SATS Ltd – Underlying Growth Remains Intact

traderhub8

Publish date: Thu, 14 Feb 2019, 11:10 AM

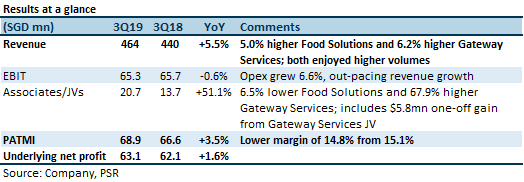

- Revenue was within expectation

- PATMI came in +9.5% higher than we forecast, due to one-off gain of $5.8mn from disposal of JV, DFASS-SATS; PATMI would have been in line without the one-off gain

- Maintain ACCUMULATE; unchanged target price of $5.47

The Positives

- Higher Food Solutions revenue driven by higher meal volumes across the Group. Meal volumes had increased across all core catering subsidiaries in Singapore, Japan (TFK Corp) and China.

- Higher Gateway Services revenue driven by both Aviation and Non-Aviation. Revenue growth for the Gateway Services segment was due to increased contributions from Changi Airport Terminal 4 operations and cruise terminal operations at Marina Bay Cruise Centre Singapore (MBCCS). Management commented that the MBCCS business is becoming quite significant. And the homeporting of two cruise ships will bring about consistent revenue throughout the year.

- Higher Associates/JV contribution. This was mainly driven by the $5.8mn one-off gain from the disposal of the DFASS-SAT, which is a Gateway Services JV. Excluding the one-off gain, contribution from Gateway Services Associates/JV rose +13% on higher volumes. However, Food Solutions was -6.5% lower due to lower volumes at Brahim’s.

The Negatives

- Opex growth out-paced revenue growth, compressing EBIT margin. EBIT margin compressed YoY from 14.9% to 14.1%. All expense items except staff costs and licence fee grew at a faster pace than revenue. Higher depreciation & amortisation was attributable to the addition of a new facility and equipment. Other costs rose with higher IT renewal expenses, fuel costs, and professional fees.

Outlook

The outlook is positive. Passenger traffic growth is expected drive volume growth and offset the pricing pressure from airlines. SATS is also investing in new central kitchens in China to supply fast casual restaurant chains in key cities. The expectation of volume growth is driven by aviation demand and demand for quality food. Potential risk factors include challenges arising from trade tensions impacting cargo volumes and airline pressure from fuel costs.

Maintain Accumulate; unchanged target price of $5.47

We like the stock for its regional expansion story and growth initiatives. The strong cash flow generating business makes the 3.6% dividend yield sustainable. Our target price gives an implied FY19e forward P/E multiple of 24.6 times.

Source: Phillip Capital Research - 14 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024