Trader Hub

Ascendas REIT – Grabbing a New Tenant

traderhub8

Publish date: Thu, 31 Jan 2019, 12:39 PM

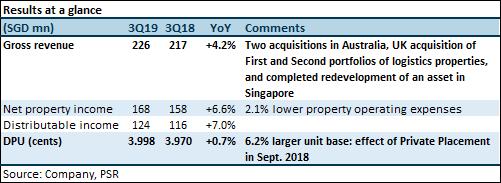

- Gross revenue and DPU in line with expectation

- Almost full quarter contribution from Second UK portfolio of 26 logistics assets

- Build-to-suit development for Grab’s new headquarters at one-north

- Maintain ACCUMULATE. Raised target price to $2.88 (previously $2.78) due to higher DPU estimate

The Positives

- Positive rental reversions across all segments in Singapore. Rental reversions ranged between +1.7% and +10.3% across the five segments, with a weighted average of +3.2%. There were no renewals signed in Australia and UK.

- Acquisition of Second UK portfolio of 26 logistics properties was completed on 4 Oct. S$800mn UK portfolio is now 7% of A-REIT’s total portfolio, compared to 3% in the previous quarter. The UK portfolio has a long weighted average lease expiry (WALE) of 11.3 years compared to Singapore WALE of 3.9 years, thus providing income visibility. The earliest lease expiry in the UK portfolio is in FY21.

- Total portfolio occupancy remains stable QoQ, inching up from 90.6% to 91.3%. This was driven by the Singapore and UK portfolios. For Singapore, there were new take ups which improved occupancy to 87.3%, while the enlarged UK portfolio remained at 100% occupancy.

- Secured S$181mn build-to-suit project for Grab’s headquarters at one-north. The asset will be a 42,310 sqm GFA business park property. The expected completion is in 4Q 2020. (For comparison, A-REIT’s Giant Hypermart property in Tampines has a GFA of 42,194 sqm.) It will be on a long lease term of 11 years with annual rental escalation and renewal option for a further five years. In the grand scheme of things, the property will not make a material impact to A-REIT’s portfolio which currently stands at S$11.1bn.

The Negatives

- QoQ higher aggregate leverage, but it does not come as a surprise. Leverage increased from 33.2% to 36.7% due to new debt to part-fund the second UK portfolio. In our previous report, we estimated 36.4% leverage by the end of FY19.

Source: Phillip Capital Research - 31 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments