of 6.9% in FY20 and FY21. |

2. Ability to leverage on financial support, expertise and acquisition pipeline from Tikehau Capital and CDL. Post-acquisition of the 80% stake in IGG, Tikehau Capital has provided IREIT with a local footprint and experienced ground team to manage existing properties in terms of asset, tenant and property management. Leveraging on Tikehau Capital’s reputation and presence, IREIT is also offered real estate deal flows in France, Italy, Spain, Germany and Netherlands for prospective acquisition opportunities. With CDL’s acquisition of a 50% stake in IGG and 12.4% in IREIT, we believe IREIT is part of CDL’s strategic move to build up the real estate fund management business given their target to achieve US$5 billion in AUM by 2023. We are hopeful that CDL may be able to offer IREIT with a European pipeline of assets. In particular, CDL’s UK properties (Aldgate House and 125 Old Broad Street) offer yields of 4.5-5%. The recent acquisition of the Spanish portfolio showcases the multiple layers of support provided by both shareholders to build IREIT as their European REIT platform:

Tikehau Capital – IREIT was able to secure the properties at a collective discount to their valuations by taking advantage of Tikehau Capital’s network and knowledge of the local markets. – Offered IREIT a call option to acquire the remaining 60% of the portfolio at market price with a floor price. The call option is for 1.5 years. – Can possibly provide IREIT with an experienced team in Spain to manage new properties in terms of asset, tenant and property management.

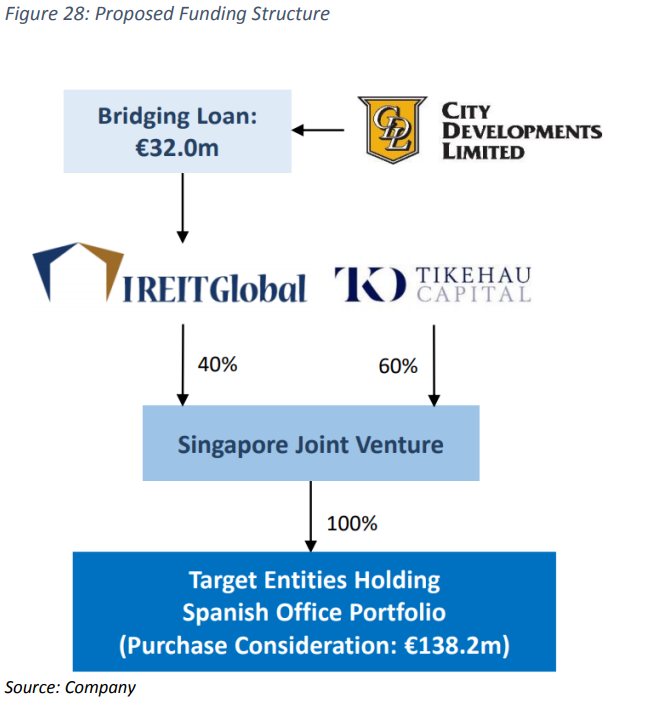

CDL – Extended a bridging loan of €32.0mn to IREIT in order for it to secure the properties, as the sale process required speed and execution certainty. |

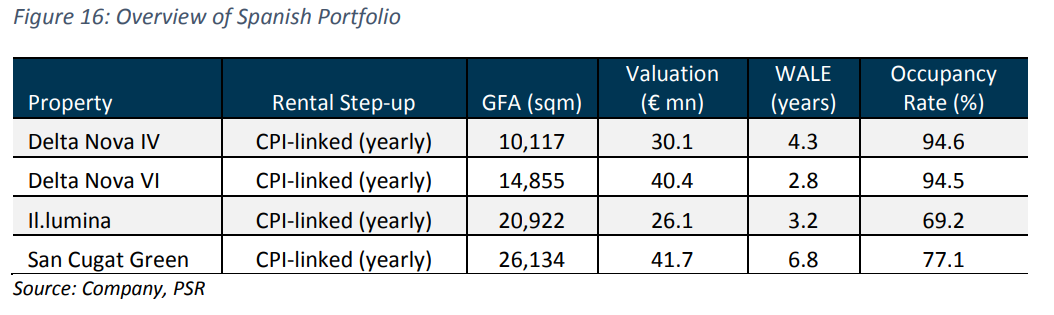

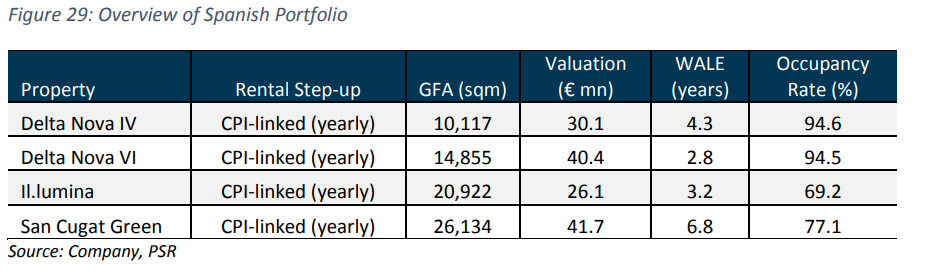

3. Acquisition to add scale, growth and diversification to IREIT. Post addition of the Spanish portfolio, the enlarged REIT will provide greater diversification in terms of location, asset and tenants. The valuation of the enlarged portfolio is expected to increase by 10.5% to €581.7mn. The acquired properties are all freehold properties, which compares favourably with other S-REITs which properties are leased up to 99 years. The properties also have a yearly rental step-up linked to the Spanish CPI. |

Post-acquisition of the 40% stake, IREIT will shed its German-pureplay status and will have a 9.5% exposure to Spain by AUM. The largest asset by contribution (Berlin campus) will also see a reduction of 4% by valuation within the enlarged portfolio. The multi-tenanted Spanish properties will introduce 28 new tenants, increasing tenant and trade diversification to IREIT’s portfolio.

The overall occupancy rates for the Spanish portfolio stands at 80.9%. This brings the average occupancy rates of the enlarged portfolio to 92.6%. Therefore, there is a potential for IREIT to increase occupancy rates through active leasing efforts and bring the under-rented properties closer to market levels. Aggregated for the portfolio, the passing rents for these properties are approximately 7.5% below the current market rents. IREIT will also be able to benefit from positive rental reversions when current leases are renewed at potentially higher rental rates.

RISK FACTORS 1. Concentration risk by country, asset and tenant mix: All the properties in IREIT’s current portfolio are based in Germany, with GMG holding more than 50% of the tenant mix. Post-acquisition, the enlarged portfolio still has an exposure of 90.5% by valuation to Germany. Berlin Campus, which is IREIT’s largest asset, contributes 32% of the portfolio’s GRI. 2. Less organic growth opportunities: Rental escalations for most of the properties are based on an inflation mechanism tagged to the Germany’s Consumer Price Index (CPI), with the exception of Berlin Campus which is based on a fixed step-up rate. Most of the leases are also locked in till 2022. German CPI remains muted, averaging at 1.1% p.a. over the past 7 years. This can weigh on rental escalation rates. 3. Foreign exchange risk: Significant depreciation of EUR/SGD beyond our estimates will impact forecasted DPU, as approximately 20% of the distributable income to be repatriated back to Singapore is unhedged. |

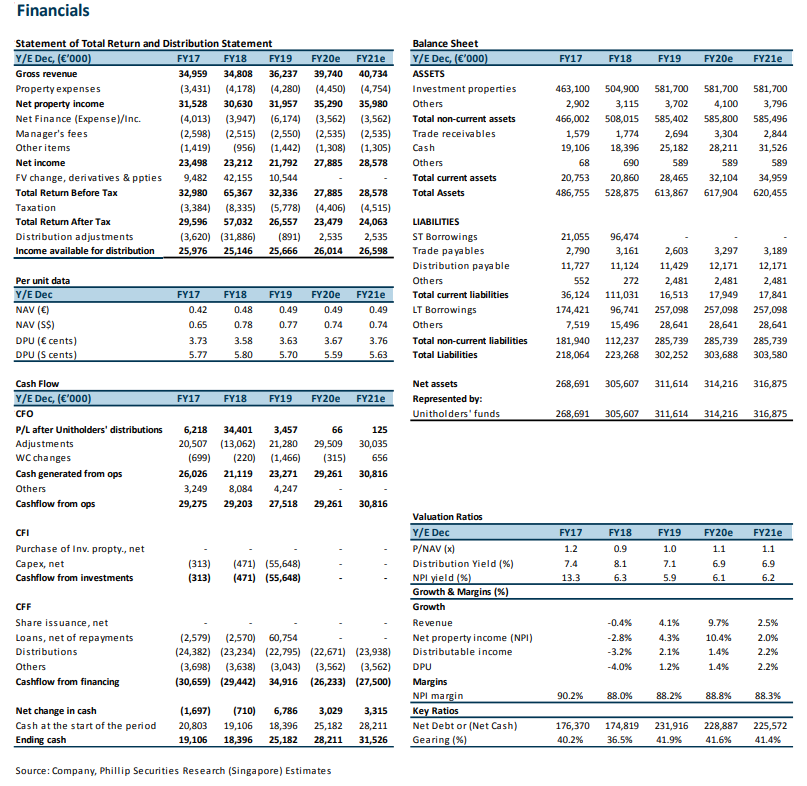

VALUATION We initiate coverage on IREIT with an ACCUMULATE rating and a DDM-derived target price of S$0.885. Our valuation assumes that the acquisition of the Spanish properties will be fully funded by debt. With a DPU yield of 6.9%, this implies a total upside of 15.4%.

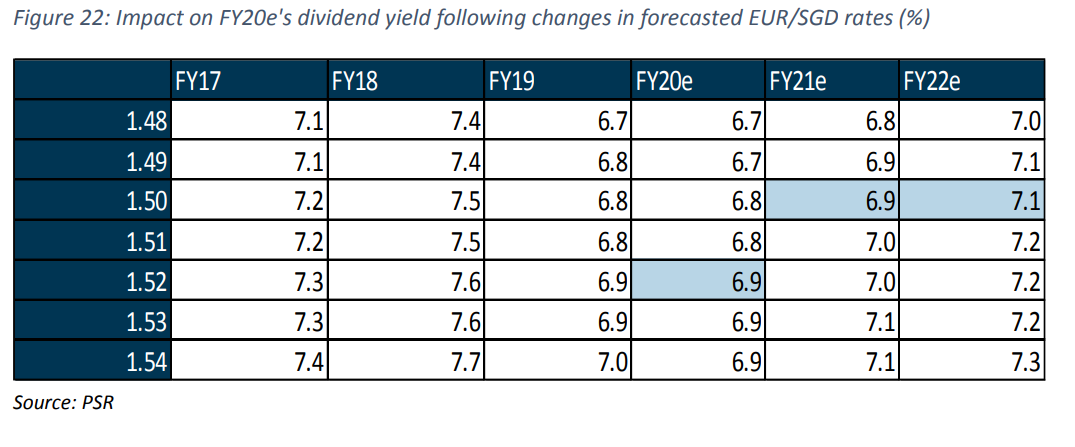

Our target price is based on a four-year projection, cost of equity of 7.1% and terminal growth rate of 1%. In our models, we estimated a 2-3% annual escalation rate for the leases. We assume a EUR/SGD exchange rate of 1.52 and 1.50 for FY20 and FY21 respectively given that interest rates are hedged one year ahead for approximately 80% of the distributable income. |

We conducted a sensitivity analysis to anticipate the impact of changes in EUR/SGD on IREIT’s forecasted distributable income to unitholders. Based on the analysis, every 2% increase in EUR/SGD will result in an 0.1% increase in dividend yield. |

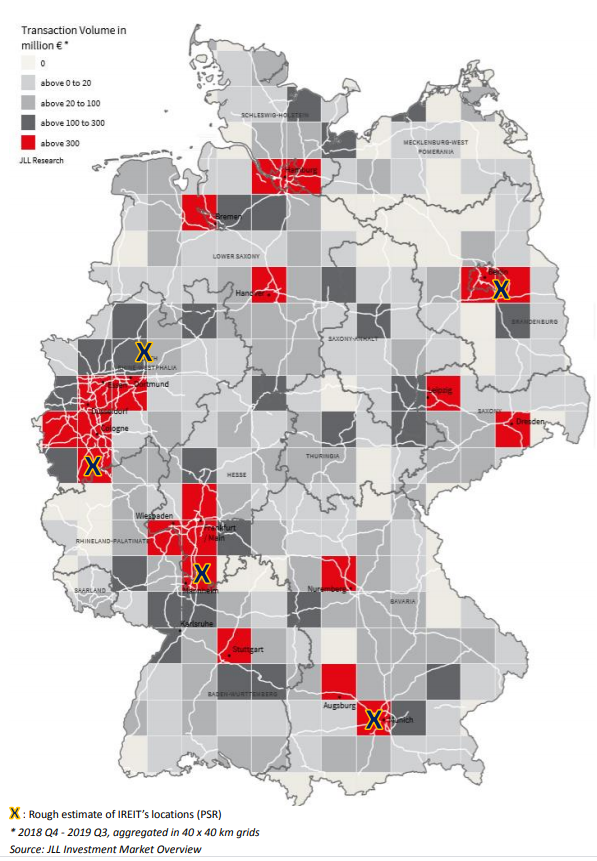

GERMANY AND ITS OFFICE INDUSTRY Germany is one of the most densely populated countries in Europe, with 83mn inhabitants in the country. Berlin is Germany’s largest metropolis and capital, while Frankfurt is Germany’s financial hub which holds the country’s busiest airport. Other of its major cities include Cologne and Munich where some of IREIT’s properties are located. |

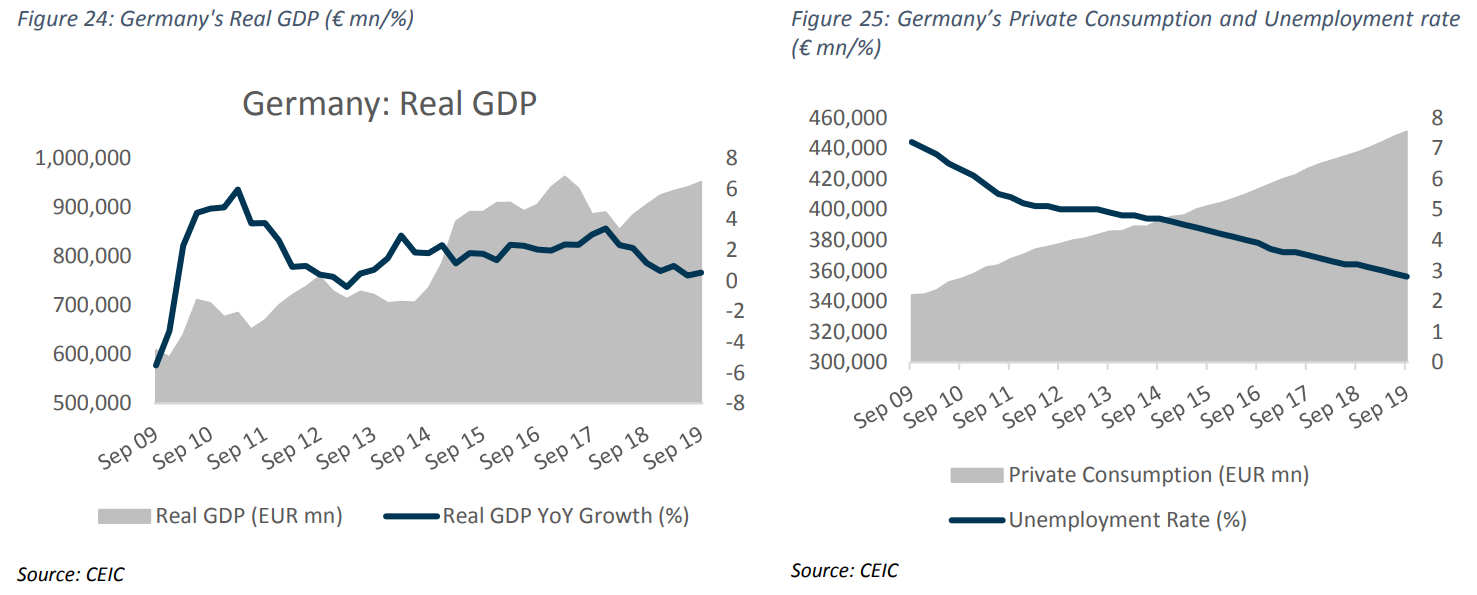

Germany’s economic growth slowed in recent years, mainly due to subdued industrial production and declining exports. Perpetuated by the trade war and ongoing Brexit negotiations, the slowdown in the Chinese economy greatly impacted Germany’s export-oriented economy as the manufacturing sector became more pessimistic.

Despite the slowdown, Germany’s economy remains robust for the 10th year running. Real GDP is still growing steadily as private consumption continues to drive the economy, supported by higher wages and salaries and record low unemployment rate. Given that the German economy is closer to 100% employment, the potential for growth might be limited moving forward, though prospects for consumption remains favourable. |

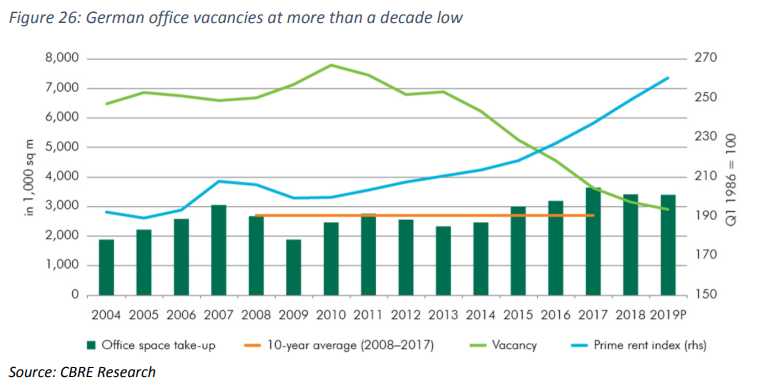

Amidst geopolitical uncertainties, Germany’s real estate investment market has been recognized to be a safe haven favoured by investors, as affirmed in the CBRE EMEA Investor Intention Survey. It is mainly attributable to Germany’s promising macroeconomic fundamentals and its low-interest rates. In particular, office property is the most dominant asset class in the German real estate market with a market share of 40% as of 2Q19. Upward trending rents, along with low vacancy rates and strong demand in the letting market drive investor interests in office properties located in investment centres. Met by an increasingly tapered supply, this phenomenon is apparent especially in top markets like Berlin, Düsseldorf, Frankfurt, Munich, and Hamburg. |

Limited by a shortage of adequate and available spaces, pipeline growth for offices is expected to be absorbed quickly by the market. Besides seeing strong rental growth in the inner cities, desirable city fringe locations do see rental uplifts underpinned by the search for alternative investments. |

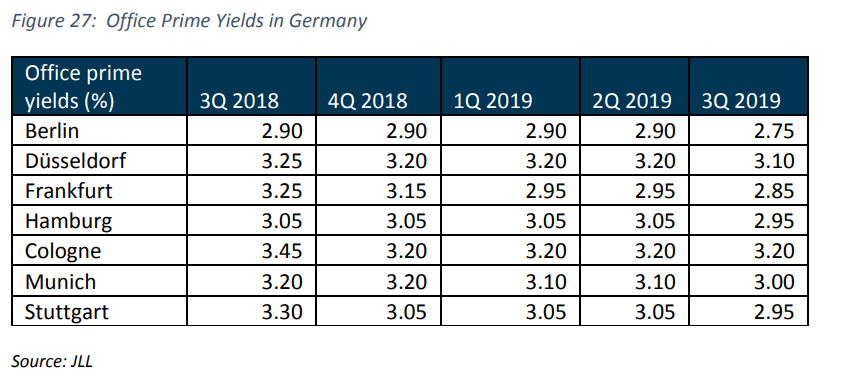

Positive rental price trend and outlook for the seven strongholds contribute to the yield compression in the German office market. We believe that the strength of the German office market will persist on the back of tight supply amidst rising demand for attractive office properties. Excess demand is expected to be able to support rising rates in the near term. |

ACQUISITION: TRANSACTION OVERVIEW IREIT partnered with Tikehau Capital and CDL to acquire 100% interest of 4 multi-tenanted freehold office properties located in the established office areas of Madrid and Barcelona. The Spanish portfolio will be held through a 40:60 joint venture (JV) by IREIT and Tikehau Capital and it is IREIT’s maiden acquisition since Tikehau Capital and CDL formed a strategic partnership in April 2019. The total agreed property value on a 100% basis of €133.8mn represents a 3.3% discount to aggregate valuation. After taking into the mortgage financing at the asset level, the total cost of investment for IREIT’s 40% interest is €57.6mn. CDL showed its support for the acquisition by extending a €32.0mn bridging loan to IREIT to fund its investment. Tikehau Capital granted IREIT with a call option at market price with a floor to acquire the 60% stake. The bridging loan will be for a tenor of 18 months at an interest rate of 3.875% above EURIBOR per annum. IGG will explore possible debt and equity financing options to repay the bridging loan as well as exercise the call option while maintaining an appropriate capital structure for IREIT. |

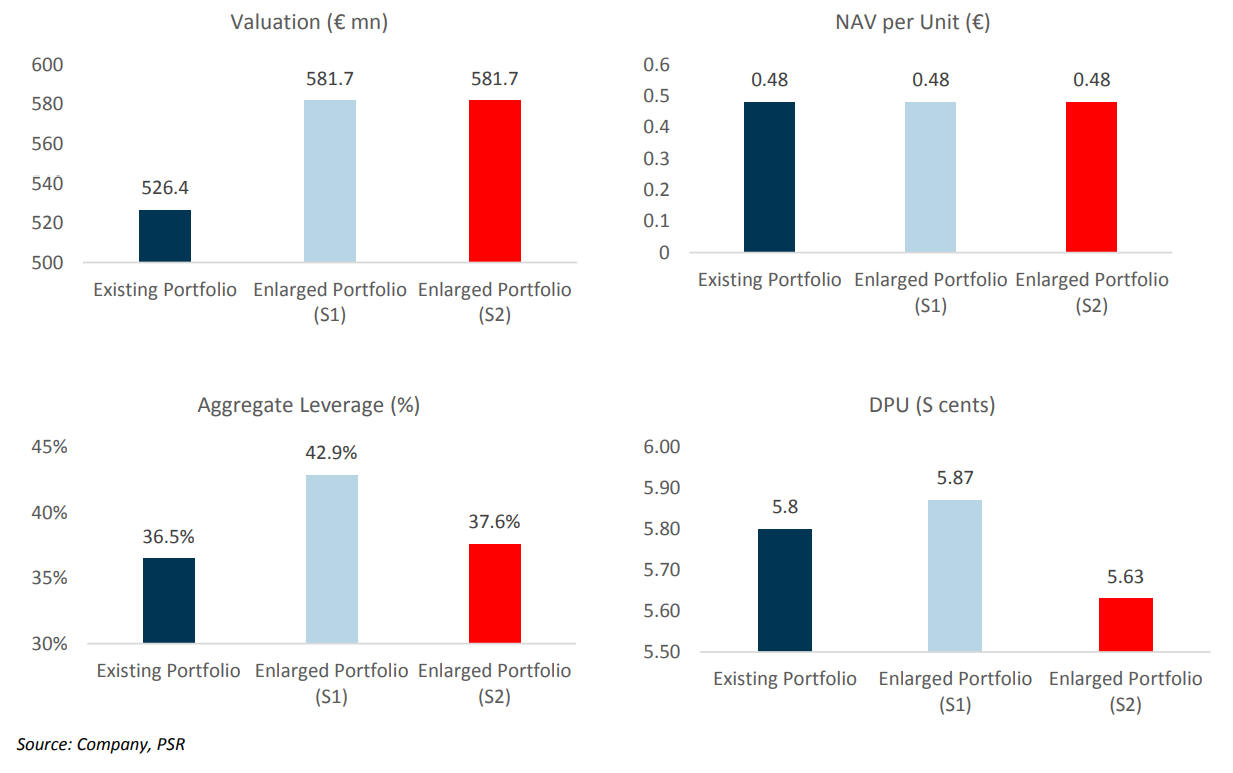

ILLUSTRATIVE FINANCIAL EFFECTS IREIT intends to finance the total acquisition cost either fully in debt which comprises of the CDL loan and mortgage financing (Scenario 1), or in a combination of debt and equity which comprises of mortgage financing and equity financing (Scenario 2). IREIT has drawn down approximately €5.4mn of the CDL Loan to fund IREIT’s proportionate share of the initial payment, with the remaining loan amount to be drawn down on closing. In Scenario 2, it is assumed that approximately S$50.0mn will be raised from the issuance of 62.7mn new units at a price of S$0.7979 per new unit at the exchange rate of €1.00: S$1.5195. The NPI yield of the Spanish portfolio as of 30 September 2019 is estimated to be 4.2%. In both scenarios, the enlarged portfolio is expected to increase by 10.5% and net asset value per unit is to remain at €0.48/unit. If IREIT funds the acquisition by debt in Scenario 1, the aggregate leverage is expected to increase by 6.4%. IREIT will be able to see DPU accretion of 1.2%. If IREIT funds the acquisition in partial debt in Scenario 2, aggregate leverage is expected to increase by 1.1% and DPU will see a dilution of 2.9%. |

APPENDIX 1 – THE SPANISH ASSETS |

IREIT is to add 4 office properties in its portfolio: a. Delta Nova IV and Delta Nova VI (Figure 30) – Delta Nova IV and Delta Nova VI are two office buildings that form an office complex located in the consolidated business office area of Manoteras, north of Madrid. Manoteras is a 15-minute drive to both the Madrid Barajas International Airport and Madrid financial centre and approximately 25 minutes from Madrid’s city centre. b. Il∙lumina (Figure 31) – Smallest property in the Spanish portfolio, Il∙lumina is an office building located in Esplugues de Llobregat. Esplugues de Llobregat is a mixed-use office and industrial area that houses technology and audio-visual office cluster which is located five kilometres away from Avenida Diagonal, the financial district of Barcelona (Avenida Diagonal). Il∙lumina was built in the 1970s and was fully refurbished in 2004 into an office building with enhanced functionality and design. c. Sant Cugat Green (Figure 32) – Largest property in the Spanish portfolio. Sant Cugat Green is a modern office building in Barcelona, located in an attractive periphery office submarket within its metropolitan area. The office is approximately a 20-minute drive away from Avenida Diagonal and has a bus stop in close proximity to the building to provide regular access to public transportation (FCC train station). It is also equipped with a restaurant and a 5,146 sqm data centre space for internal use by its tenants. Source: Company, PSR |

APPENDIX 2 – SPAIN AND ITS OFFICE INDUSTRY Spain is the largest country in Southern Europe, and the fifth-largest economy in the European continent. Spain’s largest city and capital is Madrid. Other of its major urban areas include Barcelona, Bilbao, Málaga, Seville and Valencia. IREIT’s newest properties will be located in Madrid and Barcelona. |

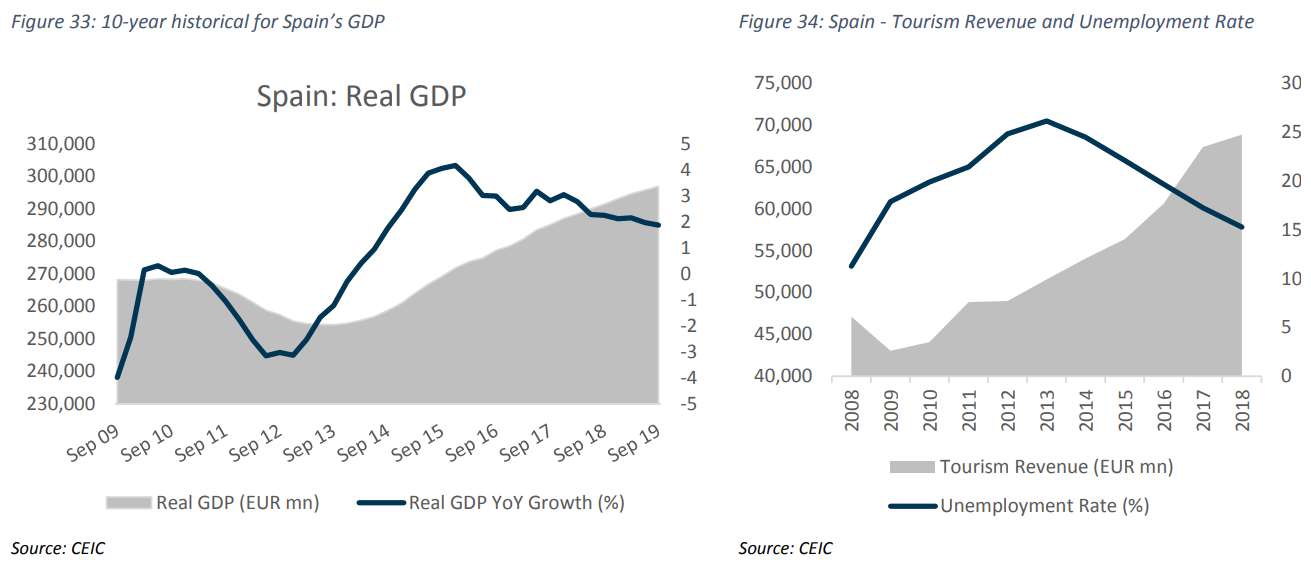

Spain’s economy continues to expand for the sixth year in a row, driven by the lower unemployment rate, strong tourist arrivals and healthy private consumption. Its GDP growth outpaces the average GDP growth across all the European states. According to CBRE Research, GDP for Spain is forecasted to grow by 2.2% from 2019 to 2020 and 1.6% from 2019-2023 while other Eurozone countries will see more muted growth rates of 1.6% and 1.3% respectively. |

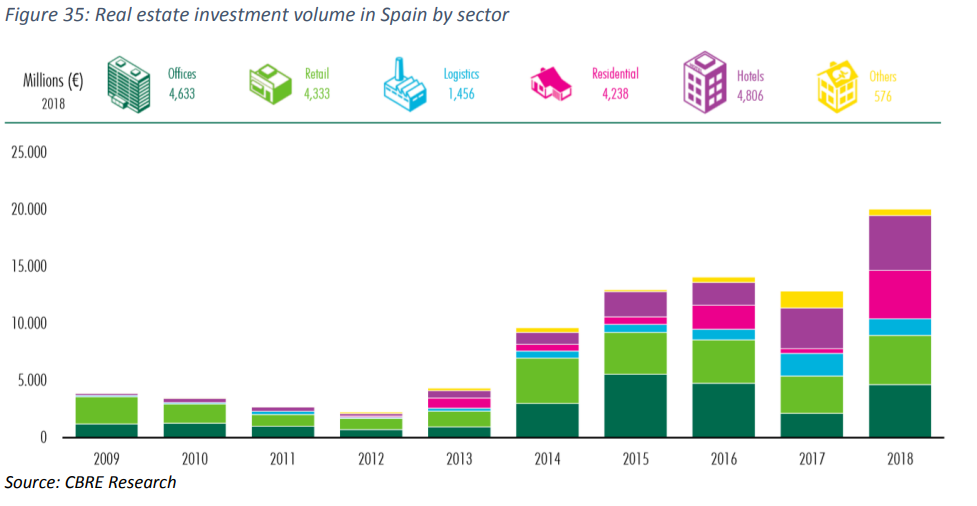

Spanish real estate investments continue to be favoured on the back of low interest rates, low sovereign bond yields in Europe and volatile financial markets. Supported by an above-average growth rate as compared to its neighbouring economies, Spain is on the watch-list for real estate investments for international investors. |

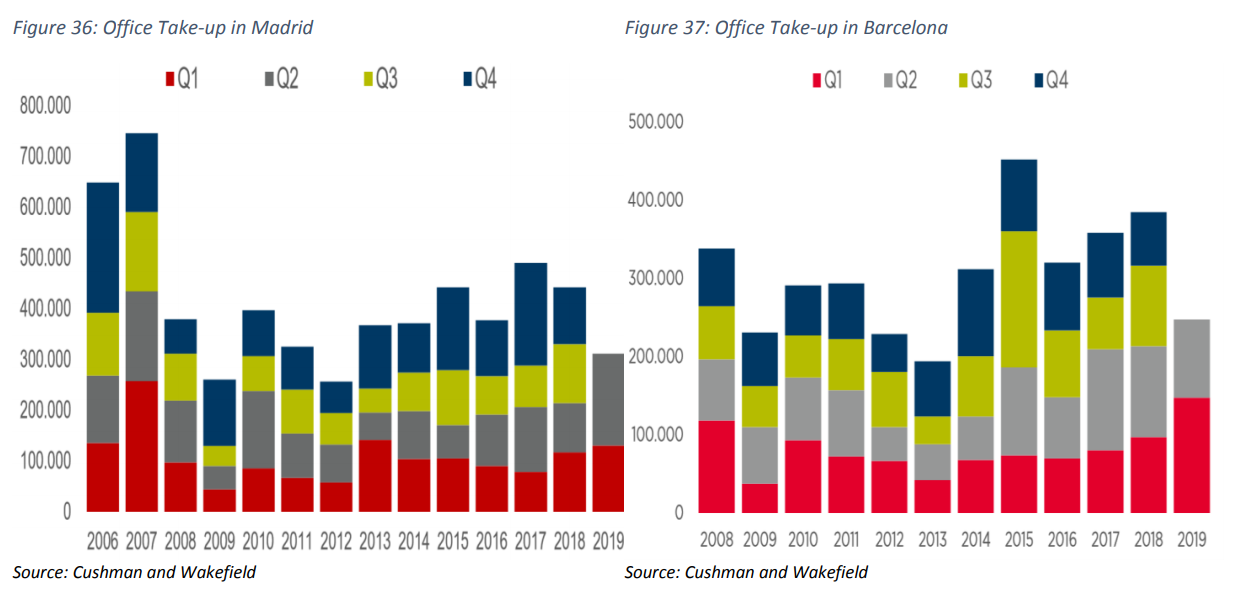

In terms of the office outlook, office take-up in Spain remains robust. It is mainly attributable to the increase in office employment, private sector demand and growth of regional productive activity. According to Cushman and Wakefield, the gross take-up of office floor space in Madrid increased 42% year over year to 334,500 sqm within 1H2019 while Barcelona recorded its best sixth month performance over the past decade with a take-up of 251,250 sqm in 1H2019. |

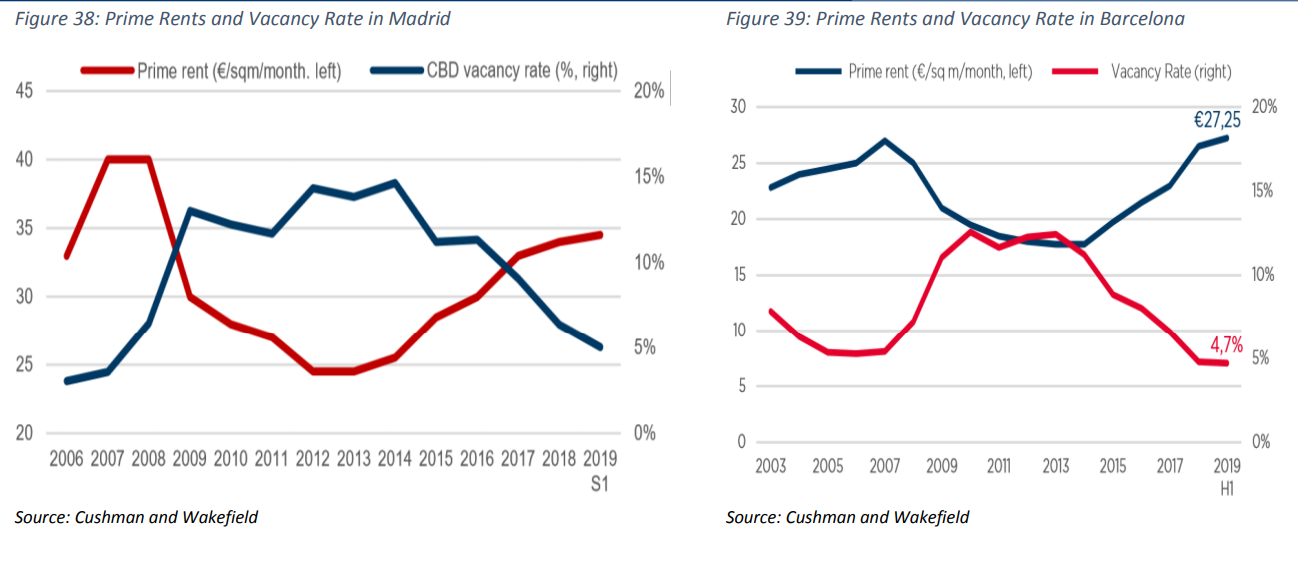

In tandem with strong take-up performance, rents in Madrid and Barcelona continue to face upward pressures on the back of strong office demand and a lack of quality supply. Prime rents in Madrid lifted moderately by approximately 3% year over year to hit €34.50/month for each square metre, while prime rents in Barcelona climbed 9% year to €27.25/month per square metre in 1H2019. Spain is an improving economy with sound fundamentals and investment climate. We note that Spain still has the room for growth and remain optimistic that IREIT’s newest acquisitions should be able to provide the existing portfolio with an adequate rental upside through active leasing management. |

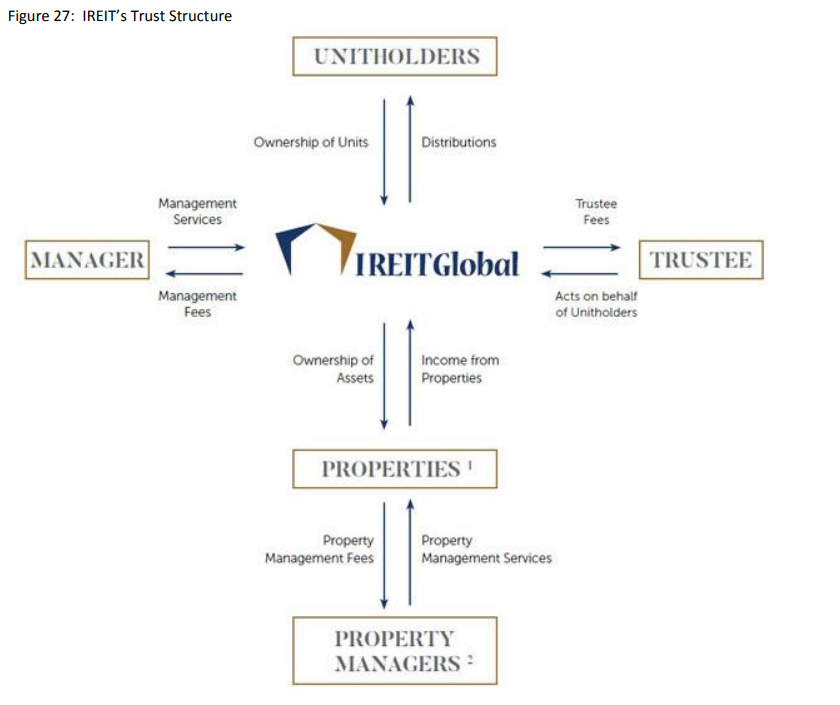

APPENDIX 3 – IREIT STRUCTURE

- The properties are held through property holding companies in the Netherlands.

- Professional third party property managers have been appointed pursuant to the property management agreements entered into between the relevant property holding company and the property manager.

Source: Company

APPENDIX 4 – IREIT Global Summary

Name | IREIT Global. Listed on 13 August 2014 on the main board of SGX @ S$0.88.

| ||||||||||||||||||||||||

Assets | 5 free-hold office properties in Germany which are valued at €526.4m as at June 2019. 4 free-hold office properties in Spain which are valued at €133.8mn as at Dec 2019.

| ||||||||||||||||||||||||

Strategic Investors | Tikehau Capital and CDL each own 50% stake in the trust manager IGG, and 16.3% and 12.3% in IREIT respectively.

| ||||||||||||||||||||||||

Manager | IREIT Global Group Pte. Ltd.

| ||||||||||||||||||||||||

Dividends | To distribute at least 90% of its distributable income.

| ||||||||||||||||||||||||

Gearing | Maximum gearing shall not at any time exceed 45%.

| ||||||||||||||||||||||||

Lease Structure | Germany: Berlin Campus’ rental escalation is based on fixed rent with built-in escalation, the rest of the properties are subjected to CPI on a cumulative basis against their respective hurdle rates. Spain: The properties for the Spanish portfolio are based on CPI, but it is done on a yearly step-up basis.

| ||||||||||||||||||||||||

Top 5 tenants | GMG – Deutsche Telekom, Deutsche Rentenversicherung Bund (DRB), ST Microelectronics, Allianz Handwerker Services GmbH, Ebase

| ||||||||||||||||||||||||

GMG Master Lease | GMG occupies 100% of Münster Campus, Darmstadt Campus and Bonn Campus. Leases are expected to expire in 2023-2024.

| ||||||||||||||||||||||||

DRB Master Lease | DRB is one of the 8 key tenants of Berlin Campus. DRB’s leases are expected to expire in 2024.

| ||||||||||||||||||||||||

Corporate Income Tax Rate in Germany | Dividends and capital gains derived from the disposal of German-REIT shares are fully subject to corporate income tax rate of 15.8%. However, tax-structuring through various SPVs and intercompany loans can be utilised to lower the effective tax rate recognised by IREIT.

| ||||||||||||||||||||||||

Source: Phillip Capital Research - 22 Jan 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024