Q & M Dental Group: Organic Growth Picking Up

traderhub8

Publish date: Thu, 16 Aug 2018, 12:00 PM

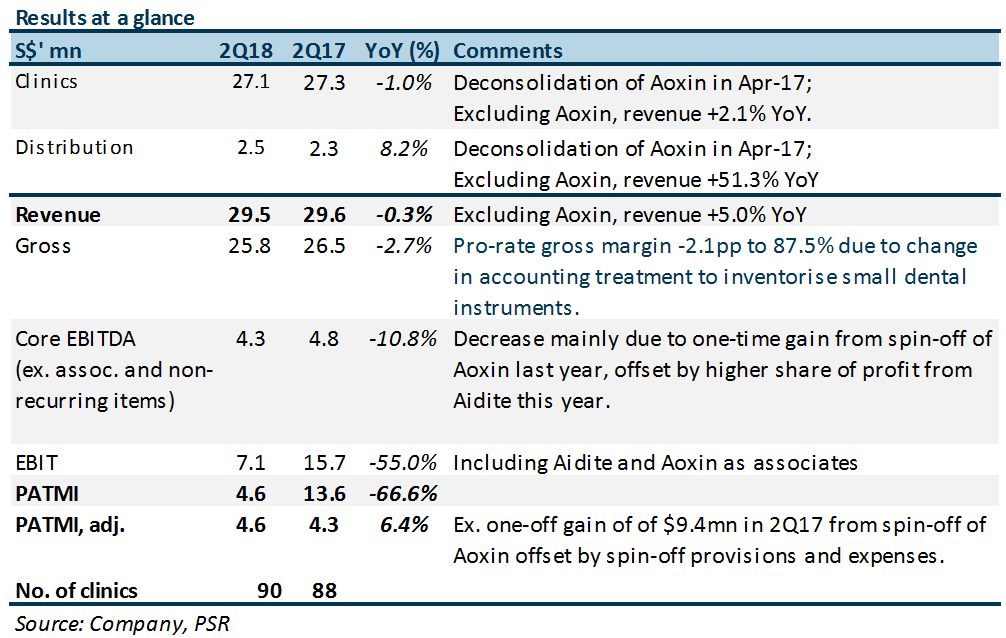

- 1H18 Revenue/PATMI met 39.3%/49.7% of our full year expectations; 2Q18 effective tax rate was lower than our assumption.

- Opened 3 new clinics in 1H18. Another 4 more clinics for Singapore and 3 for Malaysia in 2H18.

- Adoption of dividend policy of paying out at least 30% of core operating earnings. Interim dividend was lower at 0.4 cents per share (-43% YoY).

- Upgraded to BUY and TP of S$0.65 (previously S$0.63), based on estimated 2.3 SCents FY18 EPS and 28x FY18e PER. No change to our earnings estimates.

The Positives

+ Aggressive expansion plan underway in SG and MY. Management reiterated their aggressive expansion plan of adding 10 new clinics each in SG and MY by end-FY18e is underway, with the opening 3 net new clinics in 1H18 and 4 more upcoming in Singapore. Malaysia is to add 3 new clinics in 2H18.

+ Organic growth for distribution business in SG and MY. Distribution revenue excluding Aoxin increased 51% YoY mainly due to higher revenue from the distribution company in Malaysia.

+ Interest savings from refinancing. The Group repaid the 4.4% MTN on 19 March 2018 with a drawdown of S$60mn bank facilities secured on 25 January 2018. The favourable interest rate of the new bank facilities (<4.4%) will provide annual interest savings.

The Negative

– Facing some challenges in Malaysia. YTD no new clinics opened in Malaysia. Management guided to add at least 10 dental clinics in Malaysia for 2018. However, with 3 new rental agreements signed for 2H18, management still has to achieve the opening of 7 more clinics in 2H18.

Outlook

We are cautiously optimistic on the expansion plans in Singapore and Malaysia. Post-deconsolidation of its major revenue drivers in China, the Group is stepping up its regional expansion in Singapore and Malaysia to plug the gap (from its previous target of opening at least 5 new clinics per year to 20 new clinics this year). With 24 new dentists recruited in the last 3-4 months, we remain optimistic on the expansion plan.

We do not discount the possibility that the Group will expand into Southern China via joint ventures and organic growth initiatives with its Chinese associate, Aoxin Q&M Dental Group (the Group currently owns 43%). Aoxin Q&M Dental has a strong presence in Northern China.

Upgraded to BUY and TP of S$0.65 (previously S$0.63). The FY18e EPS of 2.3 SCents includes contributions from the targeted 20 new clinics in Singapore and Malaysia. We increased PER from 27.3x to 28.3x, which is in line with peers’ (excluding hospitals) average FY18e PER.

Potential re-rating catalysts would be (i) successful earnings accretive acquisitions; and (ii) better-than-expected results from associates.

Source: Phillip Capital Research - 16 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024