First REIT – A Cautionary Tale

traderhub8

Publish date: Mon, 21 Jan 2019, 10:35 AM

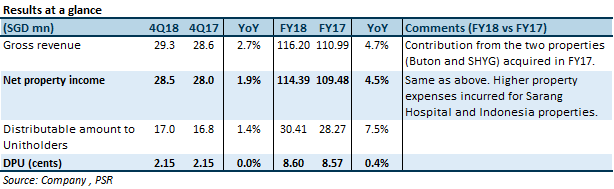

- FY18 Revenue and NPI were in line with our forecast. DPU outperformed our estimates by c.5% due to a S$15mn income tax benefit arising from a write-back of provision for deferred tax on fair value loss on investment properties, as a result of a reduced tax rate.

- 7% and 4.5% YoY boost in FY18 Gross Revenue and NPI, respectively, driven by two acquisitions made in 4Q17.

- Cost of debt relatively stable at c.3.84% despite rising interest rates.

- Receivables continue to mount, against backdrop of uncertainty over upcoming lease expires, though some S$8mn of rental payments has since been received on Jan 15, 2019.

- Ceasing coverage due to reallocation of internal resources.

The Positives

+ Cost of debt relatively stable despite rising interest rates. Given that the 3M SOR had almost doubled YTD as at end-Dec 2018, FIRT had managed to keep its cost of debt at c.3.84% (excluding a one-off write-off of unamortised costs). The Manager relayed that the FIRT’s credit spread had indeed been declining over the past few quarters, though this continued downtrend could be up in the air going forward amidst the changes in ownership and continued links with LPKR. The Manager had earlier clarified in a separate briefing that FIRT could tap onto OUE Ltd’s network for its backing of any refinancing. We note that debt of S$110mn is expiring this year, S$100mn of which was part of a term loan facility entered into in FY18. No debt is due in FY2020.

The Negatives

– Receivables continue to mount, against backdrop of uncertainty over upcoming lease expires. Outstanding receivables of S$32.4mn now translate to 102.2 days receivables (FY17: 84 days, FY16: 40 days), though some S$8mn of rental payments has since been received on Jan 15, 2019. In addition, upcoming leases for three Indonesia properties (including Lippo Village – FIRT’s second highest revenue contributor) in Dec 2021 face the possibilities of 1) conversion to IDR-denominated leases (now currently SGD-denominated) and/or 2) lower quantum of rental to be received. The Management shared that if the former scenario were to take place, the revenue formula for its Indonesia properties would correspondingly have to incorporate Indonesia’s CPI figures instead (current formula using Singapore CPI), and that rental/EBITDA levels at Siloam are at “very healthy levels”.

– Decline in portfolio valuation. FIRT ended FY18 with no acquisitions and recorded its first year of decline in portfolio valuations (excl. 2008) (on an absolute basis). On a like-for-like basis (ex-acquisitions), this -0.3% decline in valuations is a reversal from the prior year’s +1.7% increase in valuation. This was due to the appraiser’s factoring of the IDR/SGD depreciation within its discounted cash flow valuation method.

Outlook

FIRT would be re-positioned to identify more strongly with its new co-sponsor, OUE Lippo Healthcare, and will now have an expanded ROFR pipeline over new geographies – Australia, China, Japan, Malaysia and Myanmar. However, all things equal, conducting yield-accretive acquisitions in more developed markets (as opposed to Indonesia) will pose to be a challenge. Overall outlook continues to be weighed down by the mounting outstanding receivables and rising uncertainty over the Indonesia leases.

Ceasing coverage

Our most recent rating from our Jan 16, 2018 report was a “Neutral” with a target price of S$0.88. We are ceasing coverage on this counter due to reallocation of internal resources.

Source: Phillip Capital Research - 21 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024