Geo Energy Resources Ltd: Higher Start-up Mining Cost

traderhub8

Publish date: Tue, 28 Aug 2018, 10:47 AM

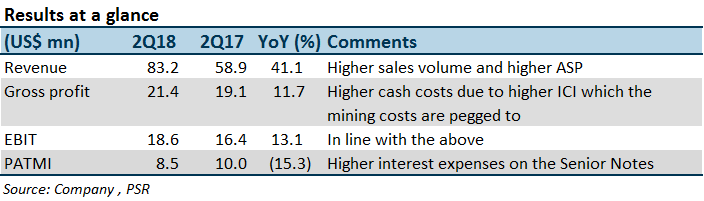

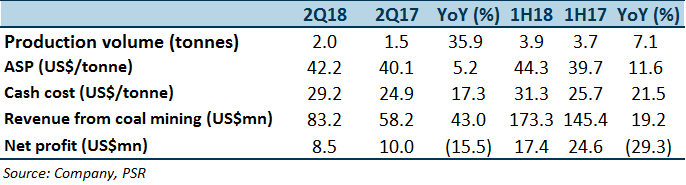

- 2Q18 revenue and net profit missed expectations due to lower production volume and higher cash cost.

- 10mn tonnes of production target is on track, but cash cost will be higher this year.

- Look forward to a new offtake agreement and a new coal mine acquisition.

- We lower forecasted sales volume to 10mn tonnes (previously 10.8mn tonnes) and revise ASP to US$40.5/tonne (previously US$41.5/tonne) in FY18. Meanwhile, we maintain cash cost of US$30.5/tonne. Accordingly, FY18e EPS is cut to 2.5 US cents (previously 3.0 US cents). Based on an unchanged forward PER of 10x (average of regional peers) and the exchange rate (USD/SGD) of 1.36, we maintain our BUY recommendation but with a lower target price of S$0.34 (previously S$0.41).

The Positives

+ Growth in production amid healthy coal prices: In 2Q18, the ICI 4,200 GAR price rose by 11.7% YoY to US$44.8/tonne. Meanwhile, sales volume grew by 35.9% YoY to 2mn tonnes. TBR mine commenced operation in May-18 and completed the first shipment of coal of c.50k tonnes in Aug-18. FY18 sales target remained at 10mn to 11mn tonnes. It is estimated that SDJ mine and TBR mine will deliver 8mn tonnes and 2mn/3mn tonnes respectively in FY18.

The Negatives

– Temporary increase in cash costs: The kick start of production in TBR mine is expected to incur higher cash costs due to a temporary high strip ratio. According to 2017 IQPR, the strip ratio of TBR mine in FY18 is estimated to be 7.1, followed by 3.9 in FY19. Accordingly, the production-weighted average strip ratio (SDJ and TBR mine) will be 3.9 in FY18, followed by 3.5 in FY19. The life of mine strip ratio of TBR is 3.6. The average cash cost for the group in FY18 will rise to US$30/tonne (SDJ mine: US$28/tonne in FY17).

Outlook

The ramp-up in coal production will continue at least till FY19. After the 30% ramp in production in FY18e, the group is looking at 13mn to 15mn tonnes of sales in FY19. It is also exploring inorganic growth throughout acquisitions of coal mines. The potential target could be a relatively high calorific value coal mine with 4,800 GAR/5,400 GAR, which enables the group to enhance cash profits.

We look forward to two catalysts being realised in the near term, a new offtake agreement for TBR mine which further strengthens the cash position and a new mine acquisition which increases coal reserves.

Maintain BUY call with a lower target price of S$0.34 (previously S$0.41)

We lower forecasted sales volume to 10mn tonnes (previously 10.8mn tonnes) and revise ASP to US$40.5/tonne (previously US$41.5/tonne) in FY18. Meanwhile, we maintain cash cost of US$30.5/tonne. Accordingly, FY18e EPS is cut to 2.5 US cents (previously 3.0 US cents). Based on an unchanged forward PER of 10x (average of regional peers) and the exchange rate (USD/SGD) of 1.36, we maintain our BUY recommendation but with a lower target price of S$0.34 (previously S$0.41).

Source: Phillip Capital Research - 28 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024