China Aviation (Singapore) – Oil Flattish Performance

traderhub8

Publish date: Thu, 02 May 2019, 11:44 AM

Positives

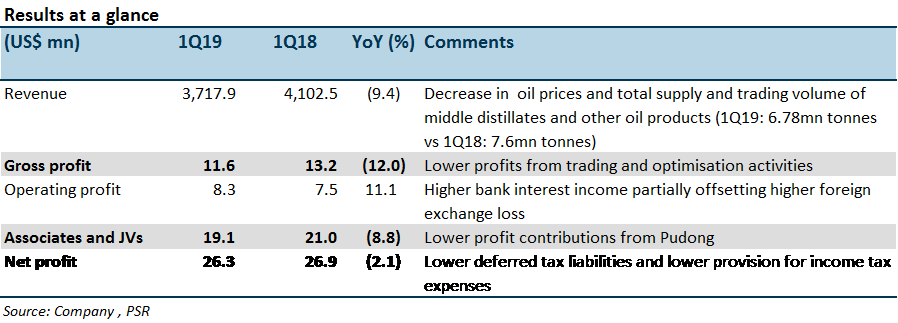

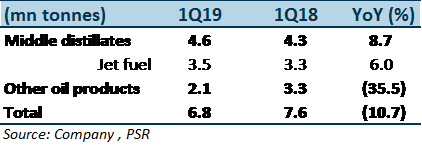

Mild growth of middle distillates supply and trading volume. As shown in Figure 1, the jet fuel volume improved by 6% YoY in 1Q19 due to recovery in supply to China. During the period, 71% of the jet fuel was supplied to China compared to the previous 60%+ in the recent quarters. Demand for gas oil increased owing to the substitution for fuel oil with higher sulphur content for the bunker market.

Negatives

– Flat overall supply and trading margin. Supply and trading margins, measured by gross profit/tonne, dipped 1.4% YoY to US$1.71/tonne in 1Q19 (1Q18: US$1.74/tonne). There was a reduction in riskier trading positions which resulted in lower profit enhancement.

– Nosedive of other oil product volume. As per Figure 1, the substantial drop in other oil products was due to the shortfall of fuel oil volume. The 2020 International Maritime Organization fuel sulphur regulation will phase out high sulphur content fuel oil. Therefore, the demand for such kind of fuel oil plummeted. Moving forward, the other oil product volume is expected to hover around the current levels.

Figure 1: Plunge in other oil products volume offset the growth of middle distillates

– Moderate decrease in profit contribution from Pudong: 1Q19 profit from Pudong was US$17.2mn (-8.9% YoY) due to lower average oil price and flat refuelling volume. During the period, refuelling volume arrived at 1.1mn tonnes, similar to volumes in 1Q18.

Outlook

The supply and trading business is expected to be stable. Growth is muted as the scale of the trading business is tightened in view of escalating geopolitical risks and market uncertainties. The fifth runway has been operating but yet to be well utilised due to the domestic control of aircraft landings. We do expect the growth of air traffic in Pudong airport to gradually rise in the foreseeable future, and our expectation contributed profit growth from which is 4.6% in FY19e.

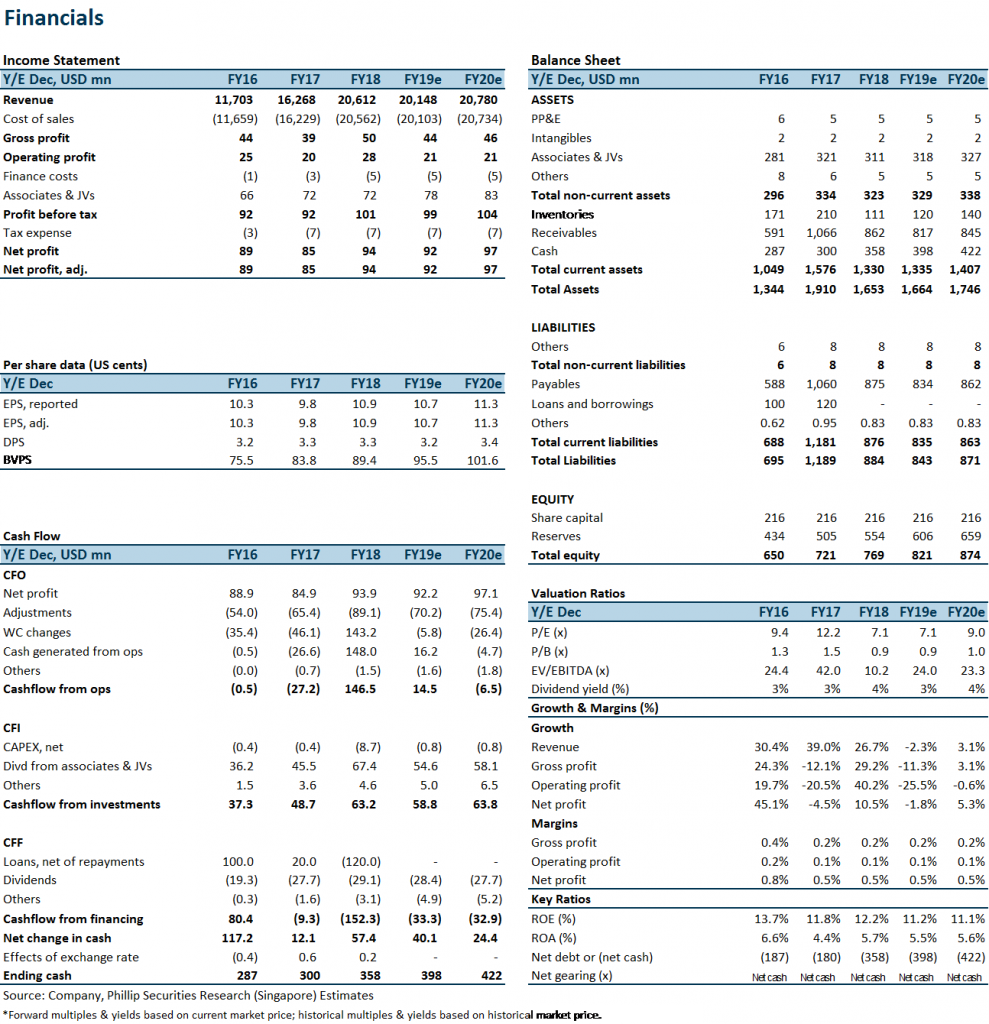

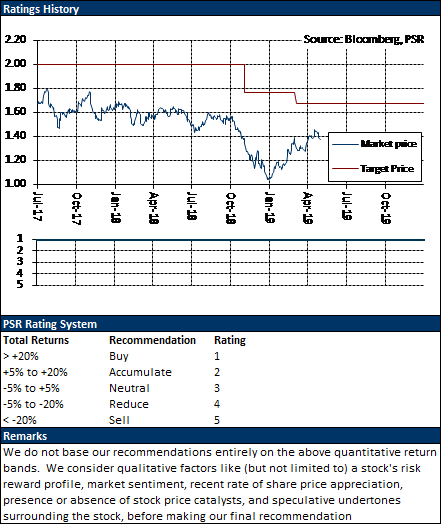

Maintain BUY with an unchanged TP of S$1.67

We keep our FY19e EPS at 10.7 US cents. Based on an unchanged average forward 12-month PER of 11.5x, we maintain our BUY call with an unchanged target price of S$1.67.

Source: Phillip Capital Research - 02 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024