Trader Hub

800 Super Holdings Ltd – Ceasing Coverage

traderhub8

Publish date: Wed, 13 Feb 2019, 09:55 PM

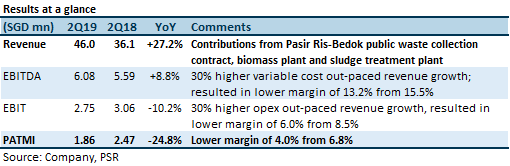

- Revenue in line with forecast. PATMI -3.2% lower than expected

- Lower profit due to ramp-up phase of new projects that are starting up; particularly the sludge treatment plant

- Next project in the pipeline is the Tuas South laundry plant

- Ceasing coverage due to reallocation of internal resources

The Positives

- Sequential improvement in EBITDA, indicating that utilisation of fixed assets has picked-up. EBITDA increased QoQ by $0.41mn to $6.08mn, but depreciation increased QoQ by only $0.21mn to $3.33mn. EBITDA is also +9% YoY higher, because of new projects that are coming online now, that were not present a year ago.

- Employee benefits expense kept under control. Labour is the largest cost component (48% of opex) and it increased +16% YoY due to the commencement of the new projects. However, the increase was at a slower clip compared to the +27% YoY increase in revenue.

The Negatives

- Purchase of supplies and disposal charge out-paced revenue growth. This expense grew by $5.54mn to $11.27mn or +97% YoY, which was faster than revenue growth. The higher expense was due to the Pasir Ris–Bedok public waste collection sector, biomass plant, sludge treatment plant and laundry plant. We believe that disproportionate increase is attributable to the laundry plant that is not performing well.

- YoY margins compression as projects are starting-up and not fully contributing. We believe the sludge treatment plant is still not fully-utilised and likewise for the biomass plant. The energy generated by the biomass plant is used to power the sludge treatment plant. Utilisation of the biomass plant should increase in tandem with power demand from the sludge treatment facility as volumes increase.

Outlook

Near-term PATMI is expected to be weaker YoY, due to transitional ramp-up of new projects. Further integration downtime is also likely to arise from the new Tuas South laundry plant which is expected to be completed in 1Q 2019. The energy recovered from the sludge treatment plant will be used to power the laundry plant.

Ceasing coverage

Our most recent rating from our 13 November 2018 report, was NEUTRAL with target price of $0.80. We are ceasing coverage on this counter due to reallocation of internal resources.

Source: Phillip Capital Research - 13 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments