CapitaLand Commercial Trust: AST2 Saves the Day

traderhub8

Publish date: Fri, 26 Oct 2018, 12:05 AM

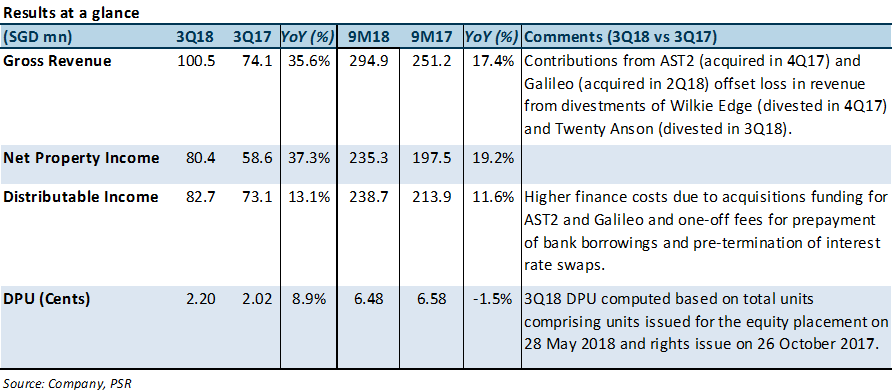

- 3Q and 9M NPI/DPU in line with our estimates.

- Full quarter contribution from Galileo, which comprises 5% of CCT’s NPI in 3Q18.

- Reduced gearing of 35.3% with higher proportion of debt on fixed rates.

- Near-full portfolio occupancy boosted by Asia Square Tower 2 (AST2).

- Negative rental reversions still plague key properties.

- Maintain Accumulate with TP of S$1.90 (prev S$1.88).

The Positives

+ Reduced gearing with higher proportion of debt on fixed rates. Gearing currently stands at 35.3% (2Q18: 37.9%) following repayment of bank borrowings from proceeds from divestment of Twenty Anson on Aug 29. Debt on fixed rate now comprises 92% of total borrowings (2Q18: 85%) with lower all-in cost of debt of 2.6%.

+ Near-full portfolio occupancy boosted by AST2. Portfolio occupancy increased QoQ to 99.2% from 97.8%, boosted by ramp-up in occupancy at AST2 (98.1% vs 91.9% in 2Q18).

The Negatives

– Negative rental reversions still plague key properties. Average expiring rents for AST2, Capital Tower and Six Battery Road were above rents committed in 3Q18. We expect reversions to turn positive as expiring rents continue to decline, against the backdrop of healthy office leasing activity and tapering office supply in the CBD Core area.

Outlook

Outlook is positive now that AST2, CCT’s biggest contributor by GRI (office portfolio), had ramped up occupancy within the quarter. In addition, CCT will record a 36% increase in rental from HSBC’s one-year lease extension at HSBC Building from April 2019, which will push NPI yield from 4% to 6%. Plans for the building thereafter include refurbishment/leasing, divestment and redevelopment. Additional recurring income would also come from a new one-year lease with the State for Bugis Village from Apr 2019 for c.S$1mn. CapitaLand had in October invested S$27 million in co-working operator The Work Project Kingdom, which will lease space at Capital Tower and Asia Square Tower 2, in pursuit of the core-flex model at these buildings. The Manager had expressed confidence that the core-flex space combinations will help tenant retention in the long-run.

Maintain ACCUMULATE with adjusted target price of S$1.90 (prev S$1.88).

This translates to a FY18e yield of 5.1% and P/NAV of 0.99x. We adjust our DPU estimates – and correspondingly, our target price – upwards to factor in better occupancy showing at AST2 (18% of CCT’s 9M18 NPI). In addition, there have been adjustments on our rental and cost assumptions, following a change in analyst.

Source: Phillip Capital Research - 26 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024