CapitaLand Limited – Forging Ahead

traderhub8

Publish date: Thu, 21 Feb 2019, 07:40 PM

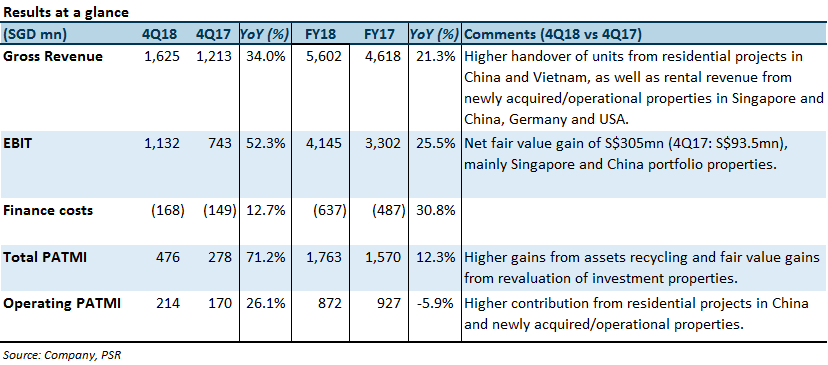

- FY18 Revenue and PATMI exceeded our forecasts. Uplift from higher handover of residential units in China and Vietnam in 4Q18, as well as rental revenue from newly acquired properties. Dividend of 12.0 cents was declared for FY2018.

- Strong bump-up in China residential sales – sold units and sales value almost doubled YoY in 4Q18.

- ROE at 9.3% had increased for third year running. The Group’s eventual goal is a double-digit ROE. Operationally healthy on all fronts – retail, office, lodging.

- Certain new launches in China still to be deferred due to cooling measures, but inventory is low and margins would still be a healthy double-digit figure even if taking into account the current price caps.

- Maintain Accumulate with unchanged TP of S$4.00.

The Positives

+ Strong bump-up in China residential sales. >85% take-up rate for all launches in 4Q18 – fully selling out the quarter’s launch for Parc Botanica in Chengdu. It was indeed a stronger quarter for the China residential segment, as was previously guided by the management. 4Q18 saw close to 2x sold units and sales value than in the same quarter last year. China residential sales was lower on a full-year basis due to the lower inventory available and delay of certain launches due to the property cooling measures.

+ ROE increased for third year running. ROE of 9.3% was achieved in FY2018, notably from the revaluations and impairments. Stripping out the gains from the sale of The Nassim units in 1Q17, FY18 operating PATMI would have increased 14% YoY, potentially tipping overall ROE levels closer to double-digit range – which is the Group’s eventual goal. ROE level could be further built up from its recurring income stream as well as fees from its private funds – which will receive a boost from Ascendas-Singbridge (ASB) (assuming a successful acquisition of them by CAPL).

+ Operationally healthy on all fronts.

Retail: On a same-mall basis, tenant sales across all geographies continued to record positive growth YoY in FY18.

Office: China – 92% occupancy for matured projects with average rental reversion of +4% for FY18. Singapore – above 99% committed occupancy, well above market committed occupancy of 95% with rents holding steady.

Lodging: FY18 RevPAU increased +4% YoY on a same-store basis, driven largely by Europe (+12%), Singapore (+11%) and China (+5%).

The Negatives

– Certain new launches in China still to be deferred due to cooling measures. CAPL had previously deferred several launches due to ongoing cooling measures and restrictions in selling prices across certain projects.

Outlook

Outlook is positive. Healthy momentum is expected to persist for the c.7k units expected to be launched this year. While the main hurdle now is the persistent delay in the launches for the China residential segment (its largest development portfolio), we understand that margins would still be a healthy double-digit figure for all existing projects even if taking into account the current price caps. CAPL’s recurring income portfolio has been grounded on healthy operating metrics and is expected to increasingly be the bedrock of its earnings.

Going forward, the anticipated acquisition of ASB will bring in new geographies and new business verticals for CAPL, further boosting its recurrent income portfolio and moving well towards its targets of 20/80 development/investment properties and 50/50 emerging/developed markets.

Deleveraging of S$3bn will be the next step to whip CAPL’s balance sheet back to a 0.64x leverage ratio (pro-forma: 0.72x) by the Group’s targeted Dec 2020 – this is where we could see more asset recycling.

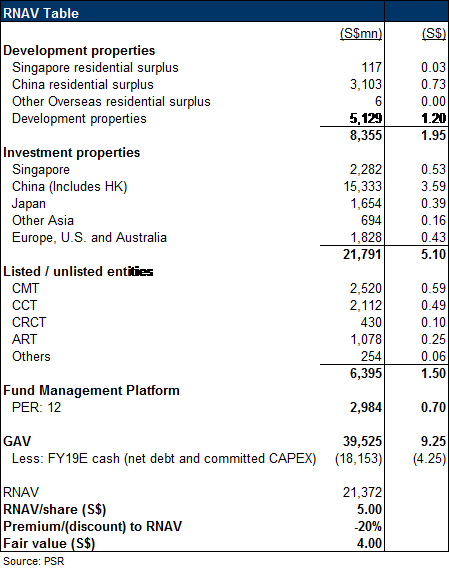

Maintain Accumulate with unchanged TP of S$4.00

We maintain our Accumulate rating with an unchanged target price of S$4.00. Our target price translates to a FY19e P/NAV ratio of 0.75x.

Source: Phillip Capital Research - 21 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024