Micro-Mechanics (Holdings) Ltd: Consumables Provide Resiliency

traderhub8

Publish date: Wed, 29 Aug 2018, 10:26 AM

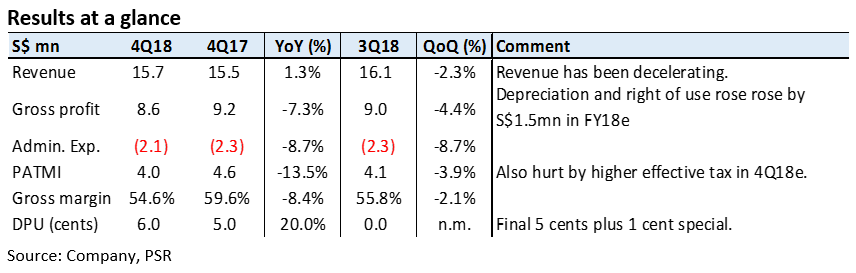

- 4Q18 revenue and PATMI were 3% and 6% below our full-year We are trimming our FY19e earnings by 14%.

- Margins hurt by higher depreciation (as capex more than doubled in FY18) and weaker sales in Singapore and Malaysia.

- Despite lowering our earnings, we maintain our target price at S$2.30. We believe Micro-Mechanics has the most resilient product line and a front-end business could surprise on the upside.

The Positives

+ Dividend rose 25%. Final dividend rose 1 cent to 5 cents. MMH has doubled their dividends over the past 4 years. The payout is now 81%. This is sustainable, as capex in FY19e will revert to S$5mn after the S$12mn jump in FY18. Company is in net cash position of S$21.1mn.

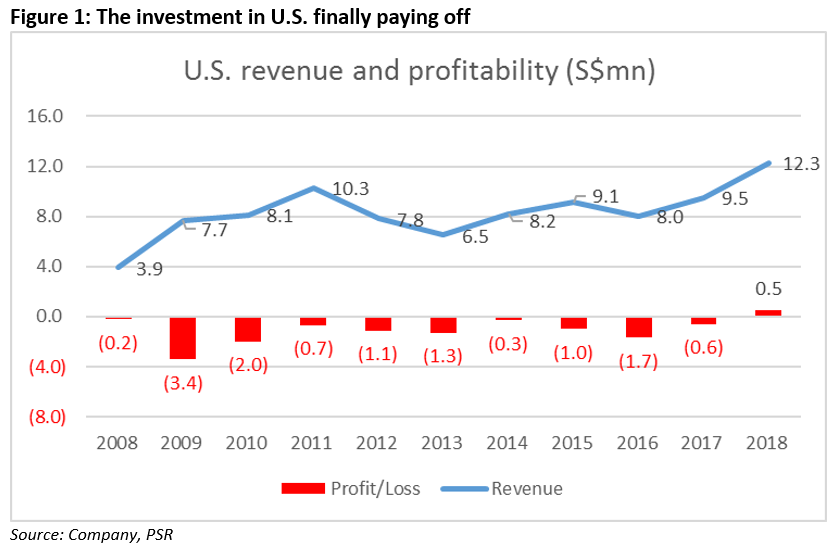

+ US could lead the next stage of growth. In FY18, U.S. revenue expanded by almost 30% and it turned profitable after 10 years of losses. We believe the company is making headway in front-end equipment parts.

The Negatives

– Margins weakest in more than 3-years. Gross margins in 4Q18 was 54.6%. This is the weakest in more than three years. Margins have been hurt by higher depreciation and slower sales in Singapore and Malaysia. Depreciation and right of use rose by S$1.5mn in FY18.

– Revenue still softer than expected. Revenue growth for MMH has been decelerating the past 3-quarters.

Outlook

We are incorporating slower growth for FY19e. Global semiconductors sales is expected to slow from 12.4% in 2018 to 4.4% in 2019. We believe the bulk of semiconductor slowdown will come from equipment sales. MMH business is more dependent on the volume and complexity of semiconductors. And this is rising. For instance, wafer dies are becoming increasingly thinner and gate size narrower. Consumables that MMH produces need to be more particle-free and electrostatic discharge (ESD) resistant. This requires more precise and environmental controlled manufacturing, together with the need for proprietary materials.

Maintain BUY with unchanged target px of S$2.30

MMH is our stable proxy to the increasing pervasiveness and complexity of semiconductors. Demand for MMH products is recurrent because it needs to be replaced from several times a day (e.g. rubber tips) to several times a week (e.g. injection needles).

The need for customization, fast response time and difficulty to produce and develop these products have led to industry-leading margins. MMH enjoys a health net cash balance sheet and high returns on capital (ROE ~30%).

Our target price for MMH is 17x PE, in line with back-end semiconductor supply chain valuations (Figure 2).

The report is produced by Phillip Securities Research under the ‘SGX StockFacts Research Programme’ (administered by SGX) and has received monetary compensation for the production of the report from the entity mentioned in the report.

Source: Phillip Capital Research - 29 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024