Mapletree Industrial Trust – Negative Rental Reversions

traderhub8

Publish date: Thu, 24 Jan 2019, 11:01 AM

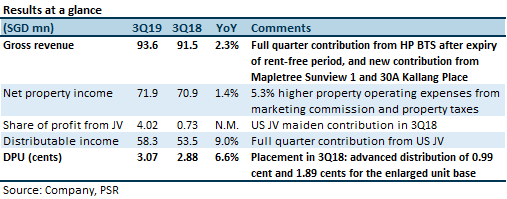

- Revenue and DPU were in line with our expectation

- Positive inorganic contribution outweighed the underlying rental renewal weakness

- Distribution reinvestment plan (DRP) from 2Q19 had 40.6% take-up rate (historical average: 42%); resulted in $22.8million cash retained

- DRP continued in 3Q19 to fund development project costs

- Downgrade to NEUTRAL; unchanged target price of $2.03

The Positives

- QoQ higher portfolio occupancy from 86.7% to 88.2%. Higher occupancy was driven by the Hi-Tech Buildings segment, due to the ramp-up of occupancy at 30A Kallang Place to 89.0% (from 75% in 2Q19). 30A Kallang Place was a speculative project that obtained its Temporary Occupation Permit (TOP) in February 2018. All segments enjoyed higher occupancy QoQ, except the Stack-up/Ramp-up Buildings and Light Industrial Buildings which were marginally lower.

- Portfolio WALE remains healthy at 3.7 years (by gross rental income), unchanged QoQ. Portfolio weighted average lease expiry (WALE) is longer than the industrial S-REITs sector median (as at Sept. 2018) of 3.5 years. This gives better income visibility and stability to cash flow for distribution.

The Negatives

- Fifth consecutive quarter of negative rent reversion. Weighted average reversion across the portfolio was -2.5%. All property segments registered negative reversions, except for Light Industrial Buildings where there were no renewals. The lower rents were also a result of measures taken to improve occupancy.

- Back-filling of The Strategy has been stagnant. Space vacated by Johnson & Johnson following its pre-termination remains at 41%, unchanged QoQ. The Manager cited keen competition in International Business Park as a challenge. Also a two tier market is evolving, with older facilities becoming less competitive.

Outlook

The outlook is mixed, with inorganic growth offsetting organic weakness. We expect negative reversions to persist for at least two more quarters, thus dragging organic growth. First full quarter contribution from the US data centres was in 4Q FY18, so the current quarter (3Q FY19) will be the final quarter where there will be material YoY uplift. 30A Kallang Place and Mapletree Sunview 1 would continue to contribute positively to distributable income YoY growth. The proposed acquisition of 18 Tai Seng Street and upgrading of 7 Tai Seng Drive are expected to contribute positively in 2019 as well.

Downgrade to Neutral; unchanged target price of $2.03

Our rating downgrade is due to the limited upside from the current price to our target price (implied 1.36 times FY19 P/NAV multiple), and not because of a change in fundamentals.

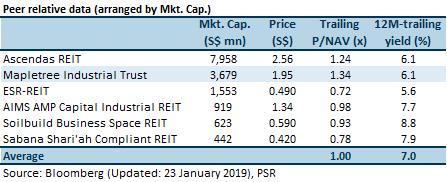

Relative valuation

MINT is trading above the peer average P/NAV multiple and at a tighter 12M-trailing yield than the peer average.

Source: Phillip Capital Research - 24 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024