Frasers Centrepoint Trust – Primed and Awaiting Imminent Growth

traderhub8

Publish date: Fri, 25 Oct 2019, 03:37 PM

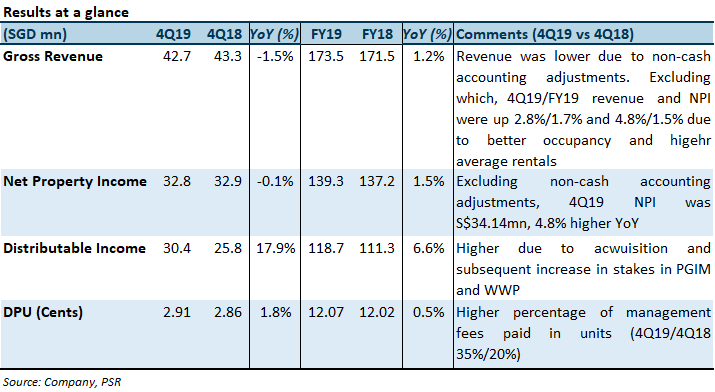

- 4Q19 and FY19 NPI and DPU in line with our forecast.

- Positive rental reversions, higher footfall and increase in FY19 revenue (excluding non-cash accounting adjustments).

- Growth catalysts include FCT’s pipeline assets, intensification of Woodlands and Punggol will benefit CWP and WWP, renewed strength in fringe retail rents and possible acquisition of PGIM’s assets.

- Maintain ACCUMULATE with higher TP of S$3.11 (prev. S$2.77). Higher target price due to the addition of the 6.7% stake in Waterway Point and FCT’s increased stake in PGIM.

The Positives

+ Positive rental reversions of 4.8% for FY19 (FY18 +3.2%). Highest reversions registered at Causeway Point (CWP) (+7.4%), FCT’s largest contributor to revenue. Reversions for the rest of the assets ranged from -1.4% to 2.2%.

+ Shopper traffic up 8.9% in 4Q19 while tenant sales came in flat. Northpoint City North Wing (NPNW), Changi City Point (CCP) and Waterway Point (WP) registered growth in tenant sales between 2% to 6%. However, this was offset by lower tenant sales at due to business disruptions at CWP (partial closure of basement due to underground pedestrian link (UPL) works) and Anchorpoint (changes in anchor tenant).

The Negatives

– Occupancy slipped 0.3ppts QoQ to 36.5%. Causeway Point’s occupancy was 97.0%, lower compared with 98.4% last year due to the ongoing works relating to the construction of the UPL link at its basement level, which is expected to complete in December 2019. Anchorpoint’s occupancy currently at 79.0%, is expected to improve to 94.2% when the new tenants complete their fitting-out progressively in October and November 2019.

Source: Phillip Capital Research - 25 Oct 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024