CapitaLand Mall Trust – Sunlight Through the Clouds

traderhub8

Publish date: Wed, 23 Oct 2019, 08:59 AM

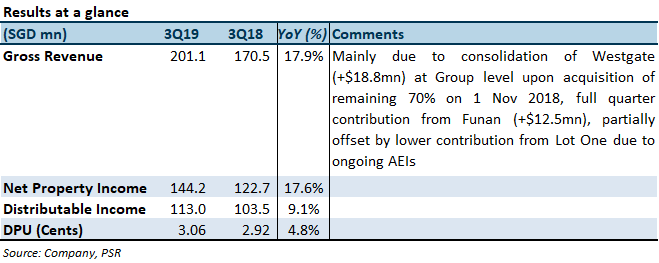

- 3Q19 NPI and DPU in line with our forecast, with 3Q19/9M19 DPU forming 26.4%/76.4% of our DPU forecast.

- Higher occupancy and positive portfolio rental reversions, with YTD tenant sales falling less than RSI Ex. MV (-1.3% vs -1.8%1) (Figure 1)

- Maintain Neutral with unchanged TP of $2.68.

The Positives

+ Third quarter of positive rental reversions. Rental reversions for 3Q19 were +1.2% over the initial signing rents (1Q19/2Q19 +1.2%/+1.8%). Positive reversions ranging 0.4% to 3.4% were observed for all malls except RCS, CQ and Bedok Mall (-0.1 to -2.2%).

+ Portfolio occupancy improved 0.6ppts QoQ. Occupancy improved across all malls except for RCS (-1.0ppts) and Lot One (-0.6%, due to ongoing AEIs).

The Negatives

– Third quarter of contracting retail sales. Despite an improvement in shopper traffic (+1.3%), tenant sales for 1H19 fell by 1.3%, slightly worse off than 1Q19/2Q19’s -0.5%/-0.9%. However, tenant sales psf/month for the top five trade categories that contributed >70% of gross turnover (GTO) income improved 1.2% YTD. These were the Sporting Goods (+8.8%), F&B (+3.5%), Shoes & Bags (+1.5%), Jewellery & Watches (+0.9%) and Fashion (+0.4).

Outlook

Ramp-up in occupancy at Funan’s office space is on track. Physical occupancy increased from 25% to 50% (as at 30 September 2019), with physical occupancy to reach committed levels (98%) by early 2020.

Retail sector outlook remains weak with the retail sales index excluding motor vehicles (RSI Ex. MV) in the red since the start of 2019 (Figure 2). CMT’s decline in tenant sales was persistently less pronounced than the fall in RSI Ex. MV (YTD -1.3% vs -1.8%1) (Figure 1).

Ongoing AEI and tenant rejuvenations are being carried out at Lot One to increase the space taken by the library and reconfigure the cinema layouts to increase the number of screens.

Maintain NEUTRAL with unchanged TP of S$2.68.

Our target price translates to a 5.4%/6.3% FY19e/FY20e distribution yield and a P/NAV of 1.35x.

Source: Phillip Capital Research - 23 Oct 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024