Astrea IV: ASTLC 4 a MTGE

traderhub8

Publish date: Thu, 30 May 2019, 09:26 AM

Launched by Azalea Asset Management, Temasek’s wholly-owned subsidiary with a Private Equity (PE) focus, Astrea IV is the first PE bond open to retail investors. The retail tranche, Class A-1, was 7.4x oversubscribed. Astrea IV is backed by cash flows from investments in 36 PE funds with 596 investee companies), with no single investee company making up more than 3% of total NAV. On 17 May 2019, credit rating agency Fitch upgraded Class A-1 bonds from Asf to A+sf, and affirmed class A-2 and class B bond’s Asf and BBBsf ratings.

Summary of first semi-annual distribution report (for period ended 14 December 2018)

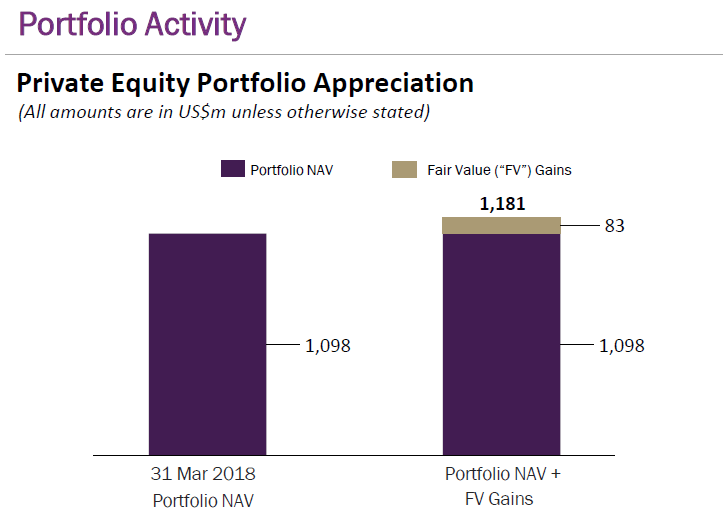

- Mark-to-market of underlying investments held by PE fund resulted in fair value gains of US$83mn; NAV rose 7.6% from US$1,098mn to US$1,181mn (Figure 2).

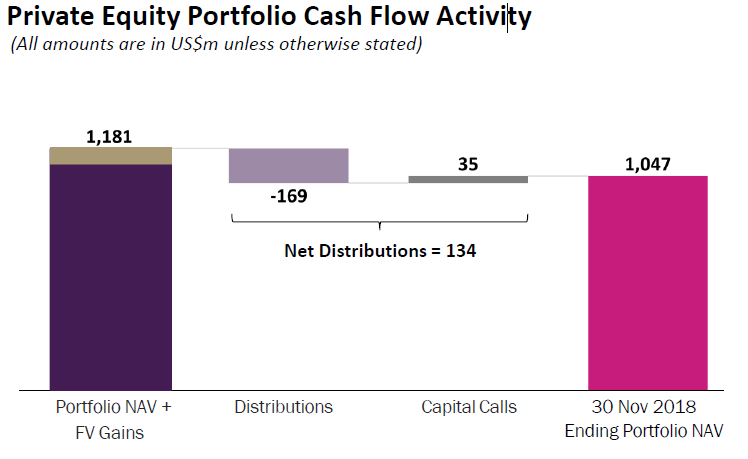

- Net distributions for the 6 months ended 14 December 2018 was US$134mn, comprising US$169mn received from PE Funds, less US$35m in fulfilment of Capital Commitments (Figure 3). Undrawn Capital Commitments stand at US$134.1mn.

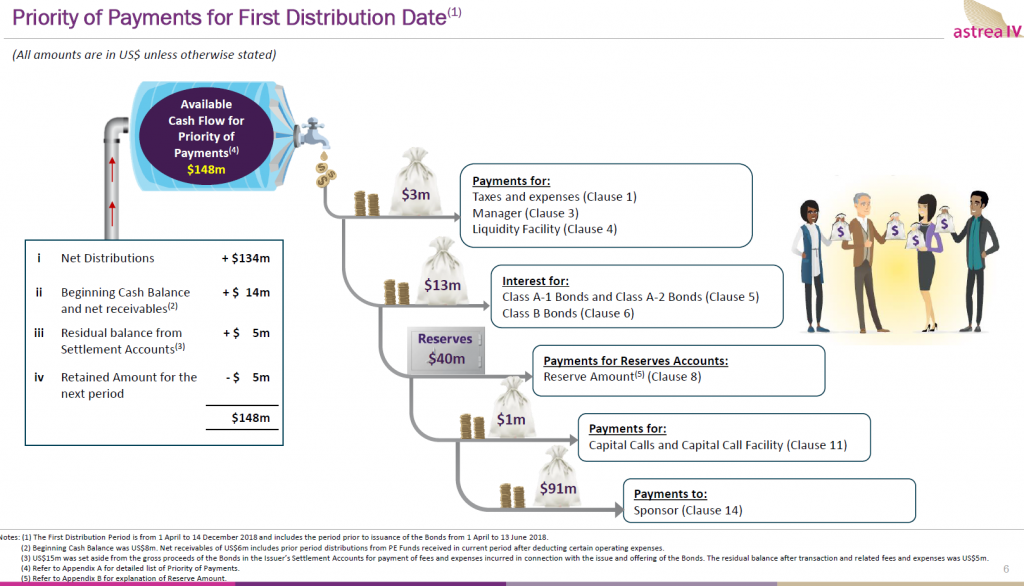

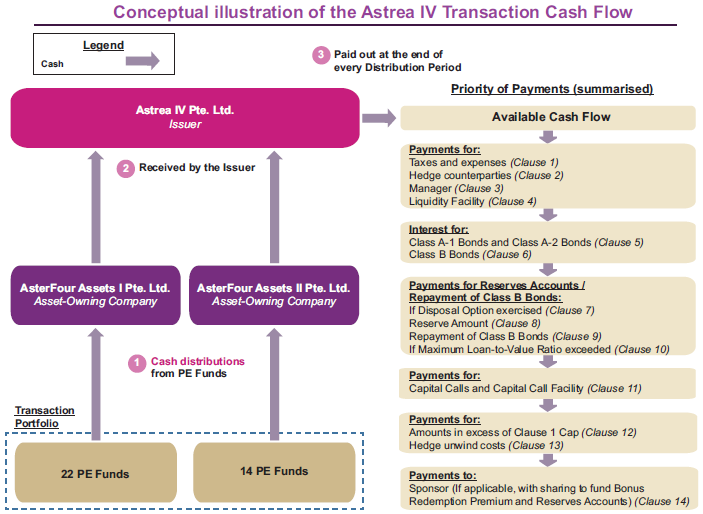

- Including the 74 days prior to the issuance of bonds (1 April to 13 June 2018), available cash flow totalled US$148m and was used to satisfy operating expenses, interest payments to bondholders, payments to Reserve Accounts and for Liquidity and Capital Call Facilities, with the residual cash paid out to the Sponsor (Figure 4).

- Liquidity (US$100mn) and Capital Call (US$134mn) Facilities were not drawn down.

- US$91.1mn paid out to Sponsor (equity holder) makes up 14.5% of total equity.

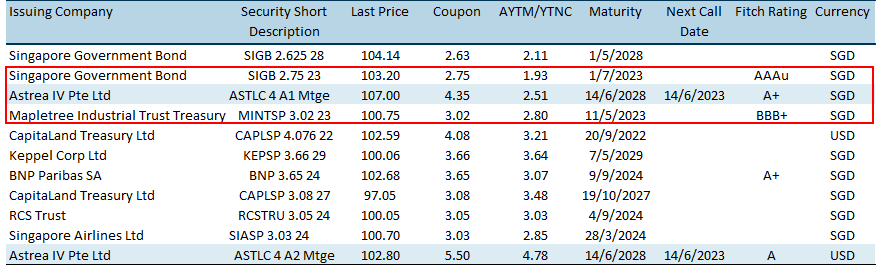

Being the only retail PE bond, there are no direct comparables. Figure 1 summarises existing bonds and their yield to give the reader a sense of how the market is pricing Astrea IV bonds.

Figure 1: Bond comparison table

Source: Bloomberg, PSR

This issuer is required to redeem Class A-1 bonds on the Scheduled Call Date (14 June 2023) once the sufficient reserves have been built up in the Reserves Accounts. The Priority of Payments (Clause 8) requires c.US$40mn to be set aside at each semi-annual distribution date to ensure the principal amounts for Class A are fully reserved by the Scheduled Call Date. Class A-1 bonds are trading S$107, 7% above par with a YTNC of 2.5% and a LTV of 19.5%.

Bondholders will be entitled a bonus payment of 0.5% of the principal at redemption (call) if the Performance Threshold is met. The Performance Threshold is defined as the Sponsor receiving 50% of its total equity before its scheduled call date 2023. To date, the US$91.1mn paid out to Sponsor makes up 14.5% of total equity.

Investment Actions

No rating or target price provided, as we do not have coverage on Astrea IV.

Figure 2: Appreciation of underlying assets held by PE fund (in US$ mn)

Source: Company, PSR

Figure 3: Cashflow activity for the 6 months ended 14 December 2019 (in US$ mn)

Source: Company, PSR

Figure 4: Priority of payments for the first distribution date (in US$)

Source: Company, PSR

Notes:

(1) The First Distribution Period is from 1 April to 14 December 2018 and includes the period prior to issuance of the Bonds from 1 April to 13 June 2018.

(2) Beginning Cash Balance was US$8m. Net receivables of US$6m includes prior period distributions from PE Funds received in current period after deducting certain operating expenses.

(3) US$15m was set aside from the gross proceeds of the Bonds in the Issuer’s Settlement Accounts for payment of fees and expenses incurred in connection with the issue and offering of the Bonds. The residual balance after transaction and related fees and expenses was US$5m.

(4) Refer to Figure 6 for a detailed list of Priority of Payments.

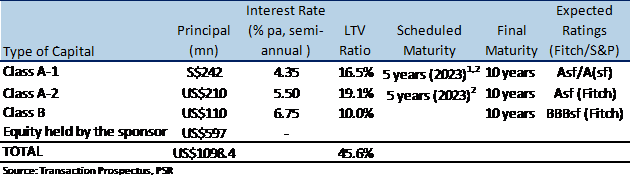

Figure 5: Summary of issue (at issuance)

Additional key terms for Class A-1 Bonds:

1Bonus payment of 0.5% of principal at redemption if the Sponsor receives 50% of its total equity before its scheduled call date (2023).

2If the Class A-1 and A-2 Bonds are not redeemed in full on 2023, the interest rate on these Bonds will have a one-time step-up of 1% per annum to 5.35% and 6.5% respectively. The latest date on which the Issuer must redeem these bonds is the Maturity Date in June 2028.

Figure 6: Priority of payments

Source: Transaction Prospectus, PSR

Source: Phillip Capital Research - 30 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024