Mapletree Industrial Trust: Operational Weakness

traderhub8

Publish date: Thu, 25 Oct 2018, 10:54 AM

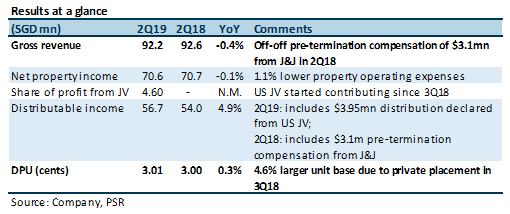

- 2Q19 gross revenue and DPU were within our estimates

- Portfolio WALE stands at 3.5 years and aggregate gearing of 35.1%

- Operational rental weakness was mitigated by inorganic contribution

- Resumption of DRP to strengthen balance sheet and fund development projects

- Maintain Neutral; new target price of $1.99 (previous: $2.09)

The Positives

+ 30A Kallang Place achieved 75% committed occupancy; higher than the 43.8% in the previous quarter. As a reminder, the asset enhancement initiative was recently completely and the property obtained its Temporary Occupation Permit (TOP) in February 2018. Separately, the back-filling of space that was pre-terminated by Johnson & Johnson at The Strategy at International Business Park has improved to 41% from 23% in the previous quarter.

The Negatives

– QoQ lower portfolio occupancy from 88.3% to 86.2%. This was driven by lower occupancy at Flatted Factories (full quarter effect of HGST departure in 1Q FY18/19 from Kaki Bukit Cluster, who was the ninth largest tenant in MINT’s portfolio) and Hi-Tech Buildings segments. The lower occupancy for Hi-Tech Buildings was due to Mapletree Sunview 1 (completed in July, but lease started in August) and 7 Tai Seng Drive (in the process of decanting tenants to undertake upgrading works at the property).

– Fourth consecutive quarter of negative rent reversion. Weighted average reversion across the portfolio was -3.5%. There were no renewals for Light Industrial Buildings, and all other segments registered negative reversions. Tactical decision was made to lower rents and maintain occupancy.

Outlook

The outlook is mixed. We expect negative reversions to persist into 2019, weighing against organic growth. However, contributions from the US data centres JV, 30A Kallang Place and Mapletree Sunview 1 would result in higher distributable income through inorganic growth.

Maintain Neutral; new target price of $1.99 (previous $2.09)

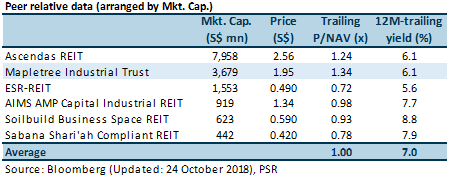

Our lower target price is due to dilutive effect of the distribution reinvestment plan (DRP). To illustrate, our FY20e DPU is lower than FY19e despite the higher distributable income. Valuation is not attractive as MINT currently trades at 1.34 times trailing P/NAV. Limited upside from current price to our target price, which represents an implied 1.34 times FY19e P/NAV multiple.

Relative valuation

MINT is trading above the peer average P/NAV multiple and at a tighter 12M-trailing yield than the peer average.

Source: Phillip Capital Research - 25 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024