Banyan Tree Holdings Limited: Increasingly Going Asset Light

traderhub8

Publish date: Fri, 24 Aug 2018, 01:19 PM

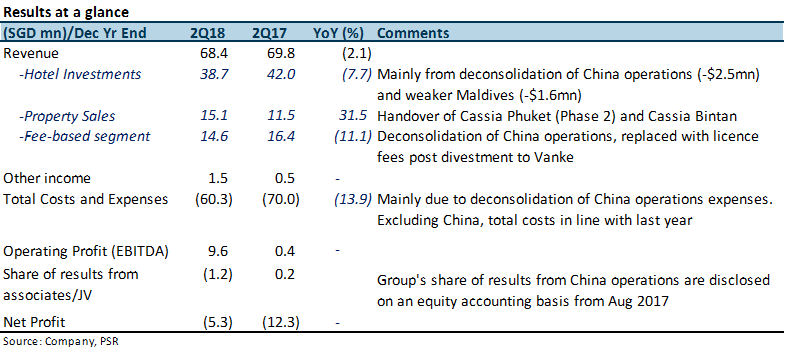

- Losses narrowed in the traditionally off-peak season due to lower operating expenses.

- Lower total costs and expenses mainly due to deconsolidation of China operations.

- Increase in forward bookings suggests tourism sentiment still healthy.

- Near-term uncertainties for Thailand operations but we expect impact to be transitional and short-term.

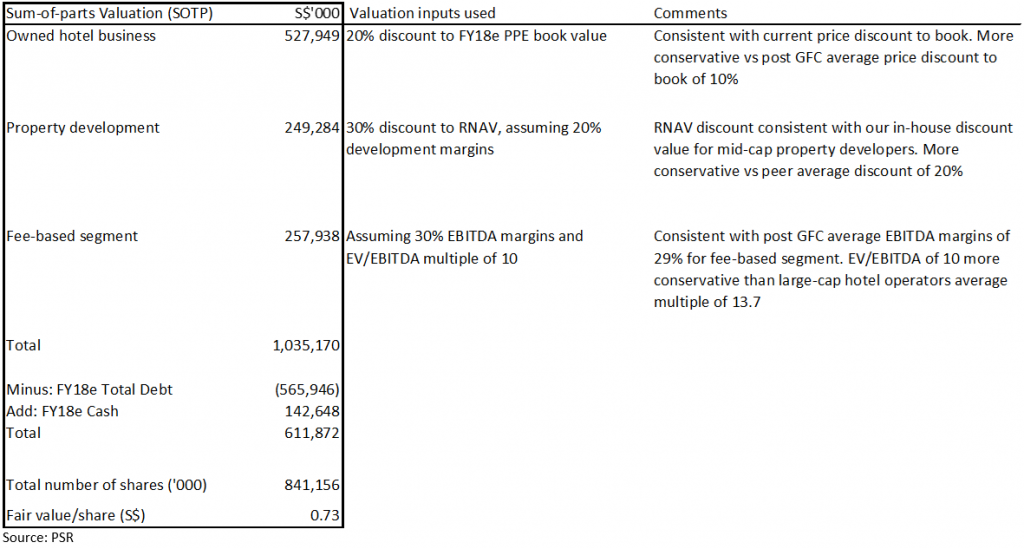

- Maintain ACCUMULATE with an unchanged target price of S$0.73.

The Positives

+ Property sales segment saw 32% increase in revenue. This is predominantly driven by the handover of 35 units of Cassia Phuket. Sales momentum is maintained with an 8% YoY increase in total sales value for units sold in the quarter. As a result, overall unrecognised revenue as at end 2Q18 remained stable at S$202mn, with about a quarter due to be recognised in 2H18. This could represent a close to 50% YoY jump for upcoming revenue from this segment for 2H18.

+ Increase in forward bookings suggest tourism sentiment still healthy. Forward bookings revenue is 6% above same period last year driven by hotels outside Thailand which jumped 18%. This was able to offset the 2% lower forward bookings in Thailand due to slower MICE and events business for Angsana Laguna Phuket.

+ Operating profit strengthened led by turnaround in property sales, fee-based segment and deconsolidation of China operations. Apart from higher revenue in the property sales segment, the standout segment driving earnings was the fee-based segment. Despite an 11% drop in revenue as a result of de-consolidation of China operations, EBITDA from this segment jumped 73% due to lower operating expenses such as lower provision for bonus and incentives and exchange gains.

+ Divesting of Seychelles assets and operating them on a management contract model. We note that management has in recent years been increasingly embracing an asset light model which leverages on their branding and hotel management expertise, with an increasing urgency to drive shareholder returns. These measures include: 1) signings of collaboration deals with Vanke and Accor, which include the divestments of China assets 2) Offer for Laguna Resorts with an increased urgency in redevelopment of Laguna Phuket land 3) Divesting of Seychelles assets and operating them on management contracts. These deals are positive for shareholder returns.

The Negatives

– Results of associates consisting of China operations still a drag on earnings. The Group’s China operations, which have been de-consolidated since August 2017, reported a loss of S$1.2mn in 2Q18.

– Hotel investments segment recorded slight drop in revenue. Excluding effect of China de-consolidation, revenue from this segment would have been down a slight -1%. Maldives continues to be weak even after the state of emergency was lifted in March 2018 following a political crisis in the country. RevPAR was down 24% YoY. With the presidential elections due in September and uncertainties over the political landscape, weakness in operations could persist despite a tapering supply of hotels and resorts. Thailand’s RevPAR was also down marginally at -2%, due to lower MICE and events business.

Outlook

There could be near term uncertainties for the Group’s resorts in Thailand after the Phuket boat accident in July which killed more than 40 Chinese tourists. Thailand accounted for 66% of Group’s FY17 revenue for the Hotel Investment segment and tourists from China makes up 40% of total Group revenue. We expect the Group’s operations to be negatively impacted near term from possible cancellations but expect the impact to be transitional for 1-2 quarters. Long term growth catalysts remain intact as the Group transitions to an increasingly asset light model, especially with the Accor/Vanke deals. Our forecasts and target price remains unchanged for now.

Maintain ACCUMULATE with unchanged target price of S$0.73.

Our target price translates to c.0.94x FY18e P/NAV.

Source: Phillip Capital Research - 24 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024