Clearbridge Health Limited – Ramping Up

traderhub8

Publish date: Thu, 30 May 2019, 09:27 AM

The Positives

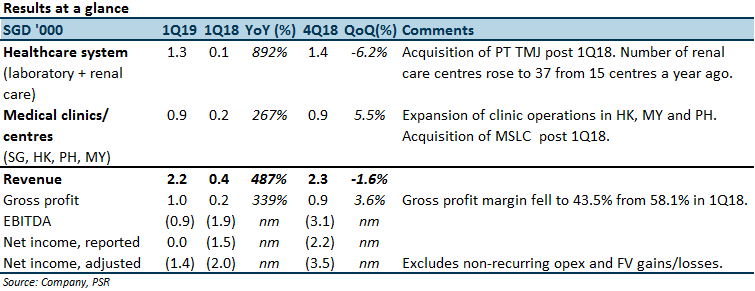

- Healthcare system (TMJ + Marzan + Laboratory) revenue surged 9x YoY to S$1.3mn. The growth was due to the acquisition of PT Tirta Medika Jaya (TMJ) located in Indonesia, in April 2018. The number of TMJ’s renal care centres that are under contract with hospitals in Indonesia increased by 22 YoY to 37 contracts currently. The key feature of renal care is its recurrent revenue stream (dialysis is a lifetime treatment). From the 37 contracts, revenue was from 23 operational hospitals, with the remainder under renovation. We expect TMJ’s revenue growth to pick up in the following quarters as renal care volume increases and more hospitals complete their renovations.

- Medical clinics and centres revenue grew 267% YoY to S$0.9mn. The growth was due to the Group’s expansion of medical clinics and centres in Hong Kong, Malaysia and the Philippines, coupled with revenue contribution from Medic Laser and Surgical Private Limited (MSLC) acquired in April 2018.

The Negatives

- Temporary disruption to business in Clearbridge Medical Philippines (Marzan) due to renovations and delay of receivables from the Department of Social Welfare and Development (DSWD). Renovations at Marzan commenced around 4Q18, resulting in a disruption to business in 1Q19. However, renovations were completed in February 2019 and revenue should recover in 2Q19. Pharmacy sales fell due to a delay in medical subsidy claim receivables from DSWD, caused by a migration of government systems.

- Margins to remain under pressure. Gross profit margin fell 14.6 p.p. YoY to 43.5% due to a 692.4% YoY increase in purchases, which rose in tandem with higher business activity as the Group expands. Purchases mainly comprised direct expenses incurred in processing specimens by in-house laboratory testing facilities or outsourced third-party clinical laboratories, as well as consumables and medicines used by medical clinics/centres.

The report is produced by Phillip Securities Research under the ‘SGX StockFacts Research Programme’ (administered by SGX) and has received monetary compensation for the production of the report from the entity mentioned in the report.

Investment Actions

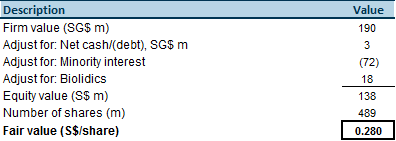

Maintain BUY with an unchanged TP of S$0.28. We believe the two primary growth drivers for CBH is the healthy underlying demand for healthcare services in the three key countries that it is operating in – Indonesia, Philippines, Singapore, and its aggressive M&A in various EBITDA accretive businesses.

Despite this quarter’s miss in earnings forecast, we expect higher revenue contribution from the following acquisitions and business expansions to kick in from 2Q19 onwards to reach our FY19e earnings estimates.

The growth drivers:

- Recovery of patient volume from Marzan

- Increased renal care patient volume in TMJ as more hospitals become operational

- New IGM acquisition in Indonesia

- Nine newly acquired dental clinics in Singapore

- Expansion of Hong Kong clinic

- New Paediatric clinic in Malaysia

Valuation

We used DCF valuation to fully capture CBH impressive growth over the next five years.

Cost of equity = 10%; WACC = 8%; terminal growth rate = 3%

For more details on CBH’s business strategy, please refer to our Initiation Report dated 1 April 2019.

Updates

Healthcare system

- Marzan – Medical centre and pharmacy business in the Philippines (acquired in January 2018 ). Marzan’s pharmacy is registered under DSWD to provide drugs at a subsidised rate to patients. Marzan’s revenue may also receive a boost, pending the approval for accreditation by the Department of Health as an approved Overseas Foreign Worker screening facility and other major Health Management Organisations for private corporate clients. Hence, we believe Marzan’s revenue should recover in 2Q19 (due to renovation completion) and pick up pace in 3Q19 (rise in pharmacy sales and accreditation approval).

- PT Tirta Medika Jaya (TMJ) – Renal care facilities (acquired in April 2018) located in Indonesia that offers renal care services through joint operations with equipment manufacturers and hospitals in Indonesia. The number of renal care centres under contract with the Group increased from 15 at acquisition to 37 in 1Q19. Out of the 37 centres, 23 is operational and 14 others are currently under renovation. The average utilisation rate of the renal care facilities was around 70%. Each patient requires dialysis around three times a week, 4 hours each treatment. The Group incurs CAPEX of S$60-80k to fit out each renal care centre. The Group currently focuses on ramping up occupancy instead of acquiring more contracts.

- PT Indo Genesis Medika (“IGM” labs) – Provides laboratory services and located in Indonesia (acquired in May 2019). IGM operates laboratories with collaborating public hospitals in Indonesia under Joint Operation (JO) contracts. Currently has 13 clinical laboratories, out of which, three is pending contracts for novation. We expect revenue contribution from the ten operating JOs to kick in around 3Q19-4Q19. With an estimated 2,500 hospitals in Indonesia, only 16 are class A, and CBH has a JO with 6 class A hospitals in the most affluent locations.

Medical clinics/ centres

- Clearbridge Medical, Hong Kong – Single medical clinic in Hong Kong, which achieved rapid patient volume growth in FY18 of > 350 patients per month. Patients are mainly from China seeking health screening and vaccinations. CBH expanded collaborations with new local and Chinese agents to introduce more medical tourists from China. Renovation of the new clinic (that is double the size of the current clinic) has been completed in 2Q19 and will be able to cater to more patients. We expect higher volume from the larger clinic to boost revenue in 3Q19. The newly renovated clinic is located in the same building as the existing clinic.

- Clearbridge Medica, Malaysia – New Paediatric clinic received MOH license and opened in March 2019. It is located in a new township with affluent middle-class young families. Revenue contribution should kick in from 2Q19 onwards. CBH also has 12 GP clinics in Klang Valley, KL. Out of which, six branches will aid in marketing CBH’s hereditary cancer gene tests.

- Dental Focus, Singapore – The Group agreed to acquire nine dental clinics in Singapore under the brand name “Dental Focus”. The acquisition is in line with the Group’s EBITDA-focused business strategy and increases its network of primary healthcare touchpoints. The clinics are profitable and the acquisition is expected to have a positive impact on the Group’s financial performance for FY19. Consideration for the acquisition is approximately S$3.3 million and likely to be funded by bank borrowings.

Source: Phillip Capital Research - 30 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024