Cache Logistics Trust – 2019 Challenges Ahead

traderhub8

Publish date: Mon, 28 Jan 2019, 12:10 PM

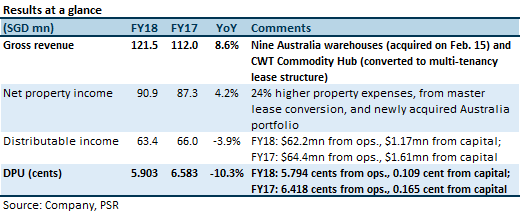

- Revenue and DPU were in line with expectations

- Tightening of capitalisation rates, offset by lower rental outlook

- Australia portfolio contributed positively, mitigating transitional weakness in Singapore

- Maintain Neutral; unchanged target price of $0.75

The Positives

- Prudent debt capital management. Gearing remains stable at 36.2%, only 0.6pp higher QoQ. We estimate a debt headroom of ~S$90mn, which can be used to grow the AUM by 7%. Weighted average debt maturity has been extended to 3.9 years (from 2.2 years) as all 2018 and 2019 SGD-debt were refinanced. Only 6% of total debt is due in 2019 from AUD-loan.

- Capitalisation rates compressed slightly YoY. Singapore average: compressed from 6.4% to 6.3% and Australia average: compressed from 6.9% to 6.5%. However, rental assumptions were lowered, thus offsetting the effect of tighter cap rates. Hence valuations were generally stable, with the exception of Precise Two and Commodity Hub.

- Lowered tenant concentration exposure to CWT. CWT remains the largest tenant in the portfolio, accounting for 20.6% of rental income, compared to 32.7% a year ago. This lowering of CWT’s presence was due to the conversion of Commodity Hub in 2018. Nonetheless, the Manager says that CWT has been paying rent promptly and is not in arrears.

The Negatives

- S$21.77mn revaluation loss. This was mainly due to Precise Two (to be converted to multi-tenancy lease in 2Q 2019) and Commodity Hub (converted from master lease to multi-tenancy lease). However, the revaluation loss is only 1.3% of AUM. The existing master tenant at Precise Two will not be renewing the master lease, and is expected to retain 20% of the space. Precise Two contributed 4.5% of FY18 gross rental income, by our estimate.

- Portfolio rental reversion of -4.4% for 4Q18 and -4.5% for FY18. We expect negative reversions to continue in 2019, as overhang of space continues to be absorbed. There is 18.7% of NLA for renewal in 2019. Slightly more than half these 2019 expiries are from Precise Two and Commodity Hub. We think there will be scope for negative rent reversions in these instances.

- QoQ lower occupancy from 96.9% to 95%. This was due to short-term contracts concluded at Commodity Hub. Nonetheless, occupancy at Commodity Hub remains at high-80%. (Committed occupancy at Commodity Hub was 94% in 3Q18.)

Outlook

The outlook is negative. Negative rent reversions expected to continue in 2019; and the expiry of 22% of portfolio leases by rental income could pose a challenge as new space in 2018 continues to be absorbed in 2019. The conversion of master lease for Precise Two is a source of vacancy risk, but is limited to about 3.6% of portfolio rental income, by our estimate.

The Manager intends to continue recycling capital into freehold assets. This will likely continue in Australia. Korea is a possible new geography as the Sponsor, ARA, has a presence there. However we see some challenges to DPU accretion, as capitalisation rates in Australia and Korea are 6%-7.25% and 6%-7% respectively, compared to the current DPU yield of 7%.

Maintain Neutral; unchanged target price of $0.75

Our target price represents an implied 1.14x FY19e P/NAV multiple.

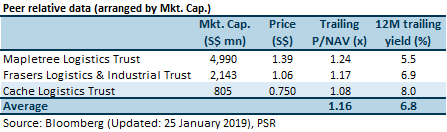

Relative valuation

Cache Logistics Trust trades at a lower P/NAV multiple and higher yield than its logistics peers.

Source: Phillip Capital Research - 28 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024