Trader Hub

Phillip Capital Morning Note

traderhub8

Publish date: Mon, 11 Mar 2019, 09:54 PM

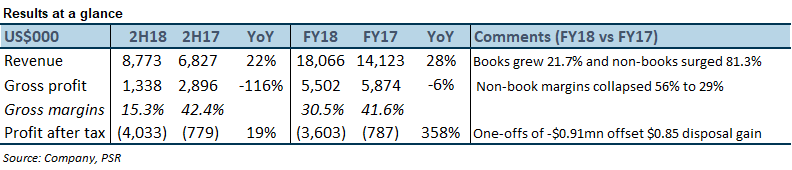

- Results were below expectations due to poor sales of non-book products, weaker gross margins, higher operating expenses and write-offs in inventory and bad debts.

- 80% of FY18 revenue is from the sale of books and YVEN has expanded their publishing principals from 1 to 8.

- A major change is strategy is to faster monetize their data analytics capabilities through the sale of services.

- We lowered FY19e earnings to marginal profitability. Any turnaround in profits is earmarked in FY20e. Our target price of S$0.16 will be based off FY20e earnings and PE of 30x. This is priced against other e-retailer comparables.

The Positives

- Book sales rose 22% in FY18. YVEN added seven book publishers to its suite of products in FY18, from just a single publisher when it was listed in 2017. The relationship and commerciality of these new publishers will require some time to mature, especially the ability to select the choicest titles. Therefore, inventory will be sub-optimal and may require a gestation period of 1 to 2 years.

- Faire Leather is performing well. This new leather products brand that was launched on Kickstarter in December 2017 is now being distributed in Taiwan, China and Europe.

The Negatives

- Margins collapsed in FY18.

- Gross margins were dragged down by GP margins in the non-books category, which fell from 56% to 29% in 2H18. There were also provisions in obsolete inventories. The non-books segment was hurt by the entry of Chinese manufacturers into the Amazon platform. Prices of these competitors were drastically below YVEN private label products. GP margins in the books category also suffered, by c.7 points, due to the aforementioned sub-optimal inventory.

- EBIT margins dipped due to provision of bad debts (trade and non-trade totaling US$0.5mn) as well as a surge in overheads as YVEN’s headcount jumped 60%. Selling expenses also increased due to higher commissions paid out.

- An external independent review. YVEN has been required to undertake an external review of its internal controls, which is estimated to cost the Group a five-figure sum.

Source: Phillip Capital Research - 11 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments