Dasin Retail Trust – Stable Portfolio

traderhub8

Publish date: Thu, 08 Nov 2018, 09:58 PM

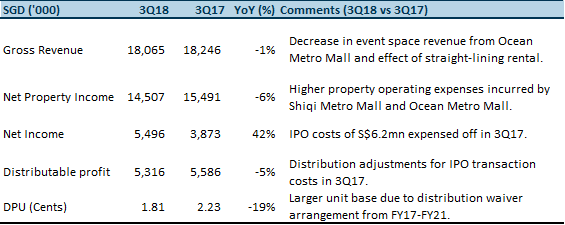

- NPI and DPU in line with our expectations. Revenue remains flat YoY due to decrease in event space revenue from Ocean Metro Mall and effect of straight-lining rental.

- Robust occupancy despite ongoing AEI and continued positive rental reversions.

- Higher cost of funds with 30bps increase in offshore debt.

- Maintain ACCUMULATE with lower TP of S$0.95 (prev S$0.97).

Results at a glance

Source: Company, PSR

The Positives

+ Robust occupancy and continued healthy reversions. Despite ongoing asset enhancement initiative (AEI) at Xiaolan Metro Mall, occupancy remains strong at 97.6% and positive rental reversions continue to be recorded in 3Q18. The Manager had communicated that the AEI at Xiaolan Metro Mall is expected to be completed this year and will yield renowned names such as Hai Di Lao.

The Negatives

– Higher cost of funds. Average all-in cost of borrowings for Dasin’s offshore debt increased by 30bps QoQ, of which only 40% is hedged. While the remainder of its 2018 debt had been fully refinanced in 3Q17, this upward movement in interest rates – especially when sustained in the current rising interest rates environment – could further inflate finance costs as we edge closer to 2019, with the first tranche of debt expiring in Jan 2019. Current gearing level was also a result of the decline in valuation of investment properties in 2Q17.

Outlook

Current gearing of 32.5% affords Dasin S$115mn of headroom (assuming 40% gearing) to pursue inorganic growth, which can be through third party or its ready pipeline of 20 properties – 12 of which have been completed.

Maintain ACCUMULATE with lower target price of S$0.95 (prev S$0.97)

We lower our target price to adjust for higher finance costs and changes in rental growth assumptions. Our target price of S$0.95 translates to a FY18e yield of 8.5% and a P/NAV of 0.58x.

The report is produced by Phillip Securities Research under the ‘SGX StockFacts Research Programme’ (administered by SGX) and has received monetary compensation for the production of the report from the entity mentioned in the report.

Source: Phillip Capital Research - 08 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024