StarHub Limited – Triple Whammy, Only Enterprise Shines

traderhub8

Publish date: Mon, 18 Feb 2019, 02:41 PM

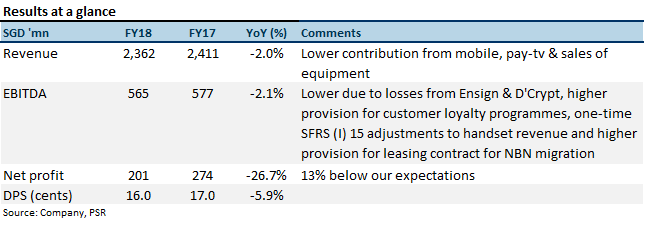

- Results were below our expectations. EBITDA and net profit disappointed 13% and 20% respectively.

- Switching from fixed to variable dividend policy and to at least pay 80% of net profit each year. Cuts dividend to 9 cents per share from current 16 cents.

- We revised our FY19e EBITDA and net profit downwards by 12% and 16% respectively due to the results. Downgrade to NEUTRAL with a lower target price of S$1.58 (prev. S$1.88).

The Positives

+ Solid growth from enterprise. The segment enjoyed a revenue growth of S$70.3mn (16%

YoY). The growth is attributed by higher contribution from managed services where there is

higher demand for cyber security, cloud, cryptographic and digital solutions. The cyber security

business contributes 7% of enterprise revenue and turned EBITDA positive in FY18. The S$30mn

cost savings as part of the restructuring exercise is likely to flow back into Ensign as cyber

security is labour intensive. We expect enterprise to continue its growth momentum in FY19 as

more resources are channelled into the segment.

The Negatives

– Triple whammy. Revenue from mobile, pay-tv and sales of equipment declined. Mobile

revenues decreased 14% YoY in 4Q18. We observe a 10% decline in mobile post-paid ARPU from

a year ago as consumers continued the shift from traditional bundled plans to sim-only plans.

StarHub added 34,000 post-paid customers a dismal amount compared to its competitors M1

(91,000) and Singtel (112,000). Pay-tv revenue saw its biggest YoY decline in 4Q18, revenue

shrunk $16.8mn (19%) the decline is contributed by a decrease in subscriber base (49,000) and

lower ARPU YoY. Sales of equipment revenue declined S$33.9mn (17.3%) this is due to lower

handset sales.

Source: Phillip Capital Research - 18 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024