Keppel DC REIT: Portfolio Remains Stable

traderhub8

Publish date: Wed, 17 Oct 2018, 04:42 PM

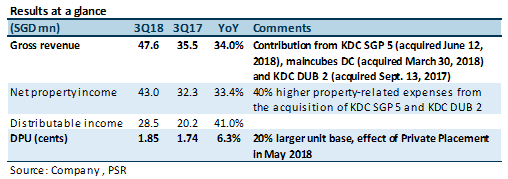

- 3Q18 revenue was 5.3% higher than expected, due to higher rental top up which is recognised periodically

- 3Q18 DPU was 4.1% lower than expected, due to Capex Reserves set aside for KDC SGP 3 and KDC SGP 5

- 9M18 revenue and DPU met 79% and 73% respectively, of consensus FY18 expectation

- Maintain Accumulate; unchanged target price of $1.45

The Positives

+ Operationally stable. Portfolio occupancy inched up QoQ to 93.1% from 92.0%, mainly due to higher occupancy at KDC SGP 5 and KDC DUB 1. Portfolio weighted average lease expiry (WALE) of 8.5 years is the longest among industrial S-REITs.

+ Stable and predictable cash flow due to limited renewal risk until 2020 and hedging of foreign-sourced distributions. Only 0.1% of leased area is up for renewal in the remainder of 2018; and less than 5% of leased space is at risk in 2019 and 2020 individually. Foreign-sourced distributions have been hedged till 1H 2020.

+ Low aggregate leverage of 32.0% and no refinancing risk for the remainder of 2018. We estimate debt headroom of S$270mn (40% target gearing), which can be used to grow the existing AUM of S$2bn by 13.5%. The next refinancing is in 2019 for the SGD-denominated borrowings that accounts for 19% of total debt. 86% of debt has been hedged on fixed-rate.

The Negatives

– Cash available for distribution to unitholders has been lowered by Capex Reserves. Capex Reserves are set aside as a percentage of rental income from KDC SGP 3 and KDC SGP 5. The amount of Capex Reserves set aside YTD has come up to S$2mn. There is currently no near-term capex commitment for either of the properties.

Outlook

The outlook is positive. Data centre demand remains robust. The manager increased demand especially from cloud service providers. These clients tend to be larger, requiring both more space and more power. The manager says the over-supply situation in Singapore applies only to smaller boutique operators; the larger players such as KDCREIT are experiencing healthy occupancy.

The AUM target of S$2bn for 2018 has been achieved. The manager does not have an AUM target for 2019, but intends to maintain the pace of acquisitions.

Maintain Accumulate; unchanged target price of $1.45

While the long-term demand drivers for data centre remains intact, downside risk arises from the rich valuation that is an implied 1.36 times FY18e P/NAV multiple.

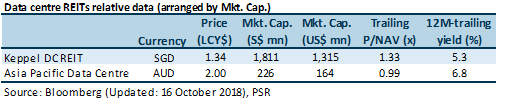

Relative valuation

KDCREIT trades at a higher P/NAV multiple compared to its Australia Stock Exchange (ASX)-listed peer, Asia Pacific Data Centre. KDCREIT is also trading at a lower yield.

Source: Phillip Capital Research - 17 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024