First REIT: Waiting for a Sign

traderhub8

Publish date: Wed, 17 Oct 2018, 04:43 PM

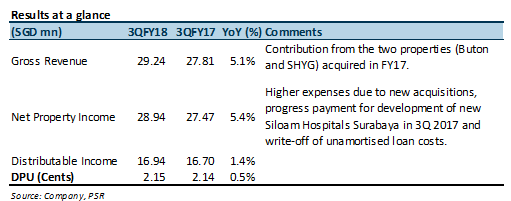

- NPI and DPU were in line with our forecast. 5.1% and 5.4% YoY boost in Gross Revenue and NPI, respectively, driven by two acquisitions made in 4Q17.

- Potential expanded ROFR pipeline and improvement in tenant concentration from proposed transaction announced in September.

- No marked improvement in outstanding receivables even accounting for the S$17.5mn of rental payments received on Oct 15 that was disclosed by FIRT.

- Maintain Neutral with lower TP of S$1.30.

The Positives

+ Lower property operating expenses. Though FIRT possesses a triple-net lease structure, its property operating expenses were lower by 13.8% in 3QFY18 due to lower expenses incurred for its Indonesia properties. This translates to an improved NPI margin of 99.0% in 3QFY18 from 98.7% in 3QFY17.

+ Potential expanded ROFR pipeline and improvement in tenant concentration. Basing on the proposed transaction announced on Sep 19 (read our full report here), FIRT could have potential expanded pipeline assets by having a dual ROFR from both Lippo Karawaci (LPKR) and OUE Limited Healthcare (OUELH). This will also help lower the tenant concentration risk moving forward given that LPKR is currently the single biggest lessee of its properties.

The Negatives

– Receivables collection remains slow. Outstanding receivables rose 70% QoQ to S$49.3mn due to advance rental receivables from tenants. While S$17.5mn of rental payments was received on Oct 15 as disclosed by FIRT, receivables would still have increased c.9.3% QoQ. However, a bright spot could emerge if and when the cash infusion into LPKR from its potential divestment of stake in FIRT and its Manager could be used to pay outstanding rental owed to FIRT.

Outlook

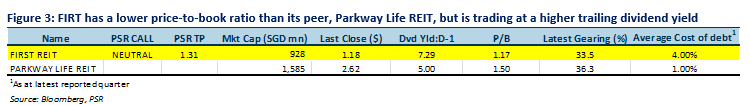

While outlook has improved for FIRT’s receivables from a potential positive spillover effect into rentals owed by LPKR, it remains to be seen if there could be any marked improvement in the near-term given that the transaction is still pending the relevant approvals. Until such an improvement comes about, we remain Neutral on FIRT. Current gearing of 36.7% affords a debt headroom of c.S$44.5m (assuming 40% gearing) to pursue inorganic growth.

Maintain NEUTRAL with lower TP of S$1.30 (prev S$1.31)

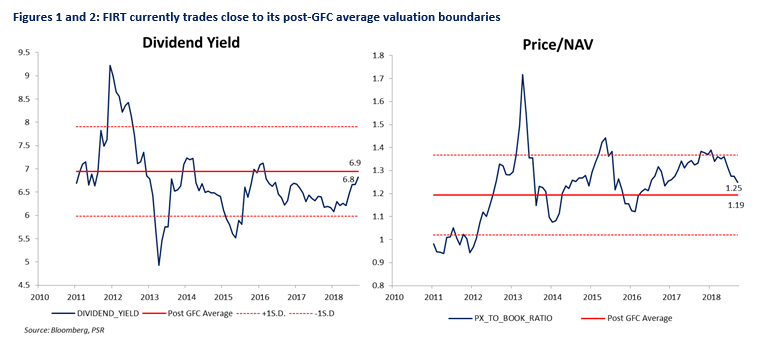

We lower our DPU estimates as we had previously factored in an acquisition to have materialised in 3QFY18. Accordingly, our target price was lowered to S$1.30. Our target price translates to a FY18e yield of 6.7% and a P/NAV of 1.20x.

Source: Phillip Capital Research - 17 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024