CapitaLand Mall Trust: Journey to the West

traderhub8

Publish date: Fri, 26 Oct 2018, 12:06 AM

- Acquisition of remaining 70% of Westgate approved by unitholders on Oct 25. Funding via private placement (c.S$245.6mn) and debt (c.S$552mn) will be accretive to FY18e and FY19e DPU. Targeted completion of transaction by Nov 1.

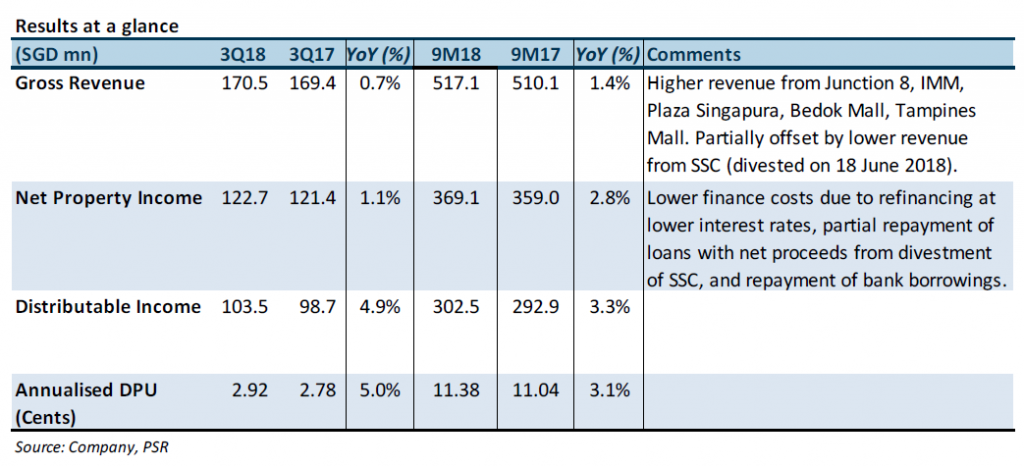

- 3Q18 NPI/DPU within our estimates. 9M18 NPI/DPU at 75% and 74% of our FY18e estimates.

- Tepid tenant sales growth, dragged by F&B sector, CMT’s biggest tenant sector by GRI. Shopper traffic continued to decline for the third consecutive quarter this year.

- Maintain Neutral with adjusted TP of S$2.09 (prev S$2.05).

The Positives

+ Acquisition of remaining 70% of Westgate approved. CMT’s unitholders have approved the acquisition of the remaining 70% of Westgate (through Infinity Mall Trust (IMT)) on Oct 25. Total acquisition outlay of S$797.6mn (excl. Acquisition fee of S$7.9mn that will be paid in units) will be funded via a c.S$245.6mn Private Placement and the remaining via debt (S$392mn of which are bank loans owed by IMT). Assuming CMT’s current funding cost of 3.2%, this funding structure of c.70% debt would be accretive to FY18e and FY19e DPU. Transaction is expected to be completed by Nov 1 and contribution from the remaining 70% of Westgate will commence then. See Appendix for more details.

+ Stable portfolio occupancy despite ongoing AEI at Westgate and Tampines Mall. Occupancy remains stable at 98.5%, with >97% occupancy achieved at its top four malls (by GRI) – Plaza Singapura, IMM, Bugis Junction, Tampines Mall.

The Negatives

– Tepid tenant sales growth and continued decline in shopper traffic. Tenant sales was flat (+0.5% YoY) for 9M18 with tenant sales growth for the food & beverage (F&B) sector (the largest trade sector contributor by GRI; 31% of CMT’s FY17 GRI) still leaving much to be desired (+0.1% YoY for 9M18 vs -0.6% YoY for 1H18). Shopper traffic continued to decline for the third consecutive quarter this year, by -1.8% YoY for 9M18.

Outlook

Catalysts for growth would be the contribution from the remaining 70% of Westgate and the upcoming completion of Funan. As at end-Sep, leases signed and in advanced negotiations at Funan reached 70% (retail) and 60% (office) – subsequent to this, one of Funan’s anchor tenants, Newstead Technologies, filed for liquidation. This might affect the amount of contribution from Funan that will start coming in in 2H19. On recurring revenue, rental reversions have weakened to 0.6% in 9M18 (1H18: 0.8%). We opine that tenant sales would need to catch up for more meaningful upsides in rental growth.

Maintain NEUTRAL with adjusted target price of S$2.09 (prev S$2.05).

This translates to a FY18e yield of 5.2% and P/NAV of 0.99x. We adjust our DPU estimates – and correspondingly, our target price – upwards to factor in the contribution from the remaining 70% of Westgate. In addition, there have been adjustments on assumptions on rental rates and financing costs, following a change in analyst.

Source: Phillip Capital Research - 26 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024